Fulfilment as a retail battleground

As retail changes, customers expect to be able to get hold of their purchases without fuss and in ways that fit in with busy lives. Jonathan Wright considers what RetailX research says about how IREU Top500 retailers are doing here.

Because of the growth in ecommerce and multichannel retail, fulfilment services are now integral to the overall customer experience. This represents a profound shift in the way retail is conducted. Where once the enormous amount of effort retailers put into Operations & Logistics went largely unseen by customers, that’s no longer the case.

If a next-day delivery item fails to arrive, or a click-and-collect purchase takes days to reach a store, the customer knows about it almost immediately and may choose to shop with another retailer next time. Even a rude third-party delivery driver can reflect badly on a retailer.

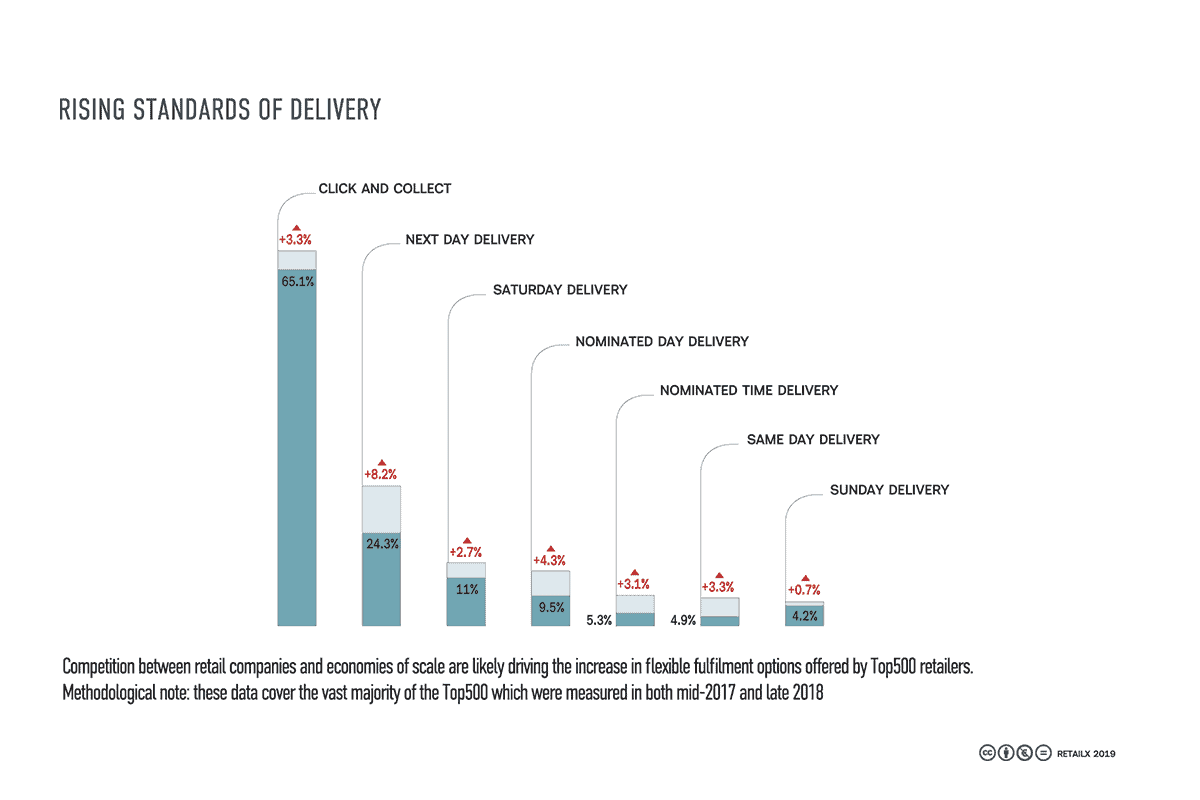

It is therefore unsurprising that, faced with such a business landscape, most retailers in the IREU Top500 are investing heavily in their fulfilment offerings. This is leading to huge improvements across different territories, with the biggest gains made outside western Europe in, for example, former Eastern Bloc countries, where there was far more room for big improvements rather than incremental changes. Next-day, same-day and weekend delivery, as well as click and collect, are now far more likely to be offered by retailers in these territories than they were just 18 months ago.

