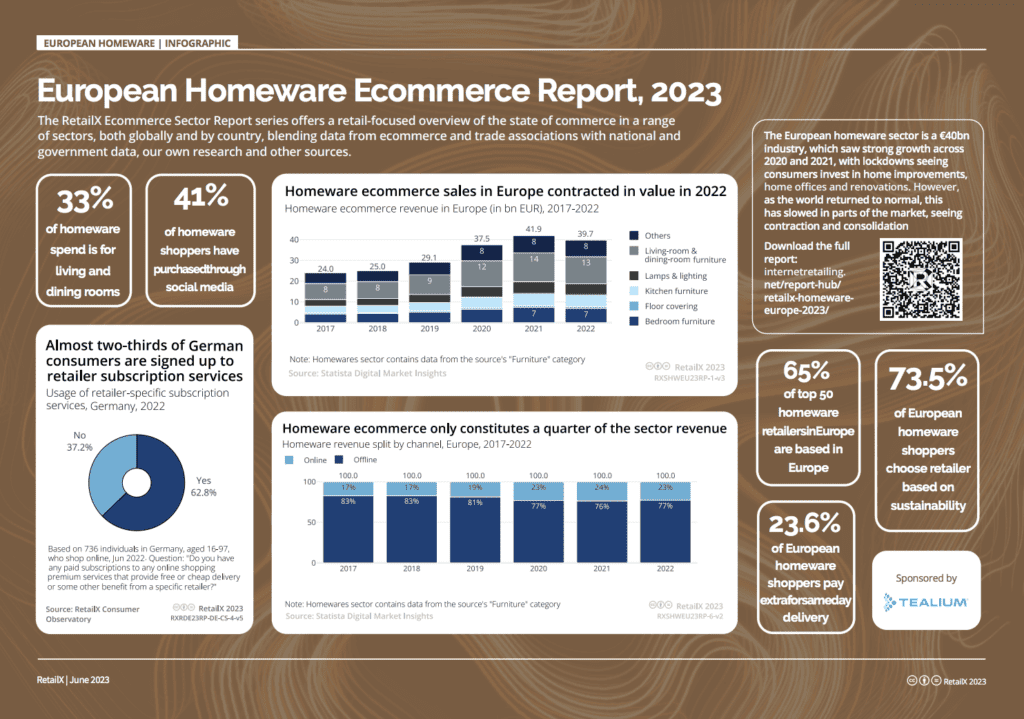

The European homeware sector is a €40bn industry, which saw strong growth across the lockdowns of 2020 and 2021 as consumers invested in renovations and home offices. As the world has returned to normal, markets have consolidated and growth in many areas has slowed due to inflation and rising house prices.

We also examine Europe’s online homeware consumers who are young, increasingly digital and driven as much by fashion as they are necessity and use online, mobile and social media as part of an increasingly complex path to purchase. As younger customers become homemakers, speedy delivery, ethical sourcing, sustainable production and delivery are becoming key drivers of this once thought of “staid” sector.

Download the full report for insight into:

- Why did the homeware market shrink in 2022?

- Why homeware has the lowest ecommerce uptake compared to all the other retail sectors

- How does Ikea attract ten times more traffic to its website than its nearest rival?

- Homeware spending across Europe is strongest in Italy, Spain and Romania

- Sustainability is a keen driver of online homeware shoppers

- 72% of homeware shoppers use their smartphones to buy all or most of the time

- Amazon’s successful push into homeware during the pandemic and the growth of marketplaces in this sector

- How this sector is already leading the way in terms of AR uptake and approval

Report highlights:

- 55 pages of market-leading research into the European Homeware Sector

- Largest 50 sector retailers

- 49 illustrative RetailX figures, charts and graphs

- 9 company profiles including: Blinds2Go, Displate, Plumbworld, Jardiland and Dunelm

- 3 case studies including: E.Leclerc, Furniturebox and Wayfair

Download our accompanying Datagraphic