Inspire and inform

John Lewis heads the Elite group in the Merchandising Dimension. The department store retailer turned in a faultless performance for the way it showcases the goods it sells online.

IT ALSO LED in a smaller but in-depth study carried out by our Knowledge Partner Editd , the fashion data analyst. Editd’s findings recognised John Lewis’ range of 66,000 products, 25 per cent of which were new in the last month. “Less newness than that could suggest a stagnant offering, and more is risky this early in the new season, therefore, we like to see an even spread of newness throughout the year,” says Katie Smith, Senior Retail Analyst at Editd. “John Lewis also have a good discounting strategy: enough reduced product to lure price-savvy shoppers, but without the high-level price slashes of poor buying decisions.”

eBuyer , Topps Tiles and ASOS also feature in the Elite cluster. Each excels, but still needs to make small improvements to match John Lewis.

The make-up of the Elite group encapsulates the idea that the best merchandising is not exclusive to any one type of company

The make-up of the Elite group encapsulates the idea that the best merchandising is not exclusive to any one type of company. From eBuyer, which sells discounted laptops and LED TVs, to fashion retailer ASOS, all share product information effectively alongside appealing images. The same is true of many of the companies in the Leading group, which includes Ikea , the Post Office , Game , Mothercare , Net-A-Porter and Karen Millen .

One sector that does feature heavily in the Merchandising Dimension is fashion. Retailers from this industry are present in every cluster. For example, apparel retailers Hobbs , Coast , Topshop , Boden and Topman make up a third of the 15 merchants that feature in the Model cluster. Perhaps that’s a function of the fact that clothing merchandisers have historically had to do much more to persuade online shoppers that the items being offered will fit customers’ needs.

Interestingly, Amazon did not impress our reviewers as much as some of the others in the study, scoring lower marks for its overall appeal. Another surprise came with the Apple store , which scored relatively poorly on measures such as social validation, stock visibility, wishlist functionality and product recommendations. InternetRetailing researcher Martin Shaw said: “Ultimately, we’re applying the same criteria to each website. If there’s a difference it might be because we’re not comparing like with like. Because Apple underperforms in the area of social media, it doesn’t mean they’re a bad retailer. Maybe if they did engage in social media, they would lose their hipsterness and esoteric appeal.”

In the Editd research, which measures range, discount and stock turnover, John Lewis was followed in the top five by M&S , New Look , Urban Outfitters and Net-A-Porter.

| The Elite group: what set them apart? |

John Lewis, Index Value: 26 out of a possible 26John Lewis didn’t miss a beat on the assessment by InternetRetailing’s research team. The department store website achieved the maximum index value for its product presentation. It rated highly on the more subjective questions of appeal and search results. It also headed the list in Editd’s research, scoring particularly highly on range and newness. Link: John Lewis creates new role of director, online product Link: Review of the John Lewis site eBuyer, Index Value: 25eBuyer proved that selling low-priced computers does not preclude high-quality salesmanship and online merchandising. The only fault our reviewers could find was to award part marks for wishlist functionality. Link: eBuyer opts for new social tools ASOS, Index Value: 25The fashion pureplay won plaudits from reviewers – only stock visibility was criticised. It came 12th on the Editd analysis, where its range was topped only by that of House of Fraser. But it had a relatively low newness rating and high levels of discounting, with products taking, on average, 138 days to sell out. Link: What big data means for ASOS Topps Tiles, Index Value: 25This multichannel tile shop won recognition across the board, with stock visibility its only missing element. |

WHAT WE LEARNED

The retailers that feature in the higher ranks of the Merchandising Dimension are those that have presentation covered from every angle. These are companies that make it easy for consumers to find the goods they’re looking for. These are companies that give information to answer potential questions on issues such as stock availability, and incorporate social feedback. That’s because these are merchants operating in competitive markets where presentation really matters.

