As Secret Sales acquires H&M Group’s digital fashion outlet Afound, the UK Fashion 2024 report looks at its ambition to become Europe’s largest marketplace for discounted fashion.

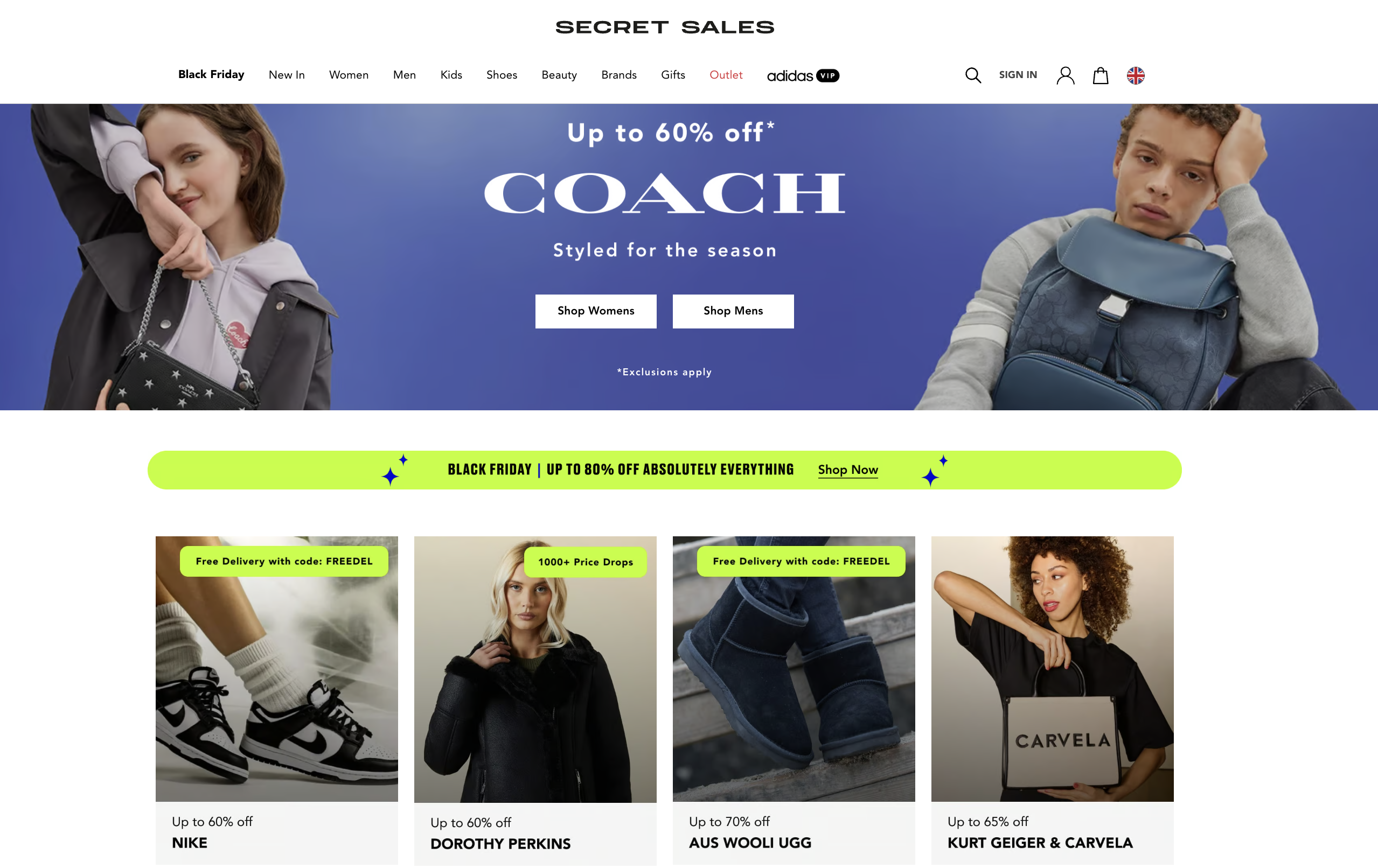

Secret Sales offers a slightly different take on the traditional online fashion offer through its digital outlet village. This enables it to offer discounts on the latest clothing trends and designer brands for its customers, with stocked brands ranging from Italian giants Gucci and Armani to Superdry, Ted Baker and Diesel.

The company first launched as a flash-sales retailer in 2007, but the business changed direction in 2020 when Chris Griffin and Matt Purt bought the company. Griffin was formerly director of ecommerce at Superdry while Purt was the founder of Lifestyle Retail Group.

Today, Secret Sales says it is “proud to be one of the UK’s leading off-price retailers, giving customers access to exclusive discounts on thousands of leading luxury designer brands”.

Growth continues at pace

Since Secret Sales’ acquisition in March 2020, the selection of brands available through the site has grown hugely – from 100 to more than 1,000 different labels. And it is not just UK shoppers that love the concept. The company’s recent launch of international websites in Belgium and The Netherlands has allowed Secret Sales to continue with its ambitious growth, and 12 additional European markets are being targeted.

The company says that its success is based on the great working relationships its buyers have built with the brands it sells. Secret Sales works on a dropship model, allowing it to reduce costs as well as its sustainability impact, as part of which all of its office staff also work from home. As well as preventing new stock from becoming waste by selling at discounted rates, Secret Sales also sells a growing collection of pre-owned stock to appeal to second-hand shoppers.

Funding for future expansion

Secret Sales announced $10mn in funding from investors including Perwyn, Belerion Capital and Big Ideas Group in May 2023. The cash injection will be used to help achieve its ambitions of becoming Europe’s largest marketplace for discounted fashion. Investment will focus on its marketplace technology which as of February 2023 had cultivated an inventory of 25mn items with a combined value of £3bn, an impressive 125% year-on-year increase.

This is one of six company profiles in the UK Fashion Sector Report 2024, with Boohoo, Cider, Kurt Geiger, M&S and Zara also looked at in detail.

Download the full report for an in-depth analysis of the UK market, its customers, brands and how it differs to the rest of the fashion world.

Stay informed

Our editor carefully curates two newsletters a week filled with up-to-date news, analysis and research, click here to subscribe to the FREE newsletter sent straight to your inbox and why not follow us on LinkedIn to receive the latest updates on our research and analysis.