How should retailers measure the effectiveness of an app? Martin Shaw outlines InternetRetailing’s latest research in this area

A RECENT STUDY by InternetRetailing and Poq Studio focused on 55 retailers’ mobile apps. Six key performance indicators (KPIs) were identified in the research, conducted exclusively for this report. Sophisticated features such as beacon tech and relevancy in search results were measured alongside more standard store finder and social-sharing features. We found that in embracing great features, some apps have lost usability in terms of stability and ease of navigation. One or two apps were practically unusable, even to the most patient shoppers. We also found that different retail sectors have different requirements, which are reflected in app design. Cross-channel retailers arguably have more to gain from app development than pureplays, and the study paid special attention to how apps can successfully drive footfall, and even add to the in-store browsing and purchasing process.

KPI 1: BANNER SIZE

A banner’s buttons should be easy to see and tap – a design constraint that competes with other uses of limited space. Because they’re so crucial to navigation, banners can be a source of frustration when poorly designed. That said, the ideal size is a subjective measure, with little consumerside research into what is ‘best’. However, we’ve taken a banner at least 4mm wide to be optimal, something that features in eight (20%) of the apps we studied. There are other nuances here: River Island’s banner was the optimal size, but it was difficult to navigate to different sections of the retailer’s stock – Women, Men, Girls and Boys. Banners are tough to get ‘right’. Nevertheless, people navigate in-app using banners and a less-is-more approach to app design should begin with these basics in mind.

KPI 2: SEARCH RELEVANCE

Search results that are genuinely useful to the consumer are more important on mobile devices than desktop computers because menus are constrained by space. Moreover, reliable apps can help retailers avoid ‘showrooming’ where people browse in-store before buying online from another company. According to an Econsultancy report, more than half of smartphone owners use their mobile device to search for information while they shop, making mobile search an integral part of in-store shopping. Our study looked at the relevance of search results under repeated tests, which included misspelt and specific items, such as ‘black dress’. Seventeen (43%) of the retailers demonstrated very strong relevancy across all the tests. The search KPI reveals that while almost half of app commerce retailers have prioritised this feature, many apps lack anything more than a basic keyword search. Cosmetic similarity belies a big difference in usability.

KPI 3: KNOWING THE CUSTOMER

Personalising the customer experience improves conversion rates and app design is crucial here. For cross-channel retailers, the single view of the shopper requires a connection between the online account and the in-store loyalty card. Of the retailers in the Poq Studio study, eight (20% of those with apps) already do this. “Providing an option to enter loyalty card details makes it easier for customers to make use of retailers’ loyalty schemes and easier to deliver customised offers to them via the app,” says Poq Studio’s Anna Abrell . One step further is to make the app itself the loyalty card, driving downloads and opens. In the case of Waitrose , customers can add products to personal shopping lists – at home or in-store – using the barcode scanner. The result is more convenience for the customer, while the retailer can target promotions with more specificity.

KPI 4: DRIVING FOOTFALL

Another emerging technique is the use of location-sensitive tracking – customers who allow geofence notification and beacons can be alerted to in-store offers. But is that too obtrusive? Actually, people prefer to receive bespoke offers. Seven out of 10 consumers enable push notifications either for offers or to hear about new products, according to a DMA consumer survey. Moreover, this is a natural development of the standard ‘store finder’ feature present in all of the 37 apps offered by cross-channel retailers in our assessment. Of the retailers in our study, 26 (65% of those with apps) use push notifications and one, JD Sports , communicated the use of beacon tech in its app. Footfall benefits from location specific offers, turning uni-channel customers into valuable cross-channel shoppers. Demanding customers seeking unique offers will drive the development of proximity marketing in the coming years.

KPI 5: MAINTAINING INTEREST

Customers’ interest in apps can soon flag. To counter the phenomenon of ‘zombie apps’ (downloaded but rarely used), limited-time offers spark interest and stimulate frequent use, especially when used in conjunction with push notifications. Only two apps in the study, by Screwfix and Amazon, offer daily deals, while Argos has weekly deals.

Displaying different products every time the app opens also leads to more use of the app. Finally, promoting the app on-site and in-store keeps the app front-of mind for customers and makes them aware of the benefits before they download. All this serves to turn customers into more valuable multichannel shoppers. But it can have a negative effect if features fail to function as advertised, which is why reliability is the sixth mobile app KPI.

