On 14 August 2024 the owner of Avon in the UK, Europe and Latin America filed for bankruptcy, in a bid to address US$1bn of debt, the RetailX Global Beauty Sector 2024 report highlights that it remains a challenging market for brands and retailers.

Economic and inflationary matters have impacted on the cosmetics and beauty industry in the last year, affecting prices of raw materials through to energy and shipping. Consumer spending across multiple retail categories has been deflated as a result of rising prices.

Some areas have been impacted harder than others; travel retail and the Chinese luxury market have been among the areas struggling for growth in 2023. While sales in the travel retail sector are returning to the cosmetics and beauty sector, 2024 remains challenging. Estée Lauder Companies’ forecast of annual sales down one to two per cent emphasises the macroeconomic headwinds still affecting the global market.

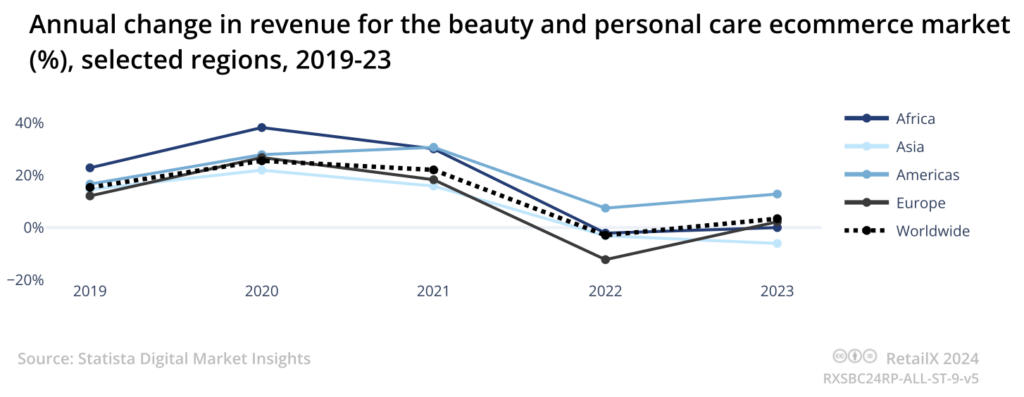

Overall, the beauty and personal care market has grown online in the last 12 months, with sales slightly above 2022’s level. Personal care is the largest part of the market, while skin care sales reached $27.13bn in 2023.

Ecommerce and marketplaces are enabling brands to extend their reach to new customers and markets. It is also opening up Western markets for Chinese companies such as Shein’s SheGlam. Smartphones, social media, virtual reality and livestreaming are moving digital from customers self-serving on ecommerce sites to greater engagement with brands, influencers and beauty advisors.

Instore, the personal approach is given by beauty advisors aided by AI, beauty tech, such as skin analysis tools, and clienteling apps. The store networks of the omnichannel retailers enable such services to be offered, along with masterclasses and special events, all the while trying to elevate experiences for customers. Loyalty schemes, which are prevalent in this sector, are one of the tools being used by retailers to gather data across all channels.

Retailers are using curation as a way to differentiate themselves. From luxury brands selling via their own ecommerce site and department stores, to brands being sold exclusively at Sephora, and the mass market, private label or dupes sold at supermarkets, there are options for every consumer.

Retailers understand how economic conditions affect their customers. “For many people, there’s a lot of uncertainty, there’s a lot of difficulty and there’s a crisis around us,” says Alexandre Meerson, chief digital, data and technology officer, EMEA, Sephora. “We bring to the table both reassurance of a strong brand that is reliable and takes care of its people and its customers, and we offer them a product

that makes them feel good and better. It’s a big responsibility for us.”

This is an excerpt from the RetailX Global Beauty Sector 2024 report, which examines the digital developments and trends in the cosmetics and beauty industry; how products are being sold online; and the impacts of other technologies on ecommerce.

The report shows an industry driven by newness, and consumers passionate about their purchases and loyal to certain brands while also being enthusiastic about beauty overall as they seek out the latest products and ‘must-haves’.

Stay informed

Our editor carefully curates two newsletters a week filled with up-to-date news, analysis and research, click here to subscribe to the FREE newsletter sent straight to your inbox and why not follow us on LinkedIn to receive the latest updates on our research and analysis.