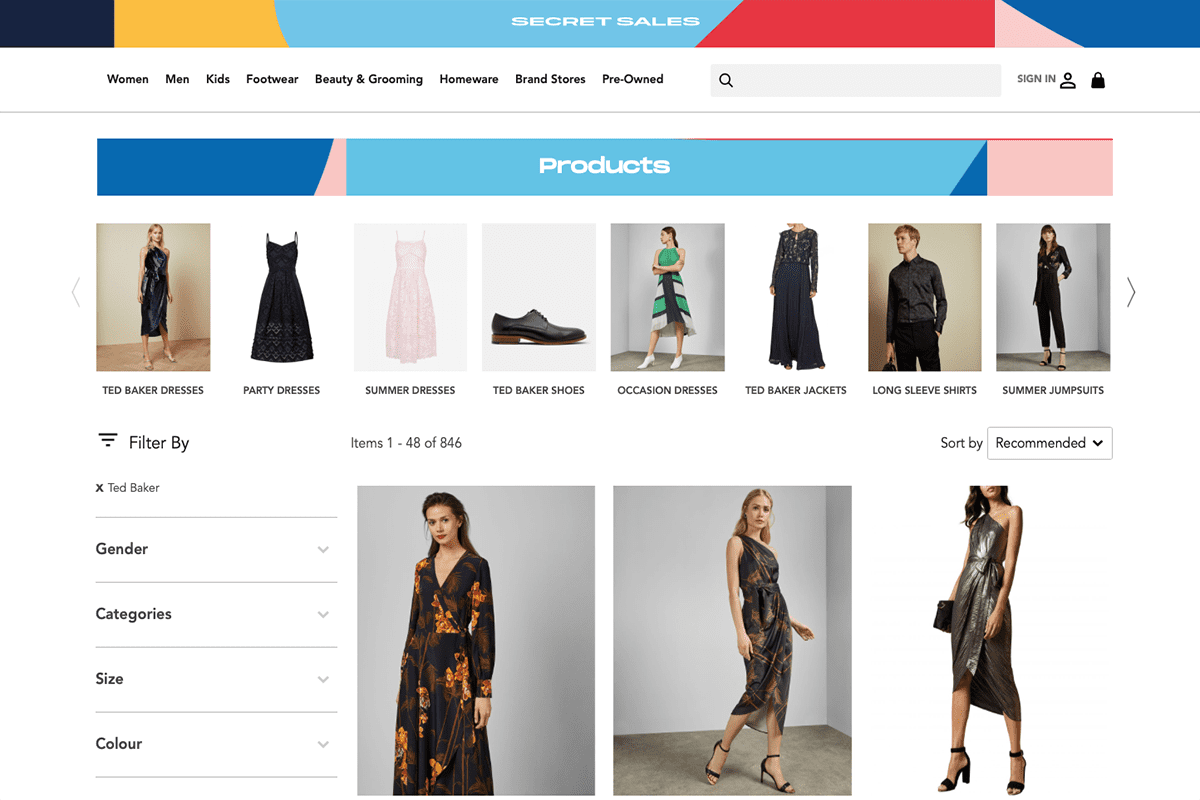

Fashion, shoes, eyewear and homeware luxury brand Ted Baker was set up in Glasgow in 1988 by Ray Kelvin following an epiphany while, according to the company’s biography, he was fishing.

By 2019, Ted Baker had become a multi-channel retailer, investing in digital, like many luxury brands, as a secondary sales channel to its stores. The pandemic forced the business to rethink the role of digital, moving quickly to shift sales online.

In 2021 in the UK and Europe, 56.2% of its retail sales were online, as were 29.4% of sales in the US.

Wholesale sales of £55.5m were 40.6% up on 2020. This saw it report revenues of £199.3m in the 28 weeks to August 14 2021, a 17.6% improvement on the same time in 2020, although sales were still more than a third lower (-36.4%) than the same time in pre-pandemic 2019.

This will streamline day-to-day back-end employee operations, while offering “a modern and frictionless customer experience tailored to the needs of each market”.

Ted Baker has pinned its hopes on becoming digital first retailer – using technology to service its customers better, as well as creating efficiencies within its own organisation.

In early 2022, the company unveiled a new multi-storefront headless platform, which the retailer says it will use to manage its global online presence from a single store. This will streamline day-to-day back-end employee operations, while offering “a modern and frictionless customer experience tailored to the needs of each market”.

The company’s 12 regional storefronts will be fully localised to enable the retailer to meet the needs of its expanding global customer base. Shoppers will be able to browse in their preferred language – including English, French, German and Spanish – and make purchases using their preferred currency of Pounds, Dollars and Euros.

Above all, Ted Baker sees the platform structure as being scalable for future expansion into other regions.

This article was originally published in the Luxury UK 2022 report. Download here to find out more about the luxury sector, including key players, consumer preferences and market trends.

For a wider overview of the global luxury sector, download the Luxury 2022 report.