The fast-moving consumer goods (FMCG) market is a $13.6tn dollar sector covering everything from groceries and cleaning supplies to toiletries, via petcare and more.

These are all goods that are essential to households across the globe and, as a result, are in high demand. Yet this demand has made the sector super-competitive, with very tight margins, according to the recently published RetailX 2025 FMCG Report.

The report focused on those things deemed household essentials – typically food and non-alcoholic beverages, household goods, personal and pet care. Other items are excluded because they are subject to a host of additional rules, regulations and laws that undermine comparative analysis across the segments. That said, the lessons and data detailed in this report do carry across all segments within the wider FMCG market and paint a picture of a sector that’s booming.

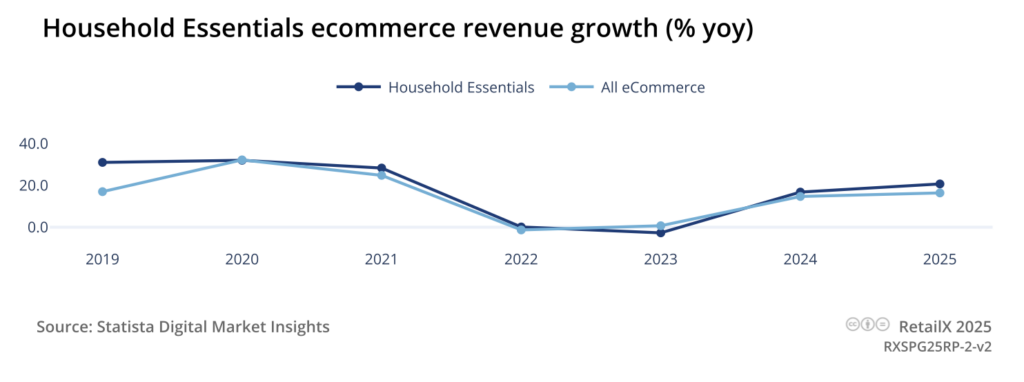

While the bulk of FMCG is still purchased instore, that is changing, with ecommerce becoming the norm, largely as part of an omnichannel shift. Online sales of household essentials is currently worth $207bn, having grown steadily since 2023. Looking purely from ecommerce point of view, sales of FMCG have kept pace with the wider ecommerce market, indicating that they are very much part of the ecommerce mix for consumers who are readily buying these goods online in vast quantities.

As we see across this report, online sales of FMCG are a growing part of the sector, yet instore remains the main channel to market. As shopper habits shift, however, bridging the gap between the two is going to become an essential part of operations for these brands and their manufacturers.

Growing omnichannel demand

This growing omnichannel demand is visible in the ways that FMCG consumers shop for their household essentials. The data shows that share of online sales remains relatively constant – at around 3% to 5% – rising across the past five years, but only marginally.

This low proportion of online FMCG sales points to the FMCG brands and consumers still being very much focused on instore sales. This is undoubtedly true, as we see in the report. However, it may also reflect only where the purchase takes place.

It doesn’t account for the vast amount of research, influence and marketing that is seen online, on mobile and on social media, and which sits behind the decisions that lead to these instore purchases.

This idea is backed up by how much consumers spend online on FMCG goods. This too has grown only slightly – and largely in line with the average level of inflation across each year – and remains a fairly static proportion of each consumer’s total online spend.

However, eshoppers are spending between $700 and $850 each year on FMCG, hitting $874 in 2025. This generally accounts for some 50% of their total online shopping budget, again reinforcing how central FMCG goods are to consumer shopping habits.

Yet the number of online shoppers buying FMCG household essentials is growing, rising in neat 20 million-person increments for the past four years and continuing to do so.

This is an excerpt from the RetailX 2025 FMCG Report. It looks at how the fast-moving consumer goods industry is experiencing its biggest transformation in decades. Traditional giants are scrambling to compete with agile startups while consumers demand personalised, sustainable experiences across every touchpoint. This isn’t just market evolution – it’s a revolution happening at unprecedented speed.

Stay informed

Our editor carefully curates two newsletters a week filled with up-to-date news, analysis and research, click here to subscribe to the FREE newsletter sent straight to your inbox and why not follow us on LinkedIn to receive the latest updates on our research and analysis.