Sector performance

Drilling down into the figures, some sectors are more competitive than others across different territories. A majority of IREU Top500 retailers in sports footwear (72%), sports clothing (70%) and sports and outdoor equipment (67%) sectors, for example, offered a click-and-collect service. It may be that these are sectors where young and internet-savvy customers are impatient of delays.

Against this, the EEA-weighted equivalent figure here was 64%, so it may be that all kinds of customers now expect to be offered a click-and-collect service, which certainly fits with the news that garden (70%) and homeware (68%) retailers also performing strongly.

There is not a correlation between offering a click-and-collect service and speed. At the time of our research, the median time for click-and-collect purchases to be ready was 48 hours across Top500 retailers within the retailers EEA. The equivalent figure for retailers in the drinks, grocery and garden sectors was 24 hours.

The trade tools (31 hours) and automotive goods (36 hours) sectors also performed comparatively strongly. It is outside the scope of this research but we would suggest that there is ample room for improvement here as, for example, more retailers prioritise the capability to be able to see stock levels in real time. Such developments should also lead to an increase in the number of retailers offering same-day collection, which stood at 13% when RetailX conducted its research. The equivalent figures for the garden (39%) and automotive goods (28%) sectors shows what can be achieved.

Click and collect

Turning to specific types of services, we have already noted how, despite overall improvements, click-and-collect services nonetheless remain more commonplace in western Europe. Looking at those countries where retailers are performing less strongly, Spain, where 52% of IREU Top500 retailers offer click and collect services, is the only southern European territory where more than half of retailers offer collection. This figure drops even further for eastern European countries such as Slovenia (16%), Croatia (24%) and Bulgaria (26%).

There are also some outliers worth noting: the equivalent figure in the Czech Republic is 52%. Conversely, Luxembourg has a particularly low offering of click and collect (33%), in comparison to its neighbours.

In terms of year-on-year changes between 2017 and 2018, and comparing only retailers that were researched in both years, the biggest shifts occurred in France (+18 percentage points), followed by Finland (+16pp) and Portugal (+15pp).

While this is the first year RetailX researchers looked in detail at same-day collection, Ireland leads the way here, with 18% of the Top500 retailers operating in the territory that already offer click and collect also offering it on the same day, followed by France (15%), and Czech Republic and Slovakia (13%). The EEA average figure is 13%.

Next-day delivery

Turning to goods that are shipped to customers, the UK also leads the way in next-day delivery offering, which is offered by less than half (44%) of the IREU Top500 operating in the country.

Retailers operating in the Benelux countries (Luxembourg: 19%, the Netherlands: 16%, and Belgium: 13%), France (15%) and Germany (13%) perform more strongly than elsewhere in Europe, but there’s still a big gap between these territories and the UK.

In this context, it’s worth noting that an increasing number of Top500 retailers across all territories are offering next-day delivery. In Luxembourg, the difference between 2017 and 2018 was +11pp, while even in the comparatively poorly performing Hungary, the equivalent figure was +2pp (from 2% to 4%).

Same-day delivery

This is still a considerably rarer service than next-day delivery, making it a marker for sophisticated retail operations. Researchers were therefore surprised to find that 6% of IREU Top500 retailers operating in Greece offer this service, the same figure as in the UK, against a benchmark EEA average is 4%.

What is noticeable is that same-day delivery is on an upward trajectory in those territories where it is offered. In Greece, just 2% of retailers offered this service in 2017.

In the UK, the same figure was 3%. Also following this pattern, the equivalent figure in Spain jumped from 1% to 5%. In all cases here, these figures compare only retailers researched in both 2017 and 2018.

Showing how far many retailers have to go, fewer than 1% offered same-day delivery in Romania, Bulgaria, Cyprus, Estonia, Croatia, Lithuania, Malta and Slovenia.

Other areas

To look briefly at some of the other key findings: retailers selling clothing and shoes are far more likely to offer pre-paid returns than those in other sectors (35% of companies against an EEA average of 25%); the median EEA threshold for free delivery is €44; and, to reiterate, grocers perform most strongly in same-day delivery and fulfilment precision with delivery time windows.

Behind each of these snapshots lies a story that requires deeper analysis. In our second Dimension Report on Operations & Logistics later this year, we will look in more detail at the issues and the innovations that lie behind these numbers.