Retailers Victorian Plumbing and Séraphine have both, separately, warned this week that profits will be lower than expected as each sees their costs rising.

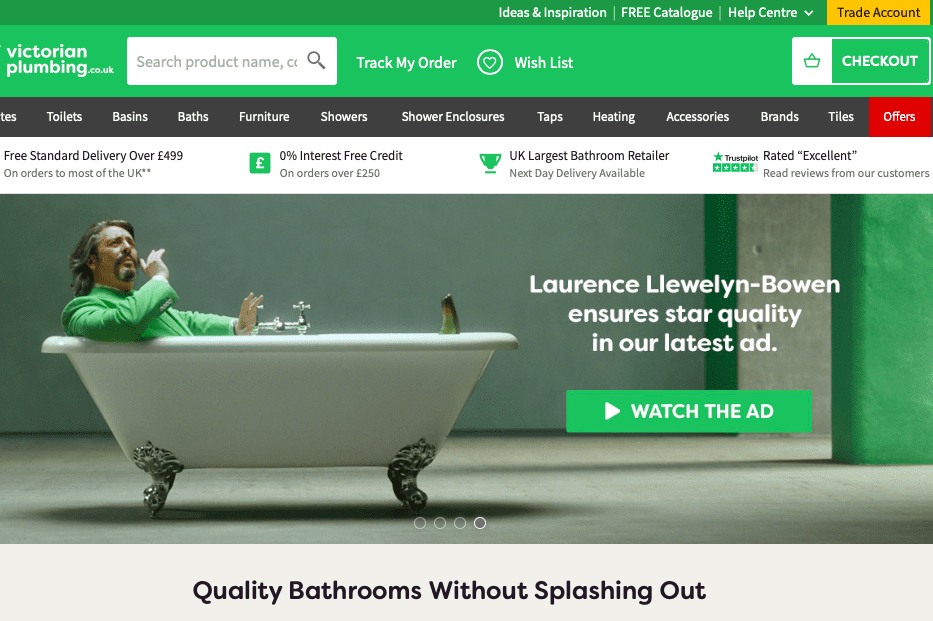

Pureplay bathrooms retailer Victorian Plumbing, ranked Top250 in RXUK Top500 research, says today that its trading is “encouraging” at a time of lower customer demand. In the four months to January 31 2022, it reports revenues 3% lower than a year earlier – but 38% up on the same period in pre-pandemic 2019/20.

It now expects to see sales grow modestly year-on-year through the second half of its year as last year’s comparisons ease – but warns of the effect of rising costs on profits.

“We are acutely aware that our customers are also managing inflationary pressures and will adopt a careful approach to price rises, which means we are choosing to temporarily absorb some additional costs,” Victorian Plumbing says in today’s AGM trading statement. “We therefore expect both gross profit margin and adjusted EBITDA margin to be slightly lower than previously anticipated. We remain confident in our ability to continue to take market share and in our long-term growth plans.”

Séraphine, ranked Top350 in RXUK Top500 research, has also reported in a trading statement this week that both revenue and earnings and will be lower than expected in its current full-year figures, with adjusted earnings before interest, tax and one-off costs likely to come in “significantly below current expectations” at about £4.5m. That comes as costs related to logistics and operations rise.

The maternity retailer says that sales grew by 45% on a constant currency basis in the 17 weeks to January 30, but since then February has been a “soft month across all markets and channels with the retail store trading environment remaining extremely challenging”. At the same time, it has seen higher than expected sales tax and duties in its new markets of Canada and Switzerland, and rising costs in warehousing and transport. It is now using bonded warehousing to eliminate duty charges on customer returns from non-EU markets, registering for sales taxes at checkout in Canada, while negotiating a new long-term agreement with its third-party logistics supplier.

It now expects sales to improve from March, and for sales then to grow by between 25% and 30% in its 2023 full year, when profit margins are also expected to improve.