Emma Herrod investigates the build up to peak 2016 and what retailers are doing to avoid the challenges of peak 2014.

THE VOLUME of sales over Black Friday 2014 was a shock for many. It heavily impacted retailers, as well as supply chains and delivery partners. In the two years since, many retailers have responded well, getting a better understanding of how to shape their offers, structure websites and develop the infrastructure and planning to drive value from it.

Shop Direct is one retailer that’s a fan of the shopping event. “Black Friday is here to stay; shoppers have embraced it and we at Shop Direct love it,” says Phil Hackney, Group Operations Director at the online fashion retailer. “Black Friday 2015 was our busiest trading day on record, with orders at Very.co.uk up 64% year-on-year, supported by 100% web stability.”

Stuart Higgins, Retail Partner, LCP Consulting, believes that the logistics challenges of Black Friday 2014 are not necessarily a thing of the past. “The potential bottlenecks will shift,” he says. “2014 was largely a carrier-based issue but in reality it was an issue with a failure to collaborate. 2015 showed us that retailers and carriers are collaborating much more closely around capacity but there are still potential issues with 2016 because any online offer, such as Black Friday, is unpredictable.”

Higgins says retailers need the infrastructure to handle the level of demand; with online continuing to grow, those retailers that haven’t invested in incremental capacity won’t be able to cope. While retailers have become better at predicting the volumes at peak, there are still those that don’t have the ability to forecast demand accurately. So they will promise at the front end and not have the back-end capability to back it up, he explains.

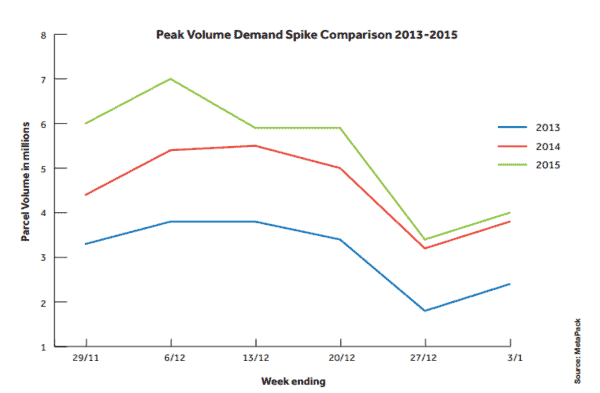

Retailers and carriers worked closer together in the run-up to peak 2015 to ensure that capacity was more accurately forecast and allocations booked. In his guest article in InternetRetailing’s sister publication, eDelivery, Kees de Vos, Chief Product and Marketing Officer, MetaPack, looks at the lessons for peak 2016. He explains that the collective investment in planning and devising strategic communications started early in 2015, laying improved groundwork that put the cyber weekend and peak period under greater shared control. More open communications and data sharing across the entire fulfilment supply chain meant consumer demand was forecast more accurately, offers and discounts were spread more evenly to smooth out the peaks, and additional capacity and resources were put in place to cope with projected demand.

ANOTHER 3-MONTH PEAK?

Inevitably, 2016 will be the third year with a 3-month peak. These seasonal promotions have become a shopping norm, so consumers will shop early for Christmas. They are also getting savvier and waiting for last-minute discounts. However, as Judy Blackburn, Director at Kurt Salmon, points out, a customer is only going to buy one TV, so if they buy it at 50% off during Black Friday, they aren’t going to go out and buy another or be foolish enough to wait to pay full price for a slightly newer model a few weeks later at Christmas.

Essentially, retailers are shooting themselves in the foot with Black Friday and early promotions unless the goods are bought specifically for these events or they are being used to shift outdated stock.

With some already offering to deliver goods within hours, consumer instinct will be to wait until the last possible moment to order, yet expect a speedy delivery; retailers are going to have to plan for this or make the cut-off dates and shipping charges very clear. A shipping survey by Kurt Salmon in October 2015 found a significant disparity between what was communicated with customers at each stage of the customer journey. “Providing better information on order status will improve the customer experience and should encourage repeat ordering at other times of the year too,” says Blackburn.

The same survey found that 90% of retailers were offering free shipping. “But retailers are not just absorbing the cost of delivery, there are also the returns to be taken into consideration,” she says. “Some 68% offered free returns and 33% refunded the delivery cost if customers returned the full order.”

Servicing this proposition is costly for online retailers, particularly as the survey found most orders were delivered in several packages, with 37% of retailers delivering an average of 2.8 parcels for multiple orders and one retailer delivering six items in six separate parcels. Blackburn warns: “Retailers cannot afford to continue to carry these losses, which will only increase as more customers shop online.”

There’s also been a huge growth in click and collect, especially during peak trading, which creates significant in-store disruption. Sean Fleming, Editor of eDelivery.net, investigates elsewhere in this issue of InternetRetailing, whether click and collect at peak is reaching breaking point.

