While the UK’s Arcadia group struggles with CVAs and a huge downturn in its fortunes, Zara owner Inditex and online Fashion pureplay BooHoo are both showing fashion retail how it’s done.

Despite the grim retail environment, Inditex – which owns Zara, Bershka, Massimo Dutti and Pull & Bear, among others – has logged a record-breaking €5.9 billion in sales for the first quarter of 2019, 5% higher than last year.

Store and Online sales in local currencies from 1 May to 7 June grew 9.5%, while like for like sales are expected to increase 4%-6% in FY2019.

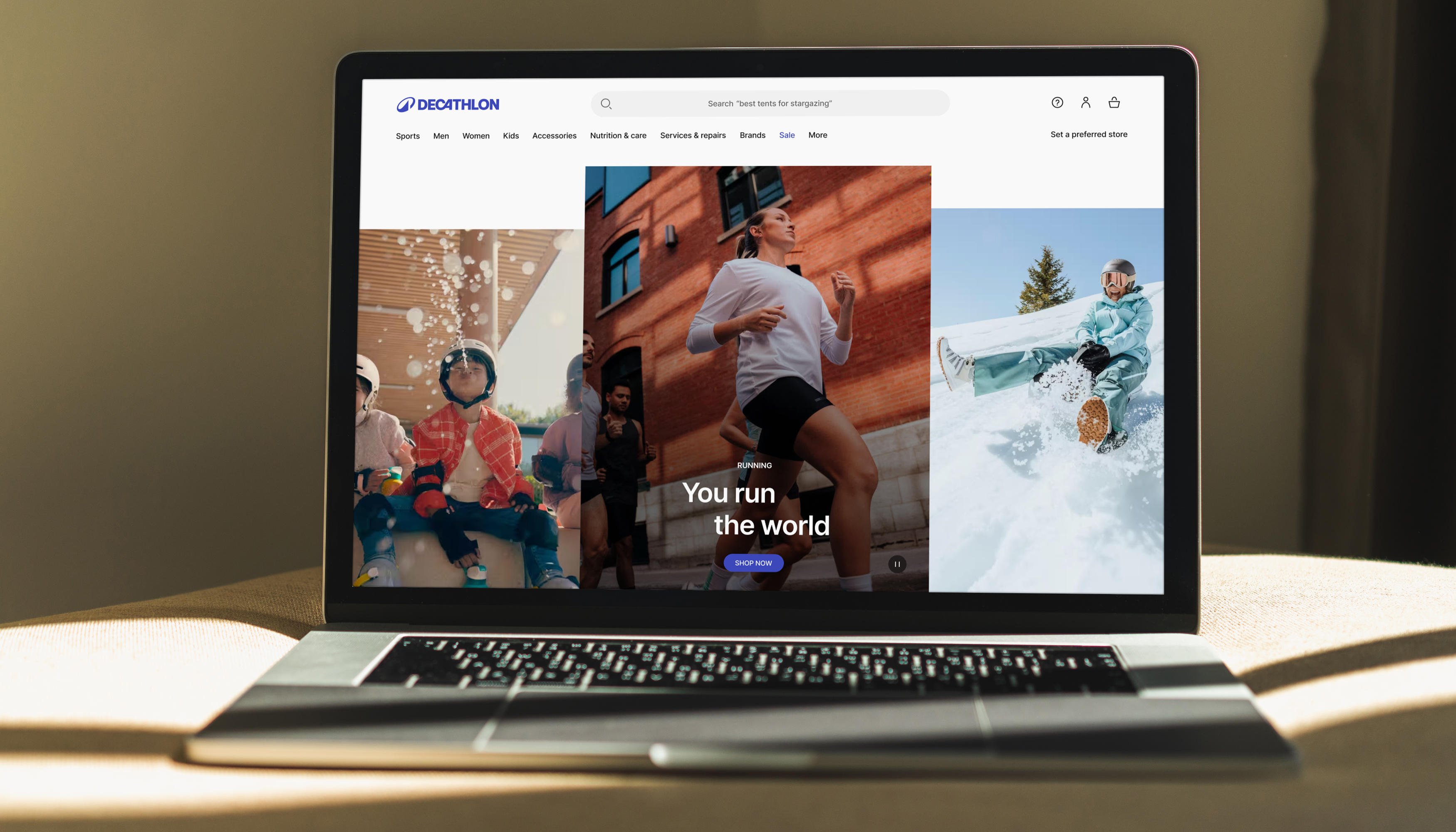

In March, Inditex launched online sales for Zara in Brazil. In May, Zara launched online sales in Saudi Arabia, United Arab Emirates, Lebanon, Egypt, Morocco, Indonesia, Serbia and Israel. In the Autumn/Winter campaign, Zara will launch online in South Africa, Qatar, Kuwait, Bahrein, Oman, Jordan, Colombia, Philippines and Ukraine.

Gross profit reached €3.5 billion, up 6% and gross margin reached 59.5% (+61 bps).

Elisha Carter, fashion and retail expert at The Cherry Moon, commented: “Zara is proof that the high street isn’t the retail graveyard it is said to be. The company’s 10% rise in net profits demonstrates it is a resilient and transformative retailer, capable of holding its own against the rise of the online giants. While there is no question that the internet has transformed how we shop, it by no means renders bricks and mortar stores obsolete. Those who are willing to work with new technologies, rather than against them, will succeed in a market where consumers rely on the internet more than ever before but who still prefer to try on and buy their clothes in-store. Zara’s triumphant first-quarter shows that there is room for success – both online and offline – but that the balancing act required is becoming all the more strategic.”

Boost for BooHoo

