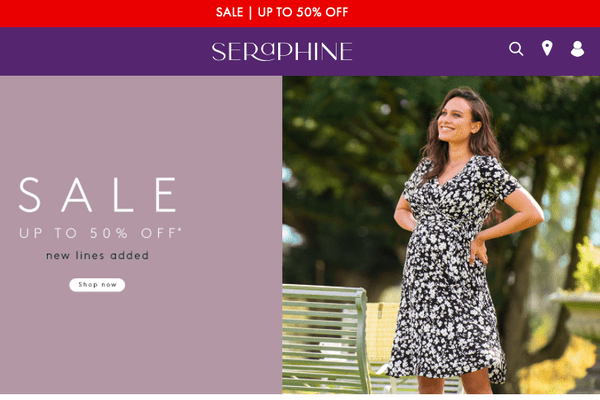

Seraphine is launching on the stockmarket with a valuation of £150.2m and a plan to expand into new markets while expanding the digital channels that it sells through.

The digital-first maternity and nursing wear retailer, ranked Top350 in RXUK Top500 research, will raise a gross £61m as it floats at a price of 295p per share, in order to expand into new markets.

Seraphine Group chief executive David Williams has welcomed a strong level of support for the IPO. He says: “This exciting next step in the company’s journey will see us building on our existing strong fundamentals, reaching more customers worldwide and continuing to deliver innovative designs that support the journey of motherhood.”

The maternity wear retailer was founded by Cecile Reinaud as a pureplay in 2002 with the aim of designing clothes women would want to wear even if they weren’t pregnant and sold it in 2020 for a reported £50m. It has now been in business for more than 18 years. Today it operates with a digital marketing-based strategy that it says enables it to find new customers in a cost-effective way.

More than 89% of revenue comes from its digital platform, which includes 10 websites in markets including North American, Europe and Australasia, while it also sells through eight flagship stores in the UK, France and the US, and through digital and wholesale partners. Now it plans to use the proceeds of its stockmarket flotation to launch in new countries and regions, including The Netherlands and the Nordics, over the next year. It will also looks to grow the digital channels through which it sells its clothing, including through other digital specialists – the retailer launched on the Zalando website in June – and through multichannel retailers.

Seraphine turned over £34.2m in the year to April 4 2021, while adjusted earnings before interest, tax and one-off asset write downs (EBITDA) came in at £7m.