John Lewis was the only retailer to achieve the maximum index value

In the fashion industry, well represented in this list, it’s important to convey the look and feel of items shoppers once hesitated to buy online. Retailers had to work hard to convince shoppers they could trust the images they saw. That hard work is now validated as online fashion grows quickly as a category. In August 2014 alone, online clothing sales grew by 20 per cent, according to the IMRG-Capgemini eRetail Sales Index for that month.

Traders where the website makes up for the lack of shops have also ranked highly in this section. The Elite group, for example, includes two pureplays, eBuyer and ASOS. But it also includes retailers with relatively few stores, such as John Lewis, which has 43. Ikea, in the Leading group, has only 18 stores. It’s important, therefore, that the company’s website has all the information about its products, including availability. In the Elite cluster, Topps Tiles, with a larger network of 336 stores, recognises that its shoppers prefer to research online before visiting a branch.

What’s clear in this Dimension is that retailers do best when scoring highly in both quantitative and qualitative research. A ‘belt and braces’ approach ensures that shoppers are fully informed, but only outstanding presentation gave retailers a place in the Elite group.

How John Lewis leads the field on merchandising

John Lewis’ lead in the Merchandising Dimension is far from surprising. In an InternetRetailing review of the site, Shane Walsh, User Experience Consultant, User Vision, rated the company’s “excellent” use of search, adding that, “The product page strikes an exemplary balance between displaying detailed images of products and information about the product.” It’s a lead that may prove difficult to challenge in the year ahead. Since our research was completed, the department store group has appointed a new director of online product. Announcing the appointment, Mark Lewis, online director at John Lewis, said the brief was to “ensure customer experience across our website, mobile, tablet and other devices is market leading.” Such dedication of resources is as yet unusual, but the move goes to show how very important online product merchandising is to a leader in this field. We’ll be interested to see whether others follow in its footsteps.

WHERE NEXT?

Traders are becoming ever more imaginative in the quest to find new ways of showing goods off to best effect online. That’s most notable in the fashion sector, where virtual fitting rooms have been put to work to show how clothing would look on the shopper, or how a particular item measures up against others the prospective purchaser already has. Online video is used alongside 360° rotation and zoom functions, in order to model clothes or show how other types of product work. Elsewhere, grocers use recipes to inspire purchases, while kitchenware retailers show wares in action through video. It’s all about the context, or, in other words, about the relevancy.

Throughout 2015, we’ll expect to see more innovation around explaining how products work and showing how they might sit within a customer’s life. Taking this further, we’ll also expect to see websites becoming ever more relevant to the individual viewer, through the use of technologies such as personalisation. Such engines show website users those items that are most individually relevant to them, based on the items they’ve previously viewed or purchased. Eventually, we’ll expect individual viewers to see their own versions of a site, which may differ enormously from the one that another user sees.

We predict that search technologies, too, will only get more sophisticated. Already it’s possible for site search platforms to learn from previous searches for similar items to show relevant results. In future years, we expect retailers to use technologies that will be far more sophisticated here. It’ll be important, then, that retailers continue to innovate. However, companies need to continue to check that the basics haven’t been overlooked in the rush towards improvement. In order to stand out next year, and in future years, traders will need to ensure that sites tick all of the boxes when it comes to social, stock availability, search, product information, and more.

| The Methodology |

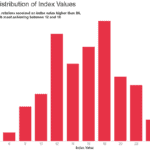

| In the Merchandising Dimension we rank the Top500 retailers according to how well they present products – from the way goods appear on the website to product information and the social sharing that retailers enable.

Researchers analysed the largest 150 retailers in depth. Each website was assessed against six criteria: social media sharing and integration; social validation; stock availability; additional or enhanced product information; predictive search/searchandising; product recommendations. Our expert reviewers then undertook a qualitative assessment of the visual appeal of the presentation and a heuristic assessment of the quality of the search results (relevance to the search string, presentation of the results, presentation of the range). Our research was supplemented by additional insights from Editd, the fashion range specialists, who conducted an in-depth analysis of the apparel retailers that feature in the largest 150. Editd assessed sell through and replenishment rates, discounting levels, the size of a retailer’s offering and the level of newness in their current assortments (data tracked in week commencing 8 September 2014). |