Meanwhile, over at BooHoo Group, there is similar good news with the pureplay online fashion retailer reporting revenue for the three months to 31 May 2019 up by 39% to £254.3 million – with the UK up 27% and international sales up by 56%.

John Lyttle, CEO, BooHoo Group commented: “The Group has made a strong start to the year as we continue to disrupt and capture market share in the UK and internationally across all our brands. I’m delighted that the Group topped the UK Hitwise rankings in May for the first time, demonstrating how our multi-brand strategy is really capturing our customers’ attention. We have ambitious plans for the Group, and continue to invest to ensure that our scalable multi-brand platform is well- positioned to disrupt, gain market share and capitalise on the global opportunity in front of us.”

Hugh Fletcher, global head of consultancy and innovation, Wunderman Thompson Commerce comments: “It’s been another strong period for Boohoo, which, yet again, highlights that consumers are turning increasingly to brands that can give them the digitally-advanced services they want and need. As a pureplay retailer, the company has had an advantage of being focused on eCommerce from the beginning, but it hasn’t allowed itself to become complacent. The company has ensured that its channels to market are fresh and in keeping with its target audience, embracing strategies including social commerce, with Instagram’s latest eCommerce feature, with 23% and 24% of consumers already using social media for inspiration and product recommendations when they are shopping online.”

What does it mean?

Taken together, these two retailers show that there is room on both the High Street and online to prosper, if the offer is right. Inditex’ brands are managing to balance both store experience and online to create a compelling offering. It shows that stores can work.

BooHoo, meanwhile, is showing fast fashion retailers just what consumers want – and goes someway to explaining the travails at Arcadia, which simply isn’t delivering the experience that shoppers want.

