2020 was a pivotal year for the online grocery industry: with masses of people, across all generations shopping online – some for the first time ever. However, with this exciting opportunity for growth, also came great challenges for the sector, ranging from unprecedented demand, through to the urgent need for digital acceleration.

Click hereto download our grocery report, produced in partnership with Salesforce to find out how the coronavirus pandemic re-shaped the grocery sector – as well as hear directly from leading players in the field.

For now – here’s a sneak peek at the research you will find inside:

Covid-19: an opportunity or threat for the grocery sector?

Although 2020 presented an abundance of challenges for grocery retailers and brands, it also brought new possibilities.

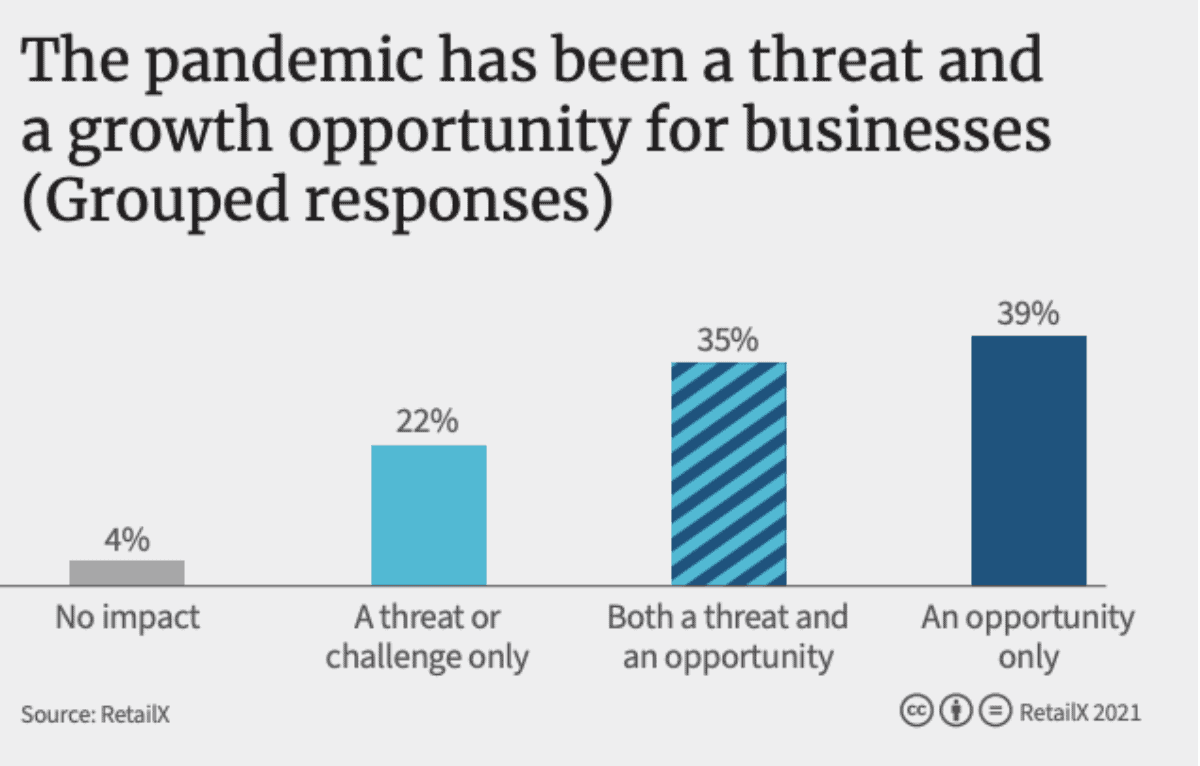

This is reflected in our findings with 35% of our survey respondents viewing the pandemic as both a threat and an opportunity, while 39% seized its opportunities.

UK’s Co-op, featured in the RXUK Top500 Report 2021, said it squashed a five year plan into a single year as it rapidly rolled out its online service.

Chris Conway, head of ecommerce for the convenience retailer, explains that customer service took a back seat when the pandemic hit: “We had lots of plans around the customer experience,” he says, “search, CRO and the usual things you would talk about in an online world. Suddenly, they were not as important as they once were as people just wanted access and to be able to shop.”

Despite seeing a staggering 45-fold increase in online demand, leading UK retailer, Tesco, also found opportunity for growth amidst the coronavirus-chaos and scaled from fulfilling 660,000 orders a week to 1.5m by the end of June 2020.

