Merchandising is an area where performance has advanced incrementally in recent years. But could the pace of change speed up? Jonathan Wright looks at the numbers.

The idea of actively offering customers products remains as central to retail in the digital age as it was 100 years ago. Savvy retailers know not only what kinds of goods their customers are buying, but also what kinds of goods they might buy if offered the opportunity.

Clearly, this is not an exact science. Some Merchandising initiatives will inevitably fail, but the broader point is that successful retailers use their knowledge of customer bases to take calculated risks by offering new products to upsell and cross-sell. When things go well, these initiatives pay off.

RetailX research aims to assess how IREU Top500 retailers are performing here by looking at the Merchandising techniques retailers use on their websites and apps. During the last research period, this involved analysing the following areas:

- Product pages on desktop and mobile websites: average number of images, helpfulness of descriptions, ratings and reviews, and cross-selling initiatives

- Website landing pages: features, options, look, etc

- Website navigation and search, ‘mobile friendliness’

- Website promotional activity

- Mobile app navigation, search, filtering and product pages

Over the years, Merchandising has been an area where there have rarely been big changes in performance. Instead, retailers have made incremental changes, and retailers in territories where ecommerce is more established have tended to roll out more sophisticated techniques first.

That said, this RetailX research revealed areas where there has been significant changes in the deployment of techniques. It also found these significant differences in the techniques being applied across different sectors:

The rise of brands

One of the most striking findings of the research is that more and more IREU Top500 retailers now offer consumers the facility to search by brand. It’s a facility offered by 57% of Top500 retailers in early 2019, a figure that’s up by eight percentage points (+8pp) since mid-2017.

While it is outside the scope of our research, we suspect this reflects the changing way that customers across territories home in on the brands they know they like.

The phenomenon of brands selling direct may also be at play here, in that retailers need to ensure that brand items are easy to find, or risk losing a sale to the brand’s own website.

We also found that more retailers are offering the facility to save items to a wishlist, 59% of retailers, +6pp since 2017. This is alongside a rise in the number of retailers offering mobile app wishlists, offered by 42% of Top500 retailers, up four percentage points between 2017 and the present. With so many purchases now completed by mobile, perhaps companies feel compelled to support this.

Research also revealed an 11pp increase in the number of retailers using upsell techniques at the checkout, a tactic employed by just under a third (30%) of the Top500. Conversely, just 8% of the Top500 used bestseller indicators, down from 10% in 2017.

These results suggest that IREU Top500 retailers are employing increasingly sophisticated Merchandising techniques that support the use of smartphones and reflect consumers’ brand awareness. Looking ahead, we expect these trends to be maintained through 2019.

We would also highlight changes in practice around social validation on the product page – a feature that requires the retailer’s website to connect to the browser’s social media profile in order to show the customer how popular the product was among friends. This is offered by 29% of IREU Top500 retailers, a decline of 9pp It may be that such techniques are regarded as being too intrusive in an era when awareness of the value of personal data is growing.

Differences across sectors

Looking at the figures from another angle, RetailX research revealed clear differences in the Merchandising techniques being used by different sectors, even in site navigation, where you might think that best practice is well established.

Filtering search by price is most commonly offered by retailers of home and industrial appliances (81% of IREU Top500 retailers within this sector). This presumably reflects customers often having a specific budget for replacing items. Those operating in the sports and leisure clothing sector, where the equivalent figure is 80%, also seem to assume they have price-conscious customers.

By contrast, those selling ready-made food (55%), drink (60%) and groceries (62%) are less likely to use this technique.

Filtering by brand is also important within the home and industrial appliances (78% of IREU Top500 retailers within this sector offer this facility), while the sports and leisure footwear (76%) and sports and outdoor equipment (75%) sectors also employ the technique. We were surprised that the equivalent figures in fashion clothing (45%) and fashion accessories (49%) are so low, suggesting a fruitful area for future sectorial research.

More generally, the fashion footwear, clothing and accessories sectors rate highly for sites being easy to navigate. The grocery sector lags here, possibly because it has to offer so many products, or because long-established companies need time to adjust to an ecommerce world.

However, it would seem remiss not to point out that Amazon is eyeing the grocery sector as a place where it can expand.

Presentation

RetailX research shows retailers in the fashion clothing and footwear, sports and leisure clothing and footwear sectors investing in imagery. The median number of their images per product ranges from 4-5 on mobile and desktop websites. In contrast, the figure in the ready-made food, grocery, drink and health sectors ranges from 2-3.

User-generated content

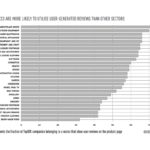

While there is some evidence that retailers are becoming more cautious in their use of social media, that doesn’t mean that interaction is unimportant. In particular, research revealed sectors where it is commonplace to offer customers the facility to leave ratings.

This is a technique most commonly offered by marketplaces (74%) followed by retailers selling sports and outdoor equipment (68%), trade tools equipment and DIY (67%), and consumer electronics (67%). It is least common in the ready-made food (30%), fashion clothing (42%) and fashion accessories (42%) sectors, as well as by direct-selling brands (40%).

In conclusion

To return to the idea of increased competition, notably from brands, and the move to a mobile-first world, we would caution against assuming that these differences in Merchandising performance across sectors will very likely remain consistent in the years ahead.