While high street shops are still responsible for the lion’s share of retail sales, there are clear signs that their role is shifting. Could it be that the future of ‘physical’ stores will be to maximise opportunities and bridge the gap between online and offline? asks Emma Herrod.

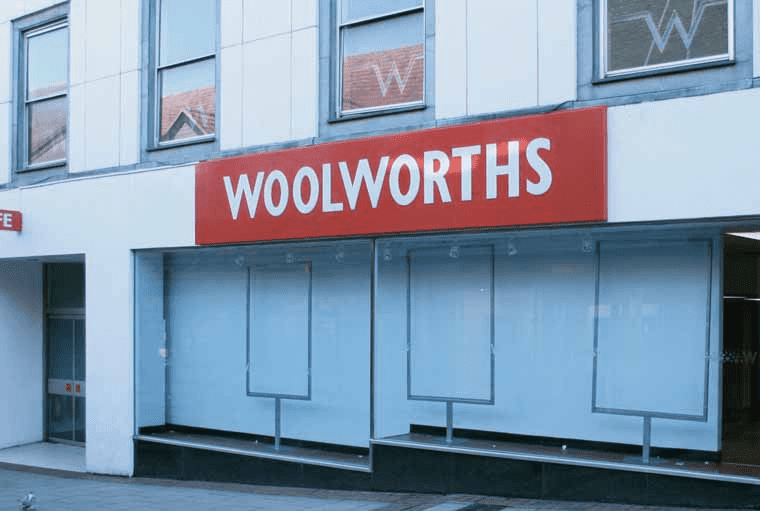

Multiple retailers closed an average of 20 stores a day in the first half of 2012, according to PwC and Local Data Company. By the end of October 2012, more than 10% of all high street and shopping centre stores in the UK lay empty with fewer people using the traditional channel to shop than a year ago.

“This new high in empty shop numbers really sets alarm bells ringing,” says Stephen Robertson, British Retail Consortium (BRC) Director General. “It’s the worst vacancy rate [since its survey began in July 2011] and confirms that financial challenges for both customers and retailers are far from over. Many retailers are battling stagnating sales and rising costs, and 2013’s threatened business rates increase can only make matters worse.”

The BRC is calling on the government to freeze business rates in 2013 to help breathe life back into the UK’s high streets. But is it too little, too late?

Some believe that the high street is already “as good as dead” with online and mobile presenting “terminal diseases” and a nightmare scenario for retailers. The past decade has taken a toll on the high street: structural change, large format shopping and product aggregators in the form of supermarkets and online all having played a part. “You just have to look at the situation with book shops,” says James Miller, Lead Consultant, Retail & Property at Experian and author of its Town Centre Futures 2020 whitepaper. “Now the economy is exacerbating that decline.”

However, Miller says the high street is far from dead, although he does admit that it has a challenge on its hands. “If it learns to adapt, its future is bright,” he believes.

HIGH STREET BEHAVIOUR

While at Internet Retailing we’ve been used to reporting growth figures for online purchases and the meteoric rise of shopping via mobile phones and tablets, physical stores still account for the majority of retail sales (between 80% and 90% of the total depending on whose figures you refer to). Cross-channel and the store environment are actually the growth areas for digital teams’ work within retail. Argos , for example, attributes more than 50% of its sales to multichannel shopping. Its fastest-growing channel remains online check and reserve, which now accounts for 30% of sales; mobile and kiosks take the remainder of multichannel sales.

Independent retailers, the high street and shopping centres are embracing online by acting as collection points for online deliveries. Locker boxes from independent companies such as ByBox and retailers including Amazon are becoming a familiar site as delivery options for consumers increase. Delivery services such as CollectPlus – which has just signed up its 5,000th outlet – see petrol stations and convenience stores acting as collection and delivery points for parcels from other retailers. eBay has been trialling same-day delivery in San Francisco in the US, and has recently started a trial of click and collect in the UK.

But the high street is more than a point from which to pick up online purchases. A significant proportion of people who look up a product online or on their mobile (38%) still want to go into a shop to actually buy it, reveals a study by TradeDoubler. Another report, by digital wallet provider Skrill, found that one in three consumers uses the high street just to window-shop, using mobile phones to compare prices, save details for buying online at home or to make purchases. Experian’s James Miller believes that the future role of the high street, as far as retail is concerned, is to become a bridge between offline and online.

People are shopping across all channels, researching in one or more, purchasing in another for delivery to home, office, store or local collection point. The line between channels has already blurred, if not disappeared, from customers’ minds and retailers are moving increasingly to multi-touchpoint operational models – or at least cross-channel teams – rather than the dual silos of shops and ‘other channels’.

