Emma Herrod looks at the growth of marketplaces and their place in retailers’ international expansion plans.

MARKETPLACES ARE on the rise, and not just in the reach and turnover of Amazon and eBay but also in the number available for retailers to sell through and ones that they themselves have launched to extend the depth of product ranges on offer.

Amazon and eBay alone account for a staggering 41% of all retail web traffic in Europe, with 47% of Amazon’s unit sales globally being generated by Amazon Marketplace sellers in Q4 2015. Export sales from its UK-based Marketplace sellers in 2015 reached nearly £1.4bn and surpassed the 100 million unit mark.

Looking at sales by ecommerce and listing platform Volo’s brand and retail customers, 20% of the £1bn turnover of GMV in a year from UK retailers is going outside of the UK. This equates to around eight million items sold to other countries. “Our customers ship to every country except North Korea every year,” says the company’s CEO, Paul Watson.

The Ecommerce Foundation puts the sales share of marketplaces at between 10% and 30%, depending on the country, and predicts that by 2020, marketplaces will have a 40% share of the global ecommerce market. In its ‘Rise of the Global Market Places’ study, it reported that as marketplaces work with a lot of suppliers, they can offer a very broad and deep assortment, giving the customer a wide range of solutions to meet their needs for products and/or services. In addition, marketplaces can offer items at a lower price than retailers because of their platform scalability.

Convenience is a key aspect of online platforms as well. They aim to make the customer experience as smooth as possible, which is evidenced by developments such as one-click buy and same-day delivery. As a result, they excel in delivering customer satisfaction.

“Marketplaces combine these three success factors with a form of inventiveness that is remarkable for companies of that size,” says report author Professor Jorij Abraham, Managing Director, Ecommerce Foundation. “For example, Amazon now has more than 150,000 employees and it still is able to remain quite innovative, by developing new products and services that benefit both the platform and consumers. They are able to combine continuous innovation with operational excellence, which gives them a clear edge over the more traditional retailers and brands.”

We like to shop in marketplaces because they offer us choice, explains Watson. “It’s how we like to shop,” he adds. If a retailer ever needed an endorsement of why they should be selling on Amazon, then the level of traffic is it, he believes.

Dave Elston, Digital Director, European Region, at footwear retailer Clarks, agrees. “Some of the sites have insane amounts of traffic and some people will only buy from those markets,” he says.

German consumers, for example, feel happier buying Clarks shoes from German retailers such as Zalando than from Clarks’ own website, he explains, since they are very cautious shoppers who like to know that everything is correct and secure. “My second most visited page after the homepage is the terms and conditions,” he says.

The other part of the decision about which marketplaces to sell on is representation and brand fit. Clarks, for instance, wouldn’t list its products on a discounter’s site.

INTERNATIONAL

“There’s not one model for the global business,” says Elston, explaining that as a manufacturer, wholesaler and B2C retailer, Clarks uses a number of marketplaces in different locations. The company works with a local partner in China to list on Tmall, with the partner also handling supply chain and fulfilment operations. Elston believes that “they can execute it better than if we did it ourselves”. Clarks also lists on JD.com in China and on Japan’s leading apparel platform, Zozotown.

Elston explains that Clarks has a non-transactional site in China because the country is a difficult one in which to go it alone. “Not many people have launched a successful site in China,” he says, adding that “the aggregator model is key to business out there”.

The firm uses marketplaces in the Americas for its wholesale business.

Elston advises that If you’re going to do a marketplace in a new country you still have to localise the content. The key consideration is how good your data is, since content and imagery need to be in “tip-top” condition. “Be prepared to work at that,” he adds.

Some marketplaces make entry to new markets easier by offering fulfilment or customer services. They may even specify in their SLAs that sellers must respond to customer enquiries in the local language and within a certain timeframe. Factors such as these need to be taken into account, though, and thought through whether market entry is via a marketplace or going it alone with a localised, transactional site.

As Hakan Thyr, Director of Partnerships, ChannelAdvisor, advises, retailers should think about what the demand for their product is in different markets and take an agile approach to going international. Rather than spending a lot of time and money translating their own website, marketplaces offer a much more low risk way to discover whether there is a demand for a product or service and where that demand is located.

Even within the EU, there are complexities such as managing returns from different countries and the level of returns you should expect from each market. For example, there is a high rate of returns for clothes in the Nordic region and Germany but in France it averages 15% – 20% and is even lower in Spain.

Marketplaces allow retailers to experiment with products and pricing to gather an understanding of the shopping habits, returns profile and payment needs of new markets in a way that’s cheaper than jumping straight in with a localised site.

Naveen Aricatt, legal expert at Trusted Shops, says: “They are a brilliant, cost-effective way of researching, then entering, a new country and the UK has embraced them since they landed on our shores from the US. The consumer feedback and reviews that marketplaces offer help retailers gain instant trust when trying to sell in a new country. That is critically important as the heritage and trust UK retailers have built with a customer base here will not be carried with them.”

