Are retailers keeping up with customers? Researcher Polina Modenova considers the latest research into consumer attitudes towards digitally driven retail

Shoppers’ expectations about how they would like to buy – and, indeed, how they will buy – are developing fast. They’re using the advanced technology and new devices that are now at their disposal to shop in the ways they want, where they want and when they want. They simply expect retailers will keep pace. We wanted to understand through our research how fast and how well traders are responding to this demand.

We drew on two sources for our research. First, we used data from an InternetRetailing survey into how consumers prefer to shop, and how they believe retailers are innovating. We questioned 200 customers, asking them eight questions about how they prefer to shop. Then we compared that data to a study of retailers’ approaches to innovation – 103 retailers took part in our survey.

We hoped to gain new insights into what consumers mean by innovation, and what the innovative services and technologies are that they believe best meet their needs. We also expected to find out whether retailers were meeting the challenges that consumers are laying down for them, and how they might best amend strategies in order to meet customer demands.

What we found

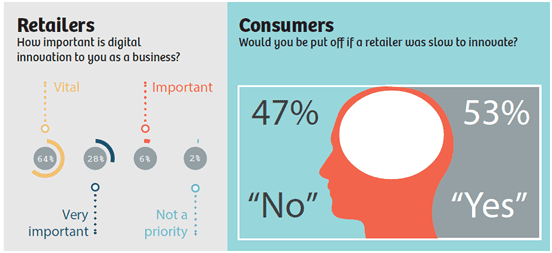

Almost two-thirds (63.6%) of retailers think digital innovation is vital, with more than half (58.1%) of boards rating this as a top priority. This correlates well with the 53% of customers who told us they would be put off by retailers that were slow to innovate. Most retailers, then, recognise the importance of innovation as a driver for consumer demand – and take steps to meet that demand.

Some 77.2% of retailers do that by focusing on web innovation. That appears to meet shoppers’ wishes, since 47% of customers said they would go elsewhere if a retailer’s website was slow and not fully functional. Industry research commissioned by Dyn and published in 2015 seems to confirm this finding, suggesting that half of UK consumers would head to a direct competitor if a site was malfunctioning or underperforming.

Mobile

One interesting finding we noted from Dyn’s research was that shoppers lack confidence in mobile performance, with 40% of UK consumers suggesting that shopping via smartphone or tablet computer was considerably more challenging than from a desktop. That was confirmed by our own consumer research, which found that 42% of consumers did not use retailers’ mobile apps. Retailers, however, showed us that a key focus was on redesigning and innovating within mobile performance, suggesting that retailers recognise the gap between mobile and computer performance, and are acting to close it.

Loyalty

When it comes to loyalty, our study indicated that customers felt equally strongly about online brands as they did about high street brands. Moreover, customers’ attitudes appeared to suggest that future generations of shoppers will be driven by the ease and speed of online shopping rather than brand loyalty. This finding did not surprise us. Accenture’s 2014 Consumer Research study suggested an overwhelming majority (91%) found it easier to complete a purchase in-store than either online (57%) or by mobile (36%).

Our research also showed that customers did not think brand loyalty was one of the most important factors when buying online. Rather, they set out their expectations of the qualities that would encourage them to shop with one retailer over another. They expected the retailer to create an excellent customer experience that didn’t rely solely on customers’ feelings about the brand to win their business. Thus, it seems retailers can achieve online loyalty by satisfying customers’ expectations of a fast and easy online experience. Research from Neilsen & McKinsey (Social Media Report, 2013) suggested that customers use social media to listen and learn about other customers’ experiences. More than three-quarters (76%) of participants said they felt positive when they had used social networks to engage with other people. Since one of the recurring themes in our retail survey was the limited resources and budget available for digital innovation, retailers may find they can use social media to listen and engage with customers, without investing in other more costly solutions.