Everyone in the industry knows peak is coming, understands the challenges and is planning further in advance. “The challenge remains how to treat every customer as if it was a normal day’s trading, because customer expectations don’t drop,” says Andy Oldham, Managing Director, Quidco.

Not only will 2016 continue with the extended peak but Black Friday is also expected to be even bigger. “We saw a 50% uplift on transactions in 2015 versus 2014 and I think we could see similar increases this year; however, its wholly dependent on the deals in the marketplace. I do think that retailers will be competitive this year in terms of pricing and product, which will drive take-up,” says Oldham.

That increase in Black Friday trading is also expected to further move online from the high street with higher returns volumes being the inevitable consequence.

Despite the challenges for retailers during this period, customers still expect to be able to get online, order and have the product delivered, without question. They are also more sensitive to issues in the run-up to Christmas since they are buying online for other people. Consumers last year were also encouraged by their positive experience of Black Friday 2015. Good communications and the ability to change delivery address, time and day of receipt reinforced their belief in retailers’ abilities to make the important deliveries and increased their confidence in purchasing online in the final few days before Christmas.

According to John Munnelly, Head of Operations at John Lewis’s Magna Park Campus, “91% of the proposition was next day” on 21 December, which is above the level of orders for next-day delivery on Black Friday. In-store footfall was down 8% on Black Friday itself but at johnlewis.com it was up 6% year-on-year following a dip in trade in the preceding days, he told delegates at the eDelivery Expo.

Munnelly believes that Black Friday is here to stay; the customer will continue to demand more for less because of the idea that delivery is free. In the medium term, he says, there’ll be more smoothing of demand. This, in turn, will lead to more collaboration across the industry and value-added services involving personalisation.

PLANNING FOR 2016

He told delegates that planning for peak at John Lewis is now supply chain led: “It was greatly collaborative and 12 months in the making.” He explained how forecast accuracy leads to fulfilment capacity and carrier capacity for that period, but warned that mobile purchases can drive split shipments thus requiring more capability capacity to be added to the operation. “Supply chain is the new rock and roll,” he added.

Shop Direct also believes that comprehensive preparations are necessary. “Even though confidence and capability are growing, peak season is vital, and those retailers that fail to plan accordingly will find it challenging and miss a massive opportunity,” says Hackney.

“During the seven weeks to 25 December 2015, we grew sales by 6% year-on-year, whereas the non-food market grew only 0.3%. This growth was the result of tireless preparation across our business, including through the supply chain and, in particular, in mobile ecommerce, which saw significant growth. Mobile sales made up 63% of Very.co.uk’s sales over Christmas.”

He adds: “Throughout the industry, customer confidence is growing after two years of strong delivery service at peak, during which time delivery capability has improved. From a supply chain perspective, retailers need to work with their partners to build true end-to-end capacity. This should be based on robust and tested forecast models, and strong, considered and tested contingency plans.”

Collaboration and communication are needed to match the customer offer to what you know you can deliver. “Don’t jeopardise your demand forecast by using unplanned or unpredictable promotions, such as free, next day on Black Friday,” says Higgins. He urges retailers to understand their daily capability and use in-flight management during the period to manage the offer and guarantee what they can fulfil against.

He believes that a separate challenge for 2016 is to what extent Black Friday will be the predictor of early volume for Christmas and how retailers will spread the promotions in the lead up to it. “That’s the uncertain area at the moment,” he says. “No-one could predict that Asda would not do Black Friday last year”.

Many of the people I spoke to on the retailer, carrier and supply chain sides think that Black Friday is a permanent fixture, and many believe its popularity will continue to grow. Indeed, as Shop Direct’s Hackney says “we’re certainly planning with that in mind”. More retailers will try and stretch Black Friday by running promotions over the week, extending the event so consumers will spread out their purchases.

To predict where they’re going to shop and therefore which channel retail operations need to support is more difficult. “Like any period of demand, Black Friday presents challenges for retailers’ systems, processes and partners,” says Hackney. “For those that get it right, Black Friday can have massive rewards.”

The ‘winners’ in 2015 were those retailers that worked in a true omnichannel way, the John Lewis’s of this world. To succeed this year, retailers need to be truly joined up across all channels, internally and customer facing. Promotions cannot be available in a single channel, stock availability needs to be managed across online distribution centres, physical stores and high-volume click-and-collect locations, and nothing should be promised through any channel if the business can’t fulfil delivery. Failure to do so will irritate consumers and cause logistical nightmares.

So, while logistics and operations are working closely with fulfilment and carrier partners and maintaining efficiencies and capacity during peak, trading teams need to communicate with them, switching on and off offers, messaging and delivery options before overpromising to customers.

It’s the one time of year when retailers need to be more supply chain led. The supply and commercial teams need to work closely together, since getting orders to individual customers is a key part of delivering the customer experience. Black Friday 2016 will present its own unique challenges, but efficient communication and collaboration will once again be vital to success.