The grocer also installed a micro-fulfilment solution at a store in London which enables it to fulfil three times more orders each day, with orders ready for collection in minutes rather than hours.

Tesco’s online managing director, Chris Poad adds: “The flexibility of having a mix of manual, human-powered activity and automation has helped us grow capacity in a way that would have been difficult had we purely had an automated platform.”

Looking ahead

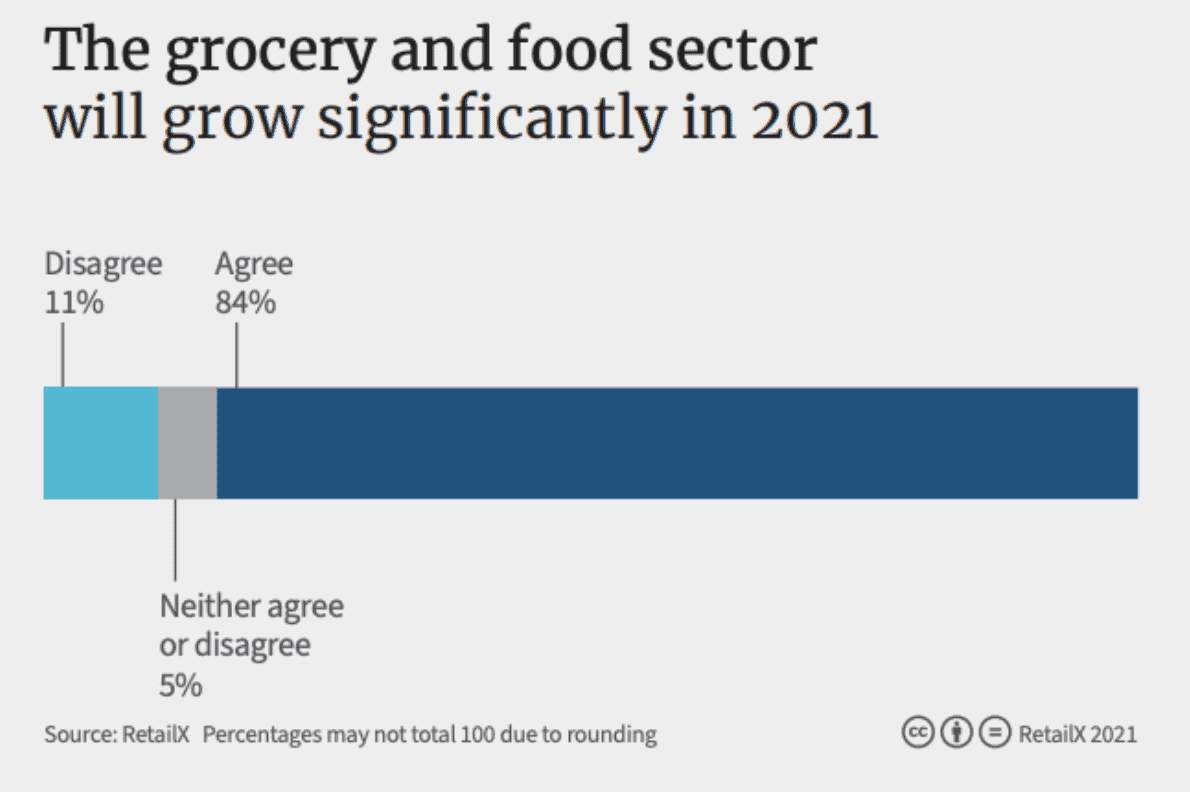

At RetailX, we interviewed retail executives across Europe to discover what their corporate plans for investment and recovery were.

An astounding 84% said they agreed with the statement that the grocery and food sector will grow significantly in 2021. This underpins the sector’s optimism for the future, and hopefully we can look forward to seeing even more exciting innovation and growth this coming year.

In particular, data insight was highlighted as one of the main priorities for grocers in 2021 by our survey. Many brands tested direct to consumer models in 2020 (read the full report to see PepsiCo case study) which is expected to continue and develop as brands realise the benefits of engaging directly with their end customers.

Hervé Beck, general manager at France Benelux & EMEA, Kind, says: “We are using Facebook and Instagram to get feedback from consumers about new recipes and what people would like to buy…in a way, this is becoming a bit like the new customer marketing insight department.”

This article is rooted in research from the InternetRetailing and Salesforce grocery report.

For more information on the focus areas, growth vectors and priorities for leading grocers, FMCG and CP brands, click here to download.