The brand new ChannelX Europe’s Marketplaces 2024 report has found the majority of traffic goes to multi-sector marketplaces, with Amazon and eBay unsurprisingly way out in front. Yet, these behemoths only take around 17% and 14% of European traffic respectively.

Behind them is a raft of ‘second tier’ multi-sector marketplaces, such as AliExpress, Allegro and Etsy, all getting single-digit percentages of traffic. Zalando, Shein and Decathlon also score well, reinforcing how fashion’s a leading specialist marketplace sector.

But it is the dominance of a very, very long tail of hundreds of other marketplaces players, each taking sub 0.5% traffic share, that is perhaps the most interesting detail. The European marketplace market is fragmented, comprising of a wide range of local players dominating in one or two local or region markets operating alongside a relatively low number of pan-national marketplaces that dominate in some regions but not others.

What this tells us is that the market is still very much in a development phase and that it has much expansion and consolidation still to go before it can be considered mature. This ongoing fluidity is what makes these profiles of marketplaces so interesting. They are all very different, despite being bonded around a common set of operating principles. While all follow the same strategic views, they have huge regional and local differences as each one focuses on servicing some very specific niches or aiming to be all things to all shoppers.

Marketplace models

Marketplaces come in many forms, so before we look individually at the leaders by sector, we need to look at how marketplaces are structured and what that means for the overall market.

At the most basic level, marketplaces can be categorised as being either general or specialised, with general marketplaces offering a broad range of goods across a wide range of verticals, while specialised sites tend to focus on goods that fit a particular niche.

Within this, there are essentially three types of marketplace models:

• Pure marketplaces

These are, as the name suggests, marketplaces that just link buyers and sellers, acting only as the platform to facilitate marketing and transaction. Around this, many of them have created an ecosystem that adds payments processing, targeted marketing and, in many cases, logistical support and shipping for merchants using them.

This model presents sellers with an easy way to get products listed, sold, shipped and even returned, if needed, usually for a monthly fee and/or a percentage of ticket price.These platforms have typically allowed the owner of the goods – who may well be retailers, brands, individuals or other sellers – to manage their own presence, use the sites marketing and payment tools and leverage shipping deals the marketplace may have in place.

Increasingly, however, these pure marketplaces are also helping with warehousing and stock control, allowing many sellers to be drop shippers rather than actual merchants.

This has proved to be a boon to many sellers and continues to underpin some of the largest and most successful marketplaces globally, including eBay, Allegro. Bol.com and Temu. These sites are growing in popularity because they offer ease of ecommerce to merchants and can offer an extremely broad range of choice at competitive prices to consumers.

• Multi-sector or mixed marketplaces

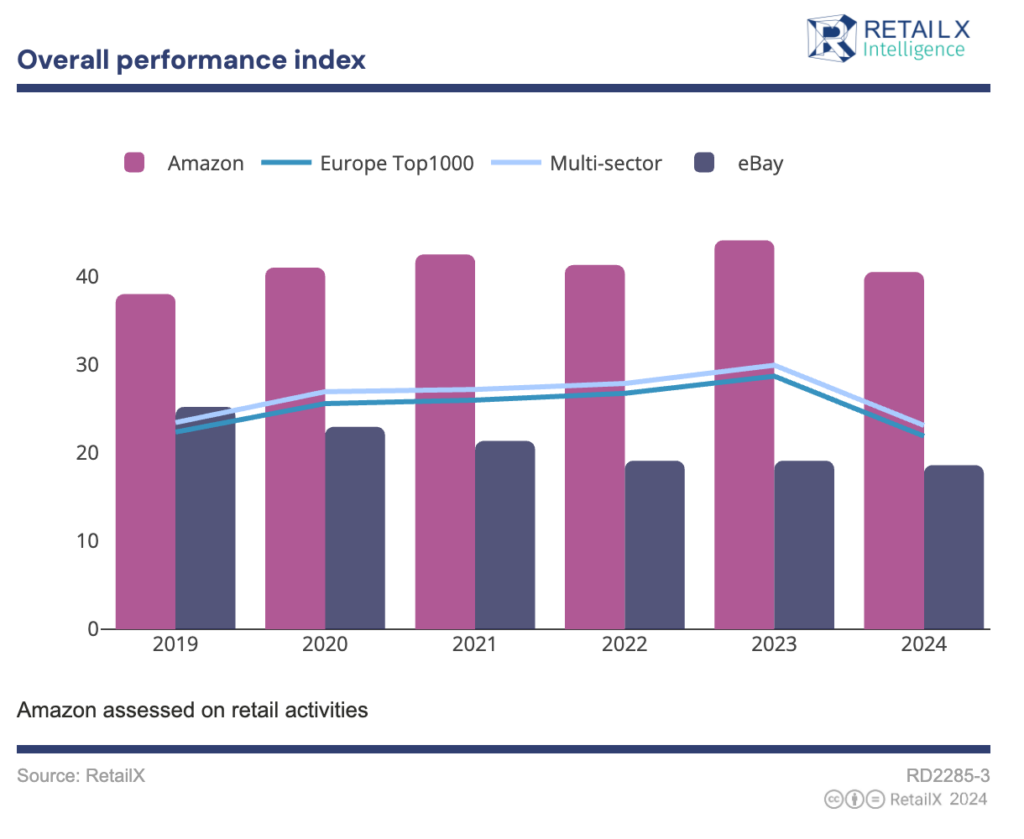

By contrast, mixed marketplaces are those that allow much or all of what happens on a pure marketplace, but which also sells their own brand products. The leading proponent of this is Amazon which, alongside the 225,000 small- and medium- sized businesses selling on the marketplace, sells its own brand goods in almost all categories – often undercutting the brands on the site.

• Retailer marketplaces

The third and newest marketplace model is that of retailer-run marketplaces. These are marketplace sites set up alongside a traditional retailer’s existing online and physical retail presence that allow retailers to sell other brands and items alongside their core ranges.

A prime example is Decathlon. The sports and outdoor goods seller has its own site selling its own brands of sports and outdoor goods. It also runs a marketplace selling allied products – for example, bikes and bike spares – that augment its core business.

However, it isn’t always that cut and dried. UK DIY chain B&Q offers an alternate example. If you want to buy tools or gardening equipment, you get those from the B&Q website. If you want to buy a water feature, that comes via a third-party selling through B&Q’s marketplace.

As a consumer, you see both via B&Q’s site or app, yet the fulfilment and any subsequent dealings take place with the third-party provider of the water feature.

Both Decathlon and B&Q offer insights into what the retailer marketplace model offers – extended range with minimal outlay being the most prominent. Yet the differences between these examples again illustrate how the boundaries between marketplace models and, indeed, retailers and marketplaces, continue to blur.

This is an excerpt from the recently published ChannelX Europe’s Marketplaces 2024 report.

The report outlines the overall performance of the sector across Europe, the report assesses how marketplace trading as a whole has changed since 2023, focussing on both the sectors using marketplaces and the regions where marketplace use has changed.

Stay informed

Our editor carefully curates two newsletters a week filled with up-to-date news, analysis and research, click here to subscribe to the FREE newsletter sent straight to your inbox and why not follow us on LinkedIn to receive the latest updates on our research and analysis.