It’s also becoming easier for brands to promote themselves on marketplaces with their own store. Thyr cites Superdry’s eBay store as an example.

Once set up, many of the processes of managing inventory and listings on international marketplaces can be automated and systems such as those from Volo and ChannelAdvisor are pre-integrated into marketplaces and carriers. As Watson explains, the vast bulk of sales are through Amazon, eBay and Rakuten, but there are many smaller marketplaces with a geographic or category-specific focus. It’s just as simple to list on Allegro in Poland, Newegg in the US, Cdiscount in France or on Google Shopping. “Allegro accounts for around 60% of ecommerce in Poland and Cdiscount is still a large force in France while not being as big as Amazon,” says Thyr. “And don’t ignore eBay; it’s still a strong force.”

Electrical goods specialist Electrolve, for example, sells to 127 markets. Owner Oliver Margasson explains: “Operating from our Grimsby warehouse, the business benefits from strong transport links and courier services; the kind of agile infrastructure from which we can quickly source and sell our products internationally. With consumers around the world getting wealthier, and governments investing in better internet access, our international trade has grown to account for 60% of total sales.”

The number of vertical-specific marketplaces is growing significantly with one going live every month to fill the niche areas into which Amazon doesn’t go deeply. One such is the sports apparel and equipment marketplace launched in February by French sports newspaper L’Équipe. L’Équipe Store offers a range of 70,000 products distributed by 30 specialist retailers and sports brands.

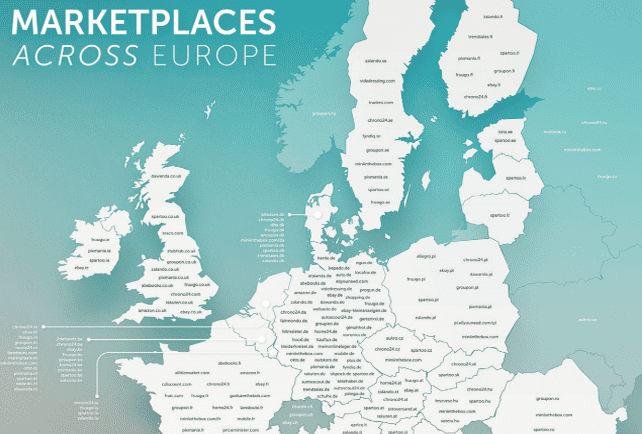

More than 50 companies operate over 220 online marketplaces in Europe, according to Germany ecommerce association BVOH. According to a column by the association’s president, Oliver Prothmann, in InternetRetailing in September 2015, there are 39 online marketplaces in Germany alone, plus 24 in France and 14 in Italy.

Most of the marketplaces differ significantly from their competitors’. The mechanisms used by the providers vary greatly with, for instance, open and closed markets. Also, the moment that ownership changes differs and can range from when the transaction takes place to when the goods are delivered. For a list of the most significant marketplaces across Europe go to www.bvoh.de and search on ‘Top-50 Online Marketplaces’.

LOCALISATION

There’s nothing saying that retailers can’t run their own localised, transactional site as well as selling on marketplaces in the same country. Of course, they have to factor in the specific costs of setting up on their own – consultancy, technology, hosting and driving traffic – all with no guarantee of return. It’s a risky thing to do, believes Thyr, so marketplaces enable retailers to piggyback onto their business. If you’re a sizeable enough seller, the marketplaces will have account teams to advise on local conditions, he explains.

In Europe, many retailers take payment in euros and add cross-border shipping from their own site. Log files show the geographies of where visitors are coming from, how they arrived on the site and what they are looking at, so retailers get a lot of insight into international customers in this way.

Where you go next with localised, country-specific transaction sites depends on your profile, explains Thyr. If you have 300,000 skus, translation is going to be a cost so launching in English-language countries will be easier. However, if you are a brand with 500 skus you don’t have to make such a big investment in translation, and fulfilment to Europe is much easier than sending and returning goods to New Zealand.

“If retailers want a low-cost entry into a new market, it’s a no brainer. It’s not an either/or,” says Watson. This is especially true when you consider that some retailers have decided to pull out of a country having tested their product or service on a marketplace. Of course, others get the information and exposure they need from their marketplace presence and then go on to launch their own localised site successfully.

While it’s true that selling through marketplaces won’t provide the richness of data that retailers can gather from their own localised site, they are certainly a force to be reckoned with. Marketplaces are growing and are set to become a much more predominant channel, so they’re something any retailer should be considering seriously. A marketplace channel, in the right location with the correct brand match can be a straightforward way to diversify revenue streams; in some countries, such as China, it’s the only way to go.