More people visited UK shops in September than did so a year earlier, the latest data suggests. Figures from the BRC and Sensormatic also show footfall continuing a recovery towards pre-pandemic levels. However, there are warnings this may be a temporary blip around back to school shopping, and one that is at odds with reports of falling consumer confidence.

The BRC/Sensormatic Footfall Monitor suggests that footfall in September was 8% higher than a year earlier, rising fastest at shopping centres (+17.3%) and high streets (+12.9%) and more slowly at retail parks (+0.4%). It also grew more quickly than in August, when footfall was 6.8% ahead of a year earlier.

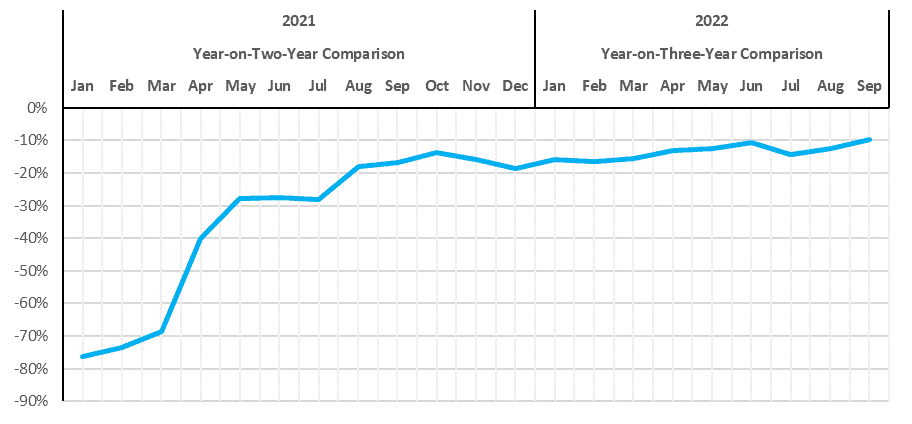

But visitor numbers are still lower than in pre-pandemic September 2019. Across all locations footfall was 9.8% lower, the data suggests – although that represents an improvement on the three-month average decline of 11.4% on the same period in 2019. Footfall lags behind September 2019 most notably at shopping centres (-22.7%), but also on high streets (-11.9%) and retail parks (-2.5%).

“Footfall reached its highest level since the onset of the pandemic, coming within 10% of its pre-pandemic levels,” says Helen Dickinson, chief executive of the British Retail Consortium (BRC). “High streets and retail parks saw an improvement in shopper numbers while shopping centres continued to lag significantly behind, still more than a fifth down from three years ago. Shopping Centres continue to see higher vacancy rates than other locations, with many not have recovered from the loss of key anchor stores such as Debenhams, which went into liquidation during the pandemic.”

Footfall was closest to 2019 levels in England (-7.9%), followed by Wales (-8.7%), Scotland and Northern Ireland (-13.4%).

Warnings on consumer confidence

Dickinson adds: “These figures belie the collapse in consumer confidence which has resulted in falling sales volumes throughout the year. Meanwhile, soaring cost inflation is leading to upwards pressure on prices. The recent mini budget failed to provide retailers with clarity on the future of business rates, already a massive cost. Without action, retailers could face a 10% rise in their rates bill – equal to an additional £800m across the industry. While the energy support for businesses has been warmly welcomed by companies, a freeze to business rates, with the promise of further reform, would go a long way to restoring business confidence and supporting future investment, as well as offering retailers a means to cut prices for their customers.”

Andy Sumpter, retail consultant EMEA for Sensormatic Solutions, says: “While total UK retail saw footfall recovery rise to its highest point this year compared to pre-pandemic levels in September, boosted in part by back-to-school trading at the beginning of the month, retailers won’t be looking at high street performance through rose-tinted glasses.

“With all eyes turning towards the Golden Quarter, perhaps with a starker air of caution given the financial turbulence seen over the last few weeks and higher energy bills starting to hit consumers from October, many are already downgrading Christmas trading forecasts amid shaky consumer confidence. And this means that amongst the usual pressures of preparing for peak, retailers will need to think hard about how they can support – and deliver value to – an increasingly cautious cost-of-living shopper during what will be a critical trading period.”