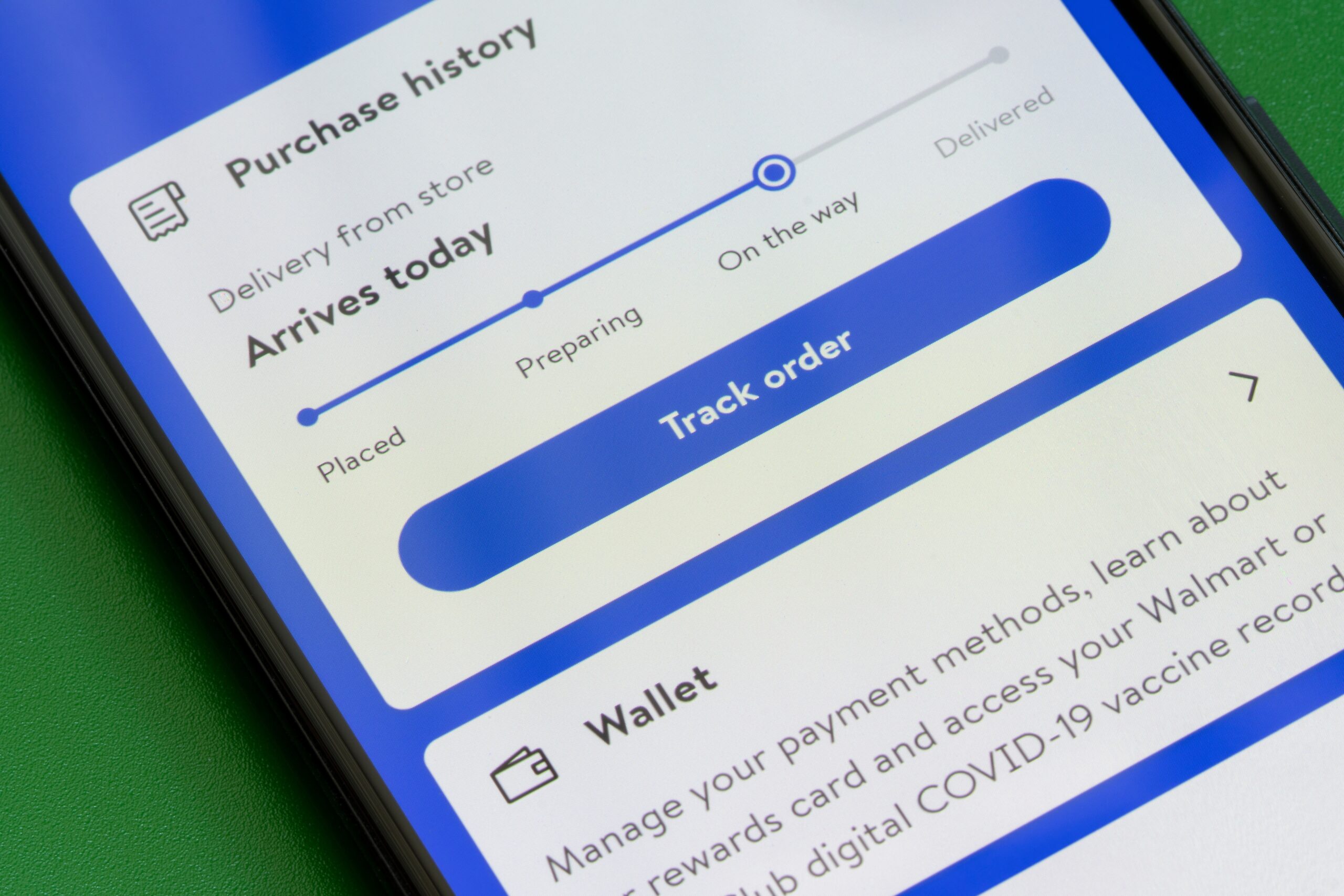

As Fletcher says: “Boohoo has been able to meet shoppers’ need for speed and convenience, offering customers a range of delivery options to suit their individual preferences – from next day delivery, click and collect, free returns and even locking customers in with its Premier account and unlimited next day delivery. By investing in infrastructure, smart retailers are seeing the value of having a robust supply chain. The crowded retail market not only warrants this type of simple, smart thinking, but shoppers will continue to demand it on a daily basis.”