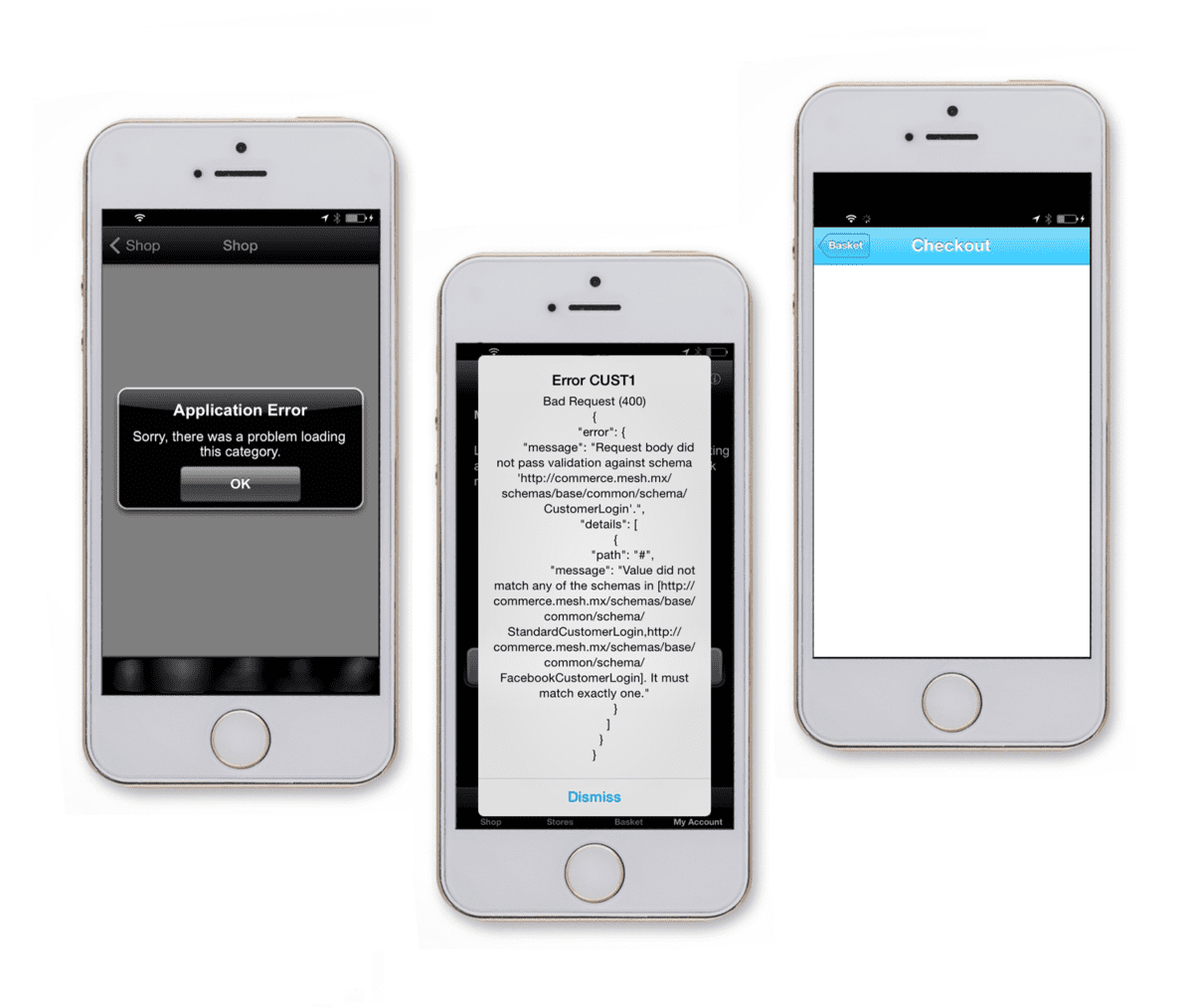

KPI 6: RELIABILITY

Crashes, logins that don’t work and checkouts that won’t load will all cause frustration for customersReliability is a critical KPI for an ecommerce app, because users will quickly delete it for slowness or faults. However, the study revealed a user login that doesn’t work, a ‘remember me’ option that fails to save card details and delivery address, and an app where the checkout screen doesn’t load. Nevertheless, we don’t want to understate the difficulty of app development and maintenance across platforms; these retailers are, after all, in the minority within the IRUK 500 merely for offering an app.

CONCLUSION

The InternetRetailing and Poq Studio study identified six KPIs to help retailers avoid problems and take hold of opportunities in mobile commerce. It also highlighted the tension between features and reliability. When even large, established retailers can trip up on basics, it’s perhaps no wonder only 19% of IRUK 500 retailers have transactional apps.Nevertheless mobile apps could soon change the way we shop.

To give one example, some international retailers have introduced self-checkout apps, fulfilling the function of physical checkout stations at a percentage of the cost; in addition, part of the promise of mobile retailing is that it will operate as a great leveller that enables medium and small-sized retailers to keep up or possibly even lead in the race to embrace technological efficiency.

In the coming weeks our research blog at internetretailing.net/iruk will assess the real value of apps and their key features, offering new insights from mobile commerce professionals, including retailers and vendors.

| The study |

|

InternetRetailing and Poq Studio researched 55 top IRUK 500 retailers, starting with whether or not they had a transactional app: 78% of the retailers offered Android apps and 73% had iPhone (iOS) apps. The 40 iOS apps were analysed in more detail across 22 metrics, covering features, usability and crosschannel integration. Search relevance, personalisation and banner size were each weighted with a maximum index rating of five. To gauge how simple the order process is, researchers counted the number of screens a purchaser passes through between home and checkout – the minimum was four and the maximum 16. Apps were assessed for product images that can be enlarged by the user, and integration of star ratings and product reviews. Just 12 retailers offered more stable native checkouts, 30% of those with apps. In the coming weeks the study will be explored further on the research blog at internetretailing.net/iruk |

Click here for a free subscription to Top500 publications, including the current issue in pdf and future reports in print, or .