House of Fraser , Marks & Spencer and John Lewis have each opened a ‘Store of the Future’ and are following this consumer trend of using the high street as a showroom for purchases to be made in other channels. Others have taken the test-everything-and-see-what-sticks approach, experimenting with mobile and other user interfaces for their staff and customers following the innovator’s mantra of ‘fail fast, succeed faster’.

FUTURE CONSUMERS – AGE, ECONOMY & TECHNOLOGY

So where is this change leading the high street and consumers? “Shopping and showrooming behaviour aside, they [high street shops] are still a place of face-to-face service and social and leisure activity, and that is not going to change,” says Miller. Indeed, almost 90% of the population live and work in towns and cities. What will change, though is the age of consumers, the economy and the technology involved.

- Between 2012 and 2020, 79% of UK town centres will experience at least a 10% growth in the 50+ age group, according to Experian. It predicts that in five years’ time there will be half a million fewer teenagers and young adults in the UK, while in ten year’s time, there will be three million more people over the age of 70. Some regions will have a much higher proportion of older consumers than others; the highest growth is expected in the East Midlands, the East, the South East and the South West.

- The shopping public will continue to look for value, and still want quality as well as choice, so retailers will also have to take these factors into account.

- The biggest game changer on the high street and in shopper behaviour by 2020 will be technology, especially smart devices such as mobile phones.

While the trend for searching the internet for the best bargains will continue – so that between 2011 and 2015 the proportion of all online-based retail spending will climb from 8.9% to 12.1% – m- commerce and click and collect schemes offer opportunities for retailers to innovate. These three drivers – demographic change, the economy and technology – will merge with existing drivers such as the demand for convenience, experience and choice, to shape future shopper behaviour.

“By 2020, the UK will be a very different place with a shift in shopper make-up and a far greater role for technology,” says Miller.

The UK’s high streets and town centres have a careful balancing act to perform. How they tackle these major drivers of change will be crucial. They must fulfil the modern need for convenience and value of those with increasingly limited resources and incomes, but not to the detriment of quality and service, sought by older and more affluent consumers. At the same time they need to embrace technology to enrich the shopping experience by combining online shopping with the often more convenient option of collecting goods from town centres.

TRANSFORMATION

Transformation is a necessity for the high street as retailers have to continue to encourage shoppers to visit stores, even if the purchase is made through another channel. According to Miller, more than half of the population in at least 500 towns will have become frequent online shoppers by 2018. This will mean more retailers will need to adopt click and collect and town centres will have to market themselves as convenient hubs for picking up products, such as through high street lockers. They will also have to embrace mcommerce and social media to develop their online presence, offering real-time vouchers and loyalty apps.

Retailers have to “embrace” changes such as showrooming and price comparison believes Jon Copestake, retail analyst at the Economist Intelligence Unit (EIU). “You aren’t going to increase custom through alienation,” he says, explaining how Best Buy’s former practice of replacing barcodes on in-store items with its Best Buy-only codes may have reduced the practice of shoppers easily comparing prices online while in store but could have also put buyers off.

“If you’re not willing to get someone into your store you may as well be a pureplayer,” he says. The showroom function of bricks-and-mortar shops will become more focused on establishing brand visibility and a reputation for service than on generating in-store sales, predicts EIU’s Retail 2022 report. As Copestake says: “A well-located store is good for marketing and branding,” and for pureplays, “click and collect lockers are only one step away from a store”. In fact, the Retail 2022 report believes that “the next decade will see a number of pureplay retailers, especially Amazon, setting up permanent branded showrooms and shops on the high street and in shopping centres”.

Half of the audience at a 2012 World Retail Congress panel discussion on the role of property in the multichannel world agreed. The group of retailers believed that “physical stores would be needed not so much to survive as to maximise the opportunities”.

As far as pop-up stores are concerned, there has always been scope for them on the high street. But there’s now more opportunity for seasonal stores, whether it’s around Christmas time, bonfire night or other big occasions, with landlords having to become more accommodating of short-term lets in the current climate.

IN CONCLUSION

The number of people who buy products online and on-mobile will increase, whether retailers like it or not: the future belongs to those prepared to innovate and adapt to this changing behaviour.

Click and collect, cross-channel and in-store experience – whether through physical interaction or virtual innovations – will all continue to be developed and tested as the high street adapts to shifting consumers demands. But these innovations need ultimately to lead to sales through one touchpoint or another. Enabling customers to do this is key for the high street store, although not necessarily its only role.

The reality is that making the most of mobile and online could be exactly what the high street needs to survive.