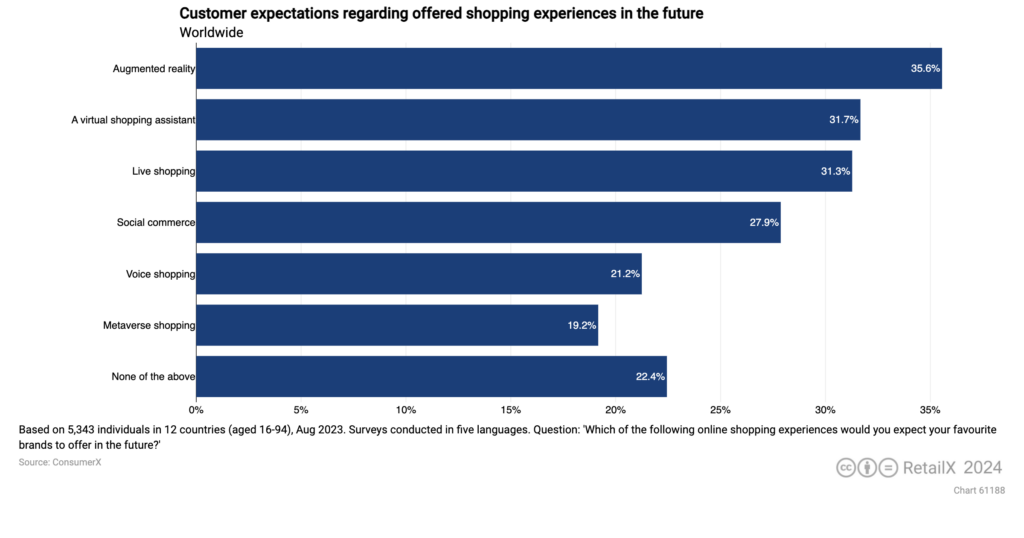

Last year, RetailX’s Metaverse Almanac report predicted that the technology is likely to have a profound impact on all facets of digital life, retail included. While it does offer an interesting, new way to access the web and hence engage in ecommerce, new ConsumerX research puts it below many other new ways of shopping.

As the below chart highlights, consumers would rather see augmented reality and live shopping prioritised by their favourite brands for future online experiences.

VR and AR retail

Using virtual reality outside the metaverse and, more commonly, augmented reality overlaid in the real world are already tried and trusted ecommerce technologies that are set for continued growth. Overlaying cosmetics or clothing onto the image of the shopper is already proven to enhance sales. According to a 2022 study by Harvard Business Review, customers who used AR spent 20.7% more time on the app and viewed 1.28 times more products on average. More importantly, their likelihood of making a purchase during the session was also 19.8% higher than customers who did not use AR.

Live streaming

Live ‘broadcasts’ of everything from make-up and cooking tutorials, to product demos and more grew in popularity over the pandemic and have cemented their role in ecommerce as a viable way to sell. Akin to TV shopping channels, these ‘live’ events online focus on practical tips and tap into the social media phenomenon of normal people offering helpful hacks.

Many luxury brands have embraced the tech, swapping glossy, high-end video content for shoppable livestream advice shows, while in the mainstream retail world, Clarins and Clarks have both been early adopters of livestreaming, with the former concentrating on skincare expert advice and the latter looking at showcasing its range of shoes.

Super apps

A growing phenomenon in China, super apps are apps that combine a range of different functions found in individual apps into one, usually socially-driven, app. A prime example is China’s WeChat, which ostensibly a social media and messaging platform. WeChat also allows users to shop and pay for things, as well as communicate directly with brands.

Over the Chinese New Year in January 2023, WeChat saw sales on its app of travel, catering, retail, and movies increase by 76%, 40%, 32% and 27% respectively, compared to the previous year. It also saw a rise of 23% of use of its own payment service on and offline.

With conversational commerce beginning to gain ground in Europe, the role of messaging apps, booking apps and payment apps are starting to merge with that of social media – and vice versa, with social sites adding these functions – the super app in Europe isn’t far off.

Metaverse

A number of high-profile retailers and retail brands are operating in the metaverse, selling both real world items and, more commonly, digital goods – or non-fungible tokens (NFTs) – which themselves are becoming an interesting new sub-sector of the ecommerce market.

34% of retailers have some presence in the metaverse already, although for many of these making early forays into the metaverse, they are simply using it as a platform to advertise – literally taking out a virtual billboard in one of the many metaverse ‘worlds’ as a means of getting their name in front of early metaverse users. Yet many others are adopting the NFT approach to sell digital versions of their items – something seen in fashion and luxury fashion with varying degrees of success.

Around this, others are combining this approach with rolling out special events in the metaverse to generate interest in the concept and to sell NFTs. Such efforts range from virtual fashion show events taking place on key metaverse platforms such as Decentraland, Roblox or Sandbox, pop-up stores appearing on these platforms, or simply selling NFT garments for characters in existing metaverse games.

This feature harnesses research from RetailX’s Metaverse Almanac report and the European Ecommerce Region 2023 report. The chart is produced by the ConsumerX App, which will be unveiled for the first time during The Spring Festival.

The app provides unique information, key data, and comprehensive graphs on everything from consumer attitudes to differences across age groups or countries, all centred on the multi-channel European customer.