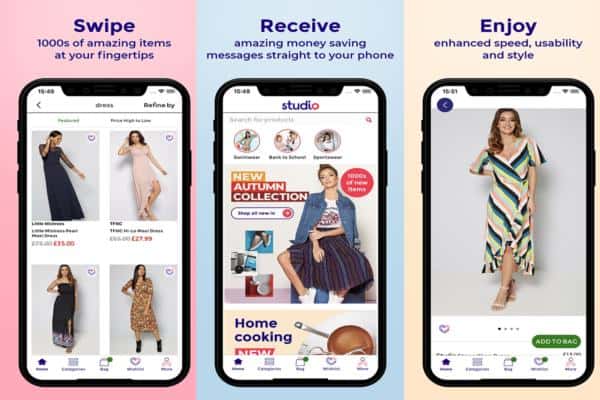

Sales at discount pureplay Studio grew by 32% in a record-breaking third quarter of its financial year. One in five (20%) sales came over mobile, via a Studio app that has now been downloaded by more than a million people.

In all, the website, ranked Top500 in RXUK Top500 research, now has 2.3m customers, including 1.5m with active credit accounts. Studio Retail Group has lending facilities in place to underwrite credit sales made to customers whose accounts are up to date or have only one payment owing. Credit sales eligible to be supported in this way increased by 19% to £349m, the retailer says in today’s third quarter trading statement.

Phil Maudsley, Studio Retail Group chief executive, says: “This was an outstanding third quarter and peak trading performance across the Studio business. The strong sales momentum continued through the period, demonstrating the strength and attractiveness of our online value retail offer.”

Its Findel Education business saw third quarter sales rise by 15%, year-on-year, although it nw expects sales to fall once more as a result of the current school closures. The group says that pre-tax profits for the 39 weeks to the end of December 2020 are expected to come in at £31.3m, 110% or £16m ahead of the £14.9m reported at the same time last year. In the first half, sales were £6m ahead of the same time last year.

The retailer is working with local authorities to administer lateral flow Covid-19 tests as part of extra social distancing measures and says it now has minimal staff on its sites.

Studio has put itself up for sale at the request of shareholders who say it is undervalued by the stockmarket. That process is taking place now, and the retailer says further announcements will be made when appropriate.

Studio Retail Group has net debt of £37.3m at the end of December, with headroom of £32.7m. Its £225m securitisation facility is fully drawn.