Shoppers appear to be moving away from quick commerce apps as they prioritise cost over convenience in a cost-of-living crisis, new analysis suggests. That offers opportunities to grocers to regain lost market share, says IT services provider NTT Data.

Quick commerce, also known as fast or ultrafast delivery – depending on whether services promise delivery within 30 minutes or 10 minutes , expanded quickly during and after the Covid-19 pandemic. In the UK, services including Getir and Gorillas started to serve inner city shoppers with a promise of fast grocery deliveries within minutes. Grocers from the Co-op to Asda, Tesco and Sainsbury’s continue to work with Uber and Deliveroo, which promise delivery in as little as 30 minutes, while Tesco also delivers via Gorillas in a number of cities. Now says NTT, interest in ultrafast quick commerce apps such as Getir, Gorillas and Zapp that offer delivery within 10 minutes appears to be waning.

The sector, which initially attracted high levels of investment, also appears to be consolidating at the same time, with Getir reportedly in talks to buy Gorillas, and also signing a deal to work with JustEat across Europe.

NTT Data, which works with major grocers, surveyed 2,000 grocery shoppers in UK inner-city areas where quick commerce services are available. It found that just under a third use quick commerce apps. But of those that use them, 59% say they are now using them less often. Respondents say that when deciding how to get their groceries they now think first about cost – cited by 92% of respondents – quality (77%), and only then about speed (17%).

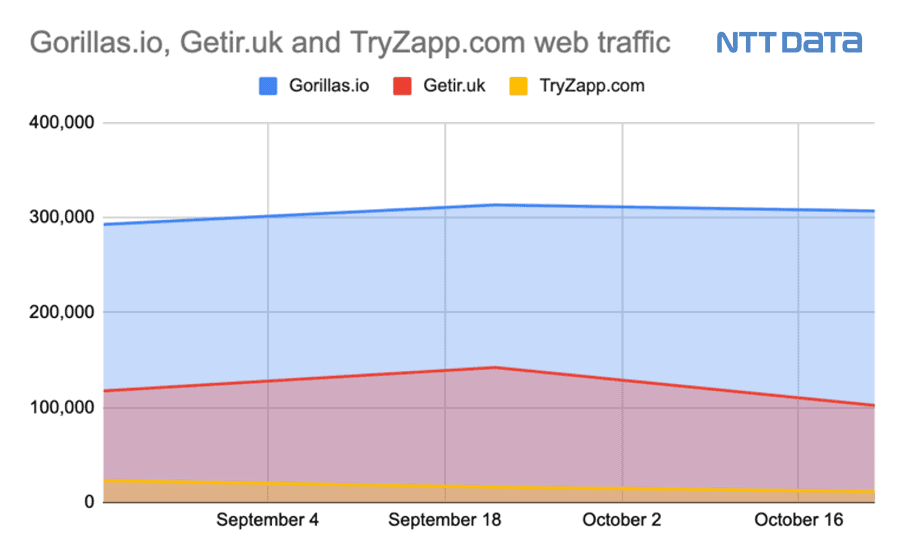

At the same time, says NTT, traffic to the Q-commerce that promise the fastest delivery is falling. NTT Data analysed SimilarWeb data and found falling traffic to Q-commerce operators that promise delivery within 10 minutes: Gorillas, Getir and Zapp. Traffic to Gorillas was down by 1.98% in October 2022 on the previous month, while traffic to both Getir and Zapp fell by 28%, over the same period.

Meanwhile, apps promising less demanding delivery times, such as Deliveroo and Uber Eats, have maintained traffic more effectively. SimilarWeb figures suggest. Visits to Deliveroo rose by 6.79% to 9m in October 2022, compared to the previous month of September, while visits to Uber Eats were up by 2.24% over the same period. Both may benefit from their partnerships with major retailers, including Amazon – which offers free Deliveroo deliveries to Prime members – and a range of UK supermarkets, as well as their core takeaway delivery services.

Geoff Lloyd, director of retail at NTT Data UK&I, says: “As a result of food inflation and the current cost-of-living crisis, consumers are becoming more cost-conscious with their purchases and are prioritising this over convenience. As a result, fewer consumers are now willing to accept the higher cost that comes with the Q-commerce model, whether it is through higher pricing of products, or additional costs they need to pay for delivery to their doorstep.

“As funding stagnates and introductory offers start to disappear, consumers are likely to decide that the convenience is not worth the cost and will move away from these applications. There is a huge opportunity here for legacy retailers and grocers to gain back market share from the Q-commerce challengers and increase sales during this time, as the current economic climate is altering consumer buying behaviour. By using data to help improve deals and targeted offers as part of loyalty programmes, supermarkets can gain the upper hand and increase margins during this difficult retail period.”

InternetRetailing has contacted Getir, Gorillas and Zapp for comment and will add responses here once received.