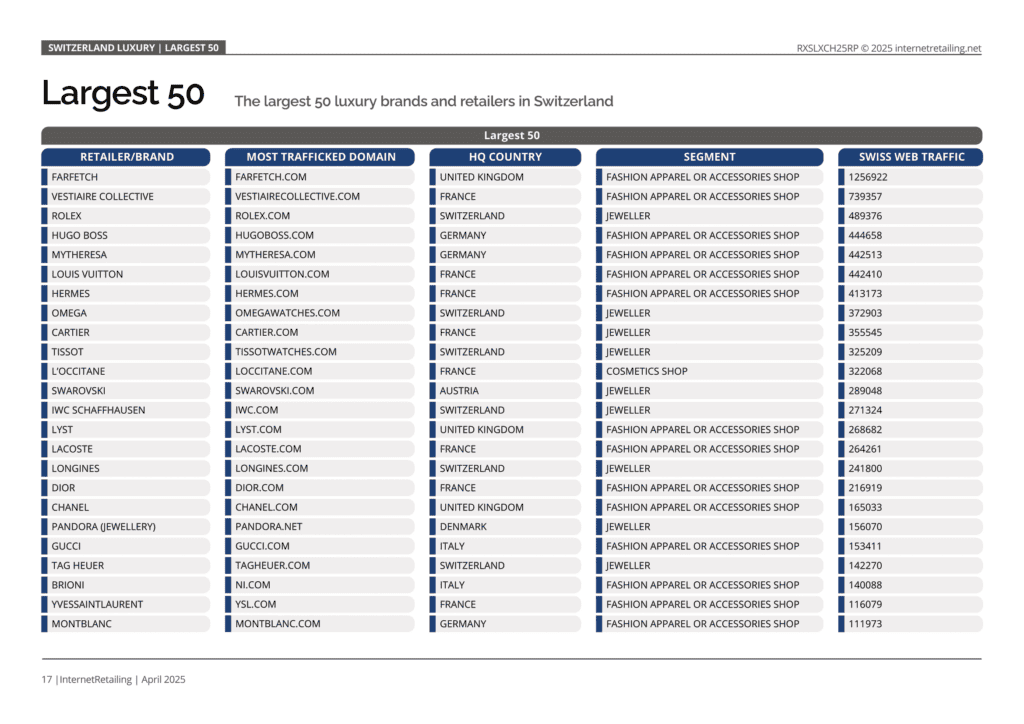

The InternetRetailing Switzerland Luxury 2025 report highlights fashion and apparel is leading the luxury sector in this region, not watches.

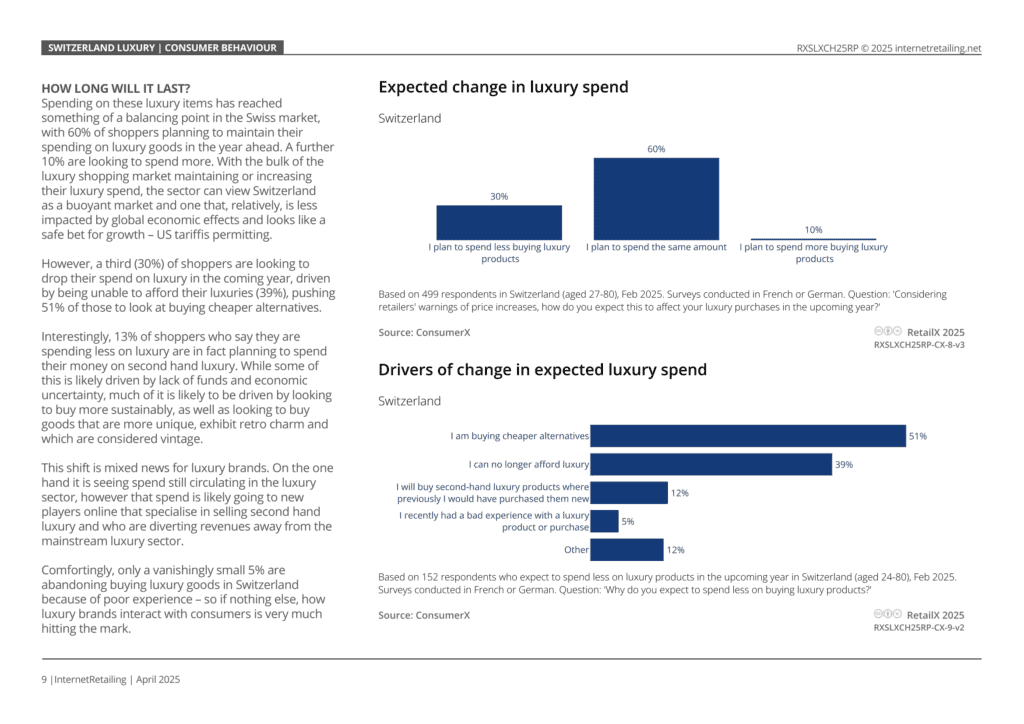

Sustainability is a significant motivator for Swiss shoppers, who are willing to pay more for ethically sourced goods and are increasingly engaging with the second-hand market.

Inside we analyse consumer behaviour, channel preferences, and the impact of sustainability, also profiling key luxury brands and retailers active in Switzerland. It discusses future trends and the role of technology in shaping the Swiss luxury landscape. The research underscores Switzerland’s unique position as a digitally advanced luxury market with evolving consumer expectations around sustainability, personalisation, and value.

Inside the report

- Largest luxury brands – We examine those top-performing sellers that have created novel ways to target this often rewarding market

- Market context – The Swiss luxury market is a buoyant one. Recovering rapidly to a small dip during the pandemic, it sailed past €34.2bn in 2023 and is on course to grow still further in 2025

- The luxury consumer – ConsumerX research highlights how these shoppers are both digitally and environmentally savvy. The Swiss love online shopping and they are keen to buy luxury – but new entrants may be making a move

- Channels and devices– Swiss consumers are very much mobile-first when it comes to shopping luxury, marking them out in Europe, if not the world

- Sustainability – The drive for sustainable living is a big factor in driving Swiss luxury consumer behaviour. Data shows that there is a growing mood among these shoppers that part of luxury’s charm lies in its resale value

Company Profiles

Our analysis of the Swiss luxury sector is illustrated with company profiles showcasing the approaches being taken by six retailers:

- FarFetch

- Gucci

- Hermes

- Hugo Boss

- Longines

- Rolex