The explosion in eCommerce may have merchants seeing dollar signs, but in a world where 24/7 commerce and new payment methods have driven a rapid increase in transactions — especially card-not-present transactions — merchants need a strong fraud prevention strategy to enable smart growth.

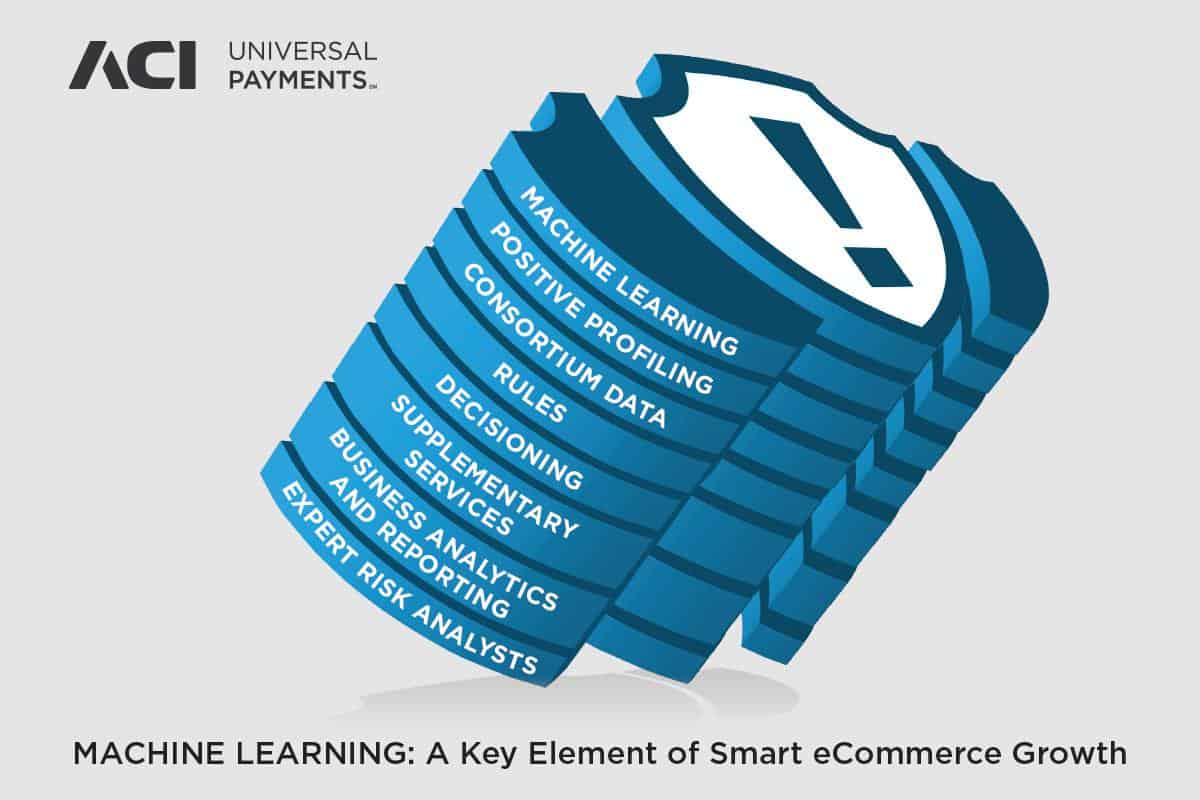

A multi-layered approach that starts with machine learning can help today’s merchant effectively fight fraud while optimizing acceptance rates, reducing chargebacks, improving customer loyalty and ultimately growing its business.

“Smart” Growth

Smart growth can be thought of as controlled growth that maximizes opportunity while minimizing risk. As merchants seek to add new payment types or channels and expand into new markets, the risk of fraud increases as well, particularly in environments where shopping behavior and preferences continue to evolve.

