Jonathan Wright and Chloe Rigby outline what our research into European retailers says about the challenges of selling abroad

Retail is a tough enough business for companies operating in only one territory, let alone those seeking to expand abroad. Yet for retailers operating at scale, we would argue it’s imperative to do more than consolidate or seek to expand at home. Not only is expansion overseas a way to boost energy levels and create momentum within the company, the raw figures on potential opportunities are also hard to ignore.

According to a European B2C Ecommerce Report from Ecommerce Europe, turnover from ecommerce grew to €455.3bn in 2015. Based on an analysis of 48 countries, the report forecast this figure would grow to €660bn by 2018.

In themselves, these figures go a long way towards explaining why we launched the IREU Top500 last year. Based on new qualitative and quantitative research, we wanted to know which European retailers were performing best across the European Economic Area (EEA) plus Switzerland. In addition, we wanted to get a sense of what was happening by seeing how Europe-wide dynamics were affecting retailers in different countries.

In this context, at least for now, it’s intriguing to note that three territories constitute by far and away the most important European markets: the United Kingdom, France and Germany. Together, these three countries accounted for 61.9% of all European online turnover in 2015. They’re also the markets where we most often find examples of new techniques being introduced.

Yet if these markets are lucrative and innovative, they are also highly competitive and they don’t necessarily offer the best opportunities for growth. Belgium, a far less mature ecommerce market, grew by 34.2% in 2015, while for braver retailers, non-EEA markets such as Ukraine (35%) and Turkey (34.9%) grew faster still.

In addition to looking at the Europe-wide picture, our research – across the six Performance Dimensions of Strategy & Innovation, The Customer, Merchandising, Brand Engagement, Operations & Logistics and Mobile & Cross-channel – offers fascinating insights into which companies are performing most strongly within different areas of RetailCraft.

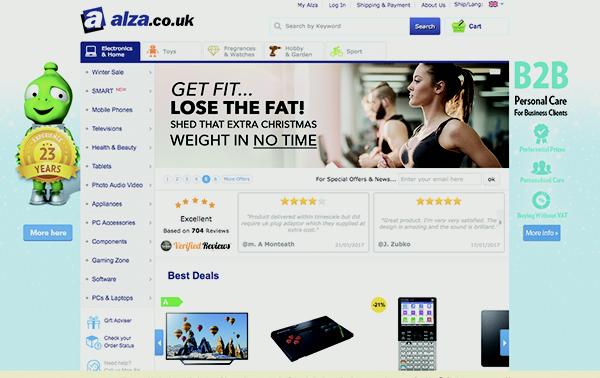

This granular detail in turn offers clues as to what makes for a successful pan-European retailer. Take a company such as Czech electronics retailer Alza. In an increasingly mobile-first world, it runs dedicated iOS and Android apps in the UK, Czech Republic, Slovakia, Germany and Austria. Its pan-European Alzashop app is available in 23 EEA countries and offers product ratings, customer reviews, the ability to share products on social media and advanced searchandising through predictive search. It’s the company’s mobile expertise that’s doing much to drive its expansion, which may prove to be an especially canny strategy in an era when many emerging countries are largely skipping over what we might call the ‘awkward desktop phase’ of digital development.

Finally, we have to mention Brexit here. Theresa May’s recent speech suggested that Britain is heading out of the EEA and this will certainly impact on British retailers. Nonetheless, we would still expect British companies to look to Europe for new markets and vice versa. Aside from anything else, it becomes no easier to export to countries outside the EEA simply because Britain is no longer part of the EU.