As we move towards a new year, consumers are increasingly taking stock of their spending habits. Tough decisions must be made during a cost-of-living crisis, priorities must be set and so some subscription packages could take a hit. But when times are tough, wouldn’t it be good to be able to pause rather than stop some subscriptions? Research by the Data & Marketing Association (DMA UK) has shown that consumers would like the option to pause one or more of them for a while and wait for a better time to turn them back on again.

Consumers crave more flexibility

According to the latest DMA Customer Engagement: Future Trends 2023 research, around 50% of millennials and a similar number of young families are already doing this, but in a cumbersome fashion. They are basically stopping subscriptions and re-starting again when it suits them. And while that makes sense, it really isn’t that convenient for them as customers, or for the services themselves, to close an account and open a new one a few months later.

When asked who would be interested in doing this, the results are even more stark, with around a third of consumers saying they would be interested in pausing subscriptions. And this doesn’t just cover media, it is everything – daily coffee subscriptions, newspapers and magazines, or those pricey chocolate and beauty boxes through the post.

Indeed, many consumers in the UK find long-term commitment to be a commercial turn-off. Over half (54%) say they have “actively avoided buying a product/service in the past because the contract tied me in for a long period of time” (according to data from Foresight Factory). Additionally, agreement with this statement is relatively consistent across the demographic spectrum, meaning all consumers appear to actively avoid committing to a brand.

Why brands should pause subscriptions

Does that make customers disloyal? Not necessarily. Particularly amid a cost-of-living crisis, this apparent ‘fickleness’ doesn’t necessarily mean consumers are disloyal. According to the DMA’s loyalty segmentation, consumers describing themselves as ‘active disloyals’ have actually reduced since 2016 from 27% to 18% this year (to find out more about this segmentation, read the How to Win Trust and Loyalty 2022 report).

In fact, being easily able to pause subscriptions could make consumers feel warmer towards brands and, therefore, likely to remain long-term customers. During the early stages of the Covid lockdown period, a few banks offered the chance to pause paying mortgages until things were more certain, and the love they received as a result was clear to see on social channels. This sentiment may well remain in consumers’ minds when they next look to re-mortgage.

So, why don’t more brands do this then? It’s clearly what many consumers want. Plus, it would help streamline the process of renewals for themselves and potentially entice consumers to resubscribe with them when the time is right – saving both parties money.

Perhaps brands are worried that when consumers pause, they then might not un-pause or resume their subscriptions. But how would that stack up against what must be unrealistic retention and acquisition figures where, as we see from the DMA’s research, customers are leaving then re-joining at present? Unless some brands take the leap then how will they know that this doesn’t solve a problem rather than create one.

Earning customer loyalty is no longer a post-sale action – it covers the customer experience as a whole – from the very first customer touchpoint, across the purchasing journey, right down to post-sale engagement. DMA research also found that 32% of customers will leave a brand after just one bad experience. A further 59% will walk away after two bad experiences. A key driver in the battle for loyalty isn’t just about the best price available or convenience, it’s about the entire customer experience and making every moment matter.

Where are customers cutting back?

While it may be clear that cutting back is a common response by consumers to the cost-of-living crisis, it is useful for brands to understand where, how much, and why.

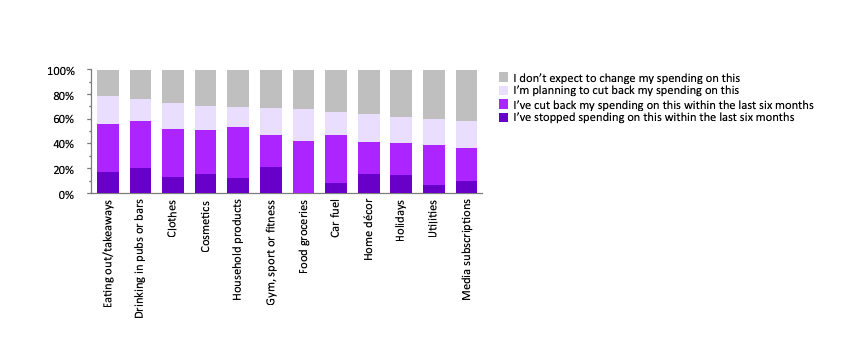

As the How to Win Trust and Loyalty 2022 report highlights, 39% of consumers who spend on eating out are cutting back on this versus 18% who have stopped spending on this completely. Meanwhile, 21% of consumers who drink out of home have stopped spending on this already, and 21% of consumers who spend on fitness or sport have stopped spending on this.

This is useful information for retailers when considering what options are best for them to consider.

Trialling new approaches

As ever, the answer for retailers must revolve around a test and learn strategy. Brands must consider profiling who is leaving and re-joining, offer them the chance to pause and observe what happens. That doesn’t feel unreasonable, and then, perhaps, retailers will create some more loyal and engaged customers as a result.

Looking at the media subscription world, BT are reportedly trialling this now. This flexible approach may even entice new customers to join who will not have considered an extra, lengthy subscription – as signing up to another TV package people feel guilty about paying for and not watching is exactly what many consumers don’t need during a cost-of-living crisis.

Adding additional flexibility and relevance to traditional subscription models offers brands an opportunity to engage customers in new and innovative ways. By putting customers’ demands at the heart of the brand experience – understanding their needs and offering relevance (both in the product/service and the way brands engage) – businesses can truly find the balance in value exchange that will better sustain their loyalty.

Scott Logie is chair of the Data & Marketing Association’s Customer Engagement Committee and customer engagement director at data marketing and insight agency, REaD Group, a Sagacity company.