Additionally, eCommerce merchants face the challenge of defeating fraud globally, even if they only sell domestically. Unlike brick-and-mortar merchants that need worry only about customers present in their stores, fraudsters can attack eCommerce merchants from anywhere. To enable growth, merchants must deploy a platform that accounts for this.

The Case for Multi-Layered Fraud Prevention

A variety of techniques, ideally combined in a single solution, can help to promote smart growth for merchants and combat the growing fraud threat. The fast-paced nature of fraud requires solutions that can evaluate potential threats more quickly than ever before — and merchants have access to growing volumes of customer data to help.

But, data alone is not useful unless it can be processed quickly and accurately enough to provide actionable insights. Artificial intelligence capabilities like machine learning are able to process and evaluate these volumes of data at speeds necessary to defeat today’s growing fraud threat.

Machine learning works by using statistical techniques to create algorithms that can “learn” from the available volumes of data — and as more data is captured, insights become more accurate.

In the case of fraud prevention, machine learning’s predictive algorithms look for signals and patterns across the millions of transactional data points collected by merchants to build a history of users and transactions that can be used to evaluate the risk of fraud.

Positive Profiling Enhanced with Consortium Data

Fraud prevention has traditionally focused on transaction anomalies, such as activity outside of a normal geographic radius of past purchase history or unusual or suspicious transactions like large purchases. Until a history can be built, these anomalies would normally cause a merchant to halt a transaction to protect itself.

A technique known as positive profiling can leverage machine learning to also analyze what is “good,” such as a known person using a legitimate address within typical purchasing parameters, even if it doesn’t have a history at that particular merchant.

The concept of positive profiling leverages data from other merchants where the consumer might already have history. ACI Worldwide’s UP® eCommerce Payments™ solution, for example, utilizes a database of consortium data from thousands of global merchants that can help to sort the bad customers from the good. So even if a customer is patronizing a merchant for the first time, that customer is a known quantity to the merchant due to the consortium data collected from other merchants.

Rather than the traditional route of screening each transaction, positive profiling focuses fraud screening on the person behind that transaction. This approach can give merchants a better understanding of their customers (both new and existing), offering the ability to tailor the customer experience, improve conversion rates and maximize revenue – while blocking fraud in the process.

Rules-Based Fraud Prevention

Traditional rules-based fraud prevention can continue to play a role in a multi-layered fraud prevention strategy. Rules can be effective in mitigating losses in straightforward situations, such as a high number of transactions within a short period of time. However, an approach that is exclusively rules-based has limitations — for example, it is not as effective at recognizing patterns.

A solution combining both rules and machine learning can overcome these challenges, however, since a strength of the machine learning model is recognizing patterns and consumer behavior.

This is critical, especially for cross-border commerce where merchants, and subsequently their rules, may have less familiarity with local sources of fraud. Additionally, patterns may be too subtle for human observers to notice, especially in the context of an omni-channel platform.

Supplementary Services

The ability to add specialized insight can extend and enrich the transactional payments data used in a multi-layered fraud prevention strategy.

For example, many service providers specialize in compiling and validating data like device ID (think smartphone or tablet indicator) or email address, phone or IP address verification, or even specialized fraud data based on vertical information like airlines and travel.

This type of specialized data provides both real-time and ongoing checks and balances that a database can leverage and supply to its machine learning capabilities and big data lakes of information.

Building a Strategy for Success

Ultimately, the best fraud prevention approach is one that takes advantage of several techniques working together. Whether it is rules, machine learning or other fraud detection measures, these approaches are most effective when combined, and when they are enhanced by business analytics and regular reporting as well as expert risk analysts who can supplement a merchant’s strategy with comprehensive reviews and industry expertise.

Merchants employing this type of multi-layered approach will be well positioned for sustainable growth that can combat the ever-evolving global fraud threat.

Visit ACI Worldwide to learn more about the benefits of a multi-layered fraud approach and how it can support smart growth for merchants.