Research suggests that brands are testing new approaches, but moving on quickly if they don’t see sufficient performance gains.

Retail brands listed in the RXBX Strategy & Innovation Performance Dimension have refined their approach to multichannel retail in the last year, RetailX research suggests. While brands are now more likely to offer product recommendations and click and collect than they were previously, they are less likely to enable shoppers to save an item to a wishlist, or to offer same-day collection. Perhaps, having trialled these strategic features in previous years, they are now less likely to continue to offer those that have not moved the dial significantly on conversions and sales.

Understanding the metrics

When RetailX researchers assessed retail brands’ performance for the Strategy & Innovation Performance Dimension, they focused on the metrics from across this research that they consider give the most insight into how retail brands have developed their retail strategies, and how innovative they are in adopting new approaches.

In 2019, researchers looked at 53 different metrics, covering areas from delivery, collection and returns, to how easy it is to load and use a website, as well as the functionality that brands include in their mobile apps. These are measures that help traders stand out from the crowd, and compete in challenging markets. We focus below on those that have shown the most significant year-on-year change.

The metrics were measured for every region of the European Economic Area (EEA) plus Switzerland. Thus brands that had localised their shopping experience, for example, to a given market, were measured on how they delivered for customers within that market.

It’s worth noting here that what is considered innovative, in particular, changes from one year to the next – and so do the research metrics that are considered. For example, in previous years researchers looked at whether a brand offered click-and-collect services at all but this year the focus is on whether shoppers can pick up their order from the store on the same day.

What the RXBX Top250 do RXBX retail brands localised their websites to an average of 5.7 member states, and a median of four. Those brands selling consumer electronics were most likely to offer a localised service – including local delivery, local language experience or landing page.

On average, consumer electronics brands offered this localised experience for 10 different markets, while those selling homewares localised to the fewest markets, at an average of 2.6.

There was a noticeable uptick in the number of brands offering alternative product recommendations to those being viewed. Almost three quarters (73%) of Top250 brands did so – up by four percentage points since 2018. Product recommendations were commonly found in the jewellery (76%) and fashion accessories (75%) sector – and least commonly found in the home and industrial appliances (36%) sector.

The tactic can help to keep potential customers on the retailer’s website by showing them a number of alternatives to the product they’re considering that might better fit their needs. RetailX expects that more of the Top250 will introduce this practice in coming years.

Fewer retail brands enabled browsers to save products that they’d viewed to their wishlist. Six in 10 (60%) of the 211 brands that appeared in the Top250 both in 2018 and 2019 offered this in 2019. That’s down from 63% in 2018. Jewellery (75%) and cosmetics (72%) brands were the most likely to offer the feature, while consumer electronics (23%) and home and industrial appliance (25%) brands were the least likely.

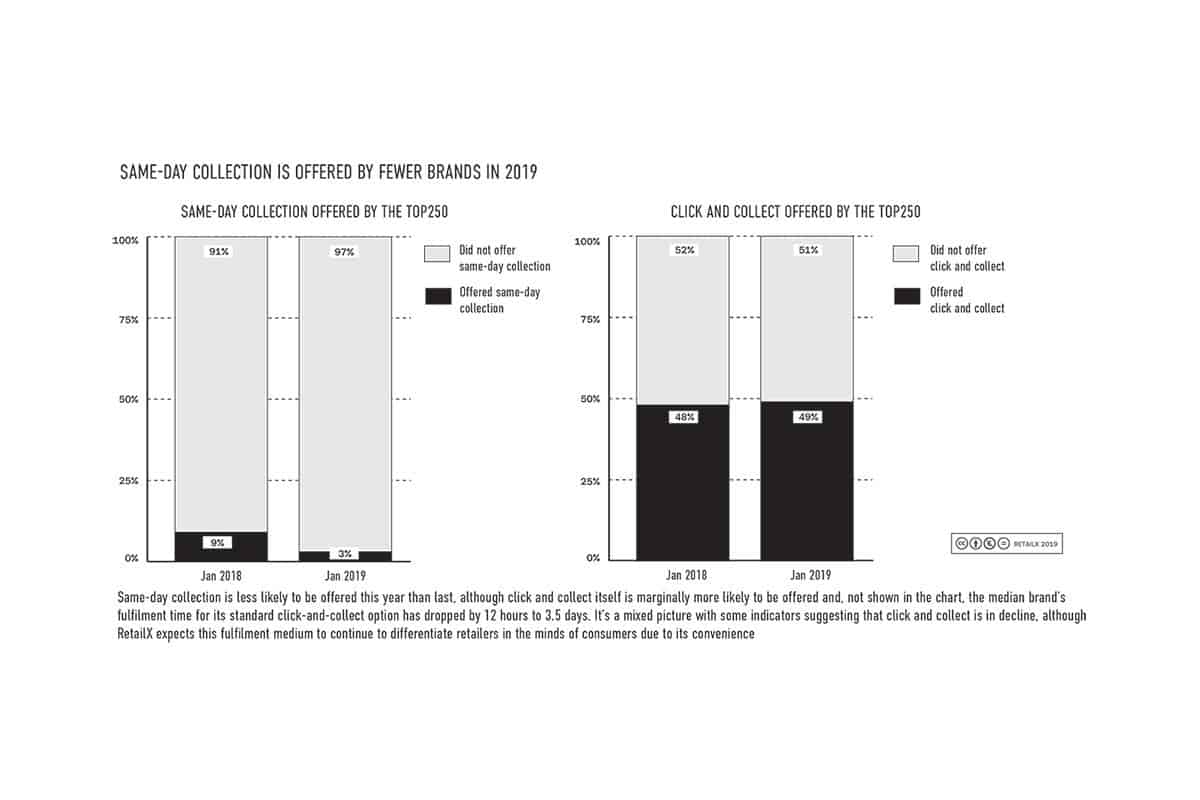

Although there was a small overall rise in the number of retailers offering click and collect, it was noticeable, in 2019, that there was a significant drop in the number of retailers offering same-day collection.

Among the 113 brands that offered a click-and-collect service in both years, 3% offered it in 2019 – down from 9% in 2018. The service was most commonly found among jewellery brands, where 4% offered it, and fashion accessory brands (2.6%).

Least likely were those brands selling sports and outdoor equipment and homewares: fewer than one per cent offered same-day collection in either of the two sectors. Use of the service varied by geography: 6.9% of those trading in France offered same-day pick up, and 4.4% of those selling in the Netherlands. However, it was least commonly found in Portugal, Ireland, Finland, Denmark and Austria, where fewer than 1% of brands offered the service.

There was a time when RetailX researchers considered that faster, more convenient, more flexible options were almost inevitably going to rise in popularity among retailers. That theory has been proven wrong over the past 12 to 18 months, with a reversal of the trend in same-day collection. The market may have determined that for many retailers more customer convenience in this area is not a strategic choice.

RetailX research continues to include the metric in this strategy and innovation dimension because the assessment is carried out from the customer’s perspective. Find out more about brands’ approaches to collection and fulfilment in the Operations & Logistics Performance Dimension analysis.