TikTok has rapidly evolved and has become a contender in the marketplace sector, its journey from social media platform to ecommerce offering has been mapped by the ChannelX European Marketplaces 2023 report.

Born out of Chinese social media site Douyin – which was developed by tech company ByteDance in 200 days in 2016 and garnered 100 million users in China in less than a year – TikTok has become the social media site of choice in the West following a surge in interest in the lockdown in 2020.

While the company was forced by the Trump administration to split its US operations from its Chinese owners – which have a 1% investment from the Chinese government – TikTok has exploded in use in the West, with 130 million downloads in the US alone and some 2 billion worldwide.

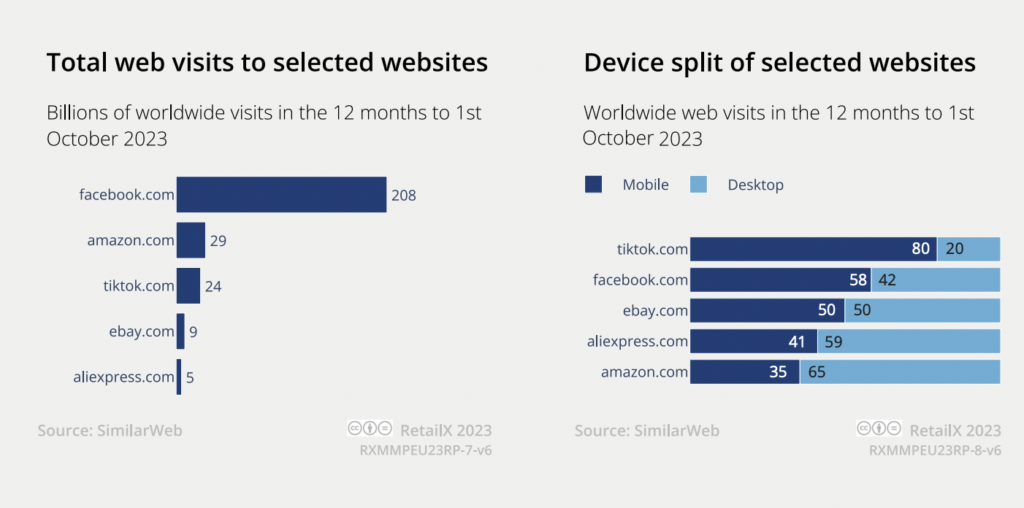

While still dwarfed by Facebook in terms of users numbers, TikTok has seen web visits hit 24 billion in the 12 months to October 2023, only just shy of the 29 billion seen by Amazon. It is also now way ahead in terms of users than giants eBay (9 billion users) and Aliexpress (5 billion).

With an average of 371 million active monthly users between October 2022 and September 2023, TikTok again has more traffic than Amazon, which generated 215 million average monthly users across the same period, eBay (38 million) and Aliexpress (64million).

The social site’s primary use is in the dissemination of shortform user generated videos, this rampant popularity has increasingly seen brands and retailers use it to first promote goods and then to direct TikTok users to buy them. Setting up TikTok Shop, then, was a natural step and has seen TikTok bridge the gap between social media and ecommerce.

With 60% of Gen Z in the US using TikTok and with one in three TikTok users who see a product promoted in their feed going on to buy it, the move makes a lot of sense. This approach of offering social engagement and endorsement, along with the ability to then go on to buy the goods – then to brag about it on the site as a social user – increasingly taps into the growing interest, especially in China, in creating ‘super apps’ that do a wide variety of tasks in one place.

Relying heavily on shoppable ads, TikTok itself has rapidly evolved to offer many marketplace-like seller functions and so increasingly has become a contender in the marketplace sector.

If you consider that TikTok’s worst quarter for downloads saw 162.9 million people download the app – compared to eBays total active user base of 129 million – you can see that it has a powerful reach. The other interesting factor about TikTok Shop is that it attracts a different demographic. Most consumers intent on shopping do head for Amazon, eBay et al.

However, TikTok converts entertainment into sales, tapping into a vast reserve of youthful discretionary spending that would otherwise largely go untapped. This is the power of super apps and why the marketplace market needs to take note of TikTok as a serious player in the sector.

Currently operating predominantly across Asia – mainland China, Hong Kong, Indonesia, Malaysia, Thailand, Vietnam, Philippines, Singapore – TikTok Shop has sough to expand this model to new markets in the West as TIkTok’s popularity has exploded. It recently embraced the UK as its first European market to set up TikTok Shop and is currently running a beta version of the service across TikTok in the US.

This marketplace profile was authored by Paul Skeldon and originally appears in the recently published ChannelX European Marketplaces 2023 report.

Download the full report to what factors are key to a successful marketplace? And how are marketplaces working to try and protect both brands and customers from fraud, counterfeits, and piracy?