While the global sports goods market is dominated by enormous, well-known brands, we also discuss the wealth of localised players that attract a lot of sales and how they are utilising new channels to grow and reach their target customers.

Inside the report we answer the most important questions about how shoppers are buying differently, as well as to reveal the main factors driving this change, what we might expect in the future and how retailers and brands can plan for that.

Report Highlights

- Millennials aged 28 to 43 make up the largest individual group shopping online for sports, accounting for 45%.

- 29% have used TikTok to buy sports goods

- On average, European consumers spent $53.33 a year on sports goods, below the spend seen in the Americas of $63 per person and the $57.19 spent per person in Asia

- A post-pandemic recalibration has happened, with total online revenue from the sector hitting $42.3bn in 2023, down from 2022’s $43.4bn.

Company Profiles

To further illustrate the findings of the report we detailed company profiles and snapshots, each profile includes web traffic, share price over time, company revenue and company profit. As well as an in depth case study highlighting consumer behaviour:

- Page 26 – Decathlon

- Page 27 – Gymshark

- Page 28 – Kicker

- Page 29 – Lids

- Page 30 – Netshoes

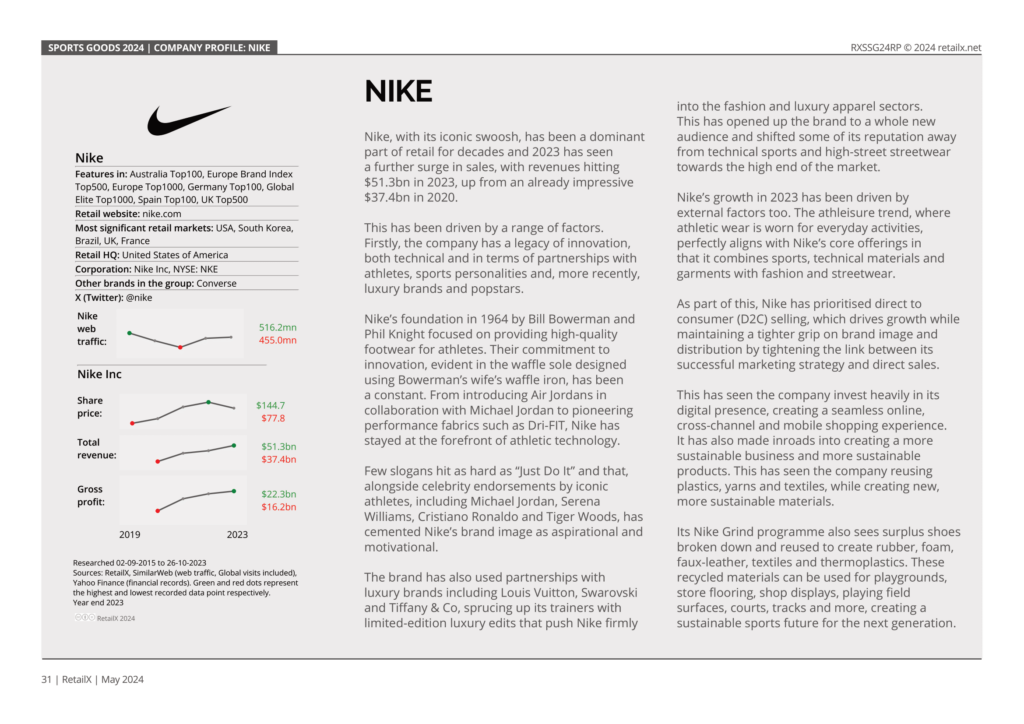

- Page 31 – Nike

- Page 32 – REI

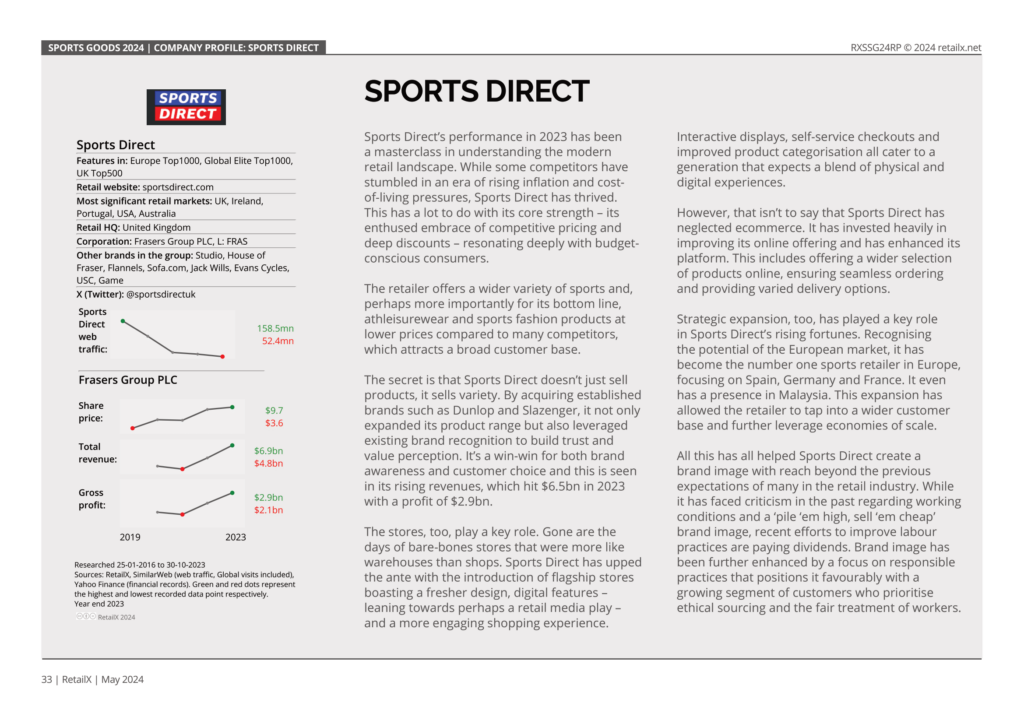

- Page 33 – Sports Direct

- Page 34 – 8A.pl; Arc’teryx

- Page 35 – Asics; Golf Digest

- Page 36 – K-Swiss; Merrell

- Page 37 – Rebel; UEFA