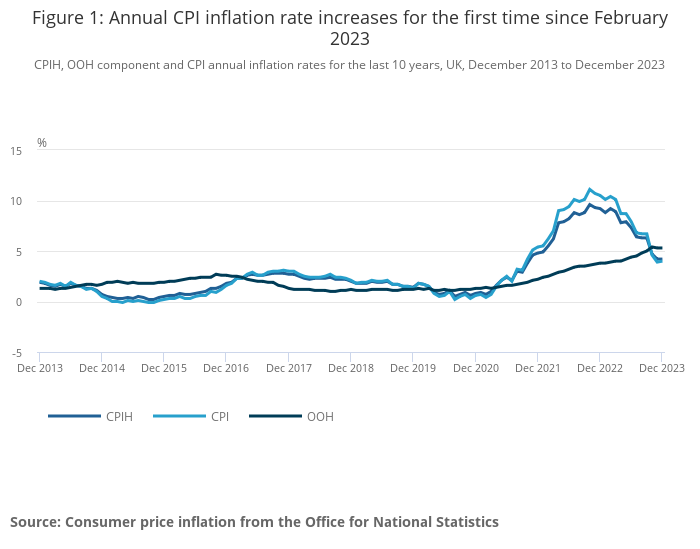

The latest data from the Office for National Statistics (ONS) has shown UK inflation rose unexpectedly in the last month of 2023. This is the first time the Consumer Prices Index (CPI) has increased since February 2023.

Grant Fitzner, ONS chief economist, explained: “The rate of inflation ticked up a little in December, with rises in tobacco prices due to recently introduced duty increases.

“These were partially offset by falling food inflation, where prices still rose but at a much lower rate than this time last year.

“Meanwhile, the prices of goods leaving factories are little changed over the last few months, while the costs of raw materials remain lower than a year ago.”

There were rises in clothing and footwear prices, with increasing costs adding to the inflation rates in furniture and household goods. The news has been met with concern form the retail industry.

Kris Hamer, director of insight of the British Retail Consortium, said: “Retailers face a number of extra costs this year that threaten the progress made to reduce prices. New EU border checks this month, disruption in the Red Sea, a hike to business rates in April, and the potential of a new grocer surtax in Scotland are all challenges that retailers need to navigate in 2024.

“With an election in the next 12 months, it is time political parties understand the value of retail to the wider economy and set out a clear and cohesive plan for retail in their manifestos. Allowing retail to thrive will create jobs, bring down prices for households, and support communities up and down the country.”

Jessica Moulton, senior partner at McKinsey & Company, commented: “It’s disappointing to see inflation rise by 4%, up from 3.9% in November 2023. This unfortunately follows the same trend as the not-great news coming out of the US and Eurozone. The spectre of embedded inflation is with us.

“One encouraging point is the fall in food cost inflation from 9.2% to 8%. While still sky high, this is heading in the right direction. This eighth consecutive fall, after the extraordinary rates of food inflation in early 2023, will be welcomed by consumers. Especially with a big decrease in some staples like milk, egg and cheese now at 3.3%, compared to 30.2% a year ago.

“Many businesses will already be re-doing their 2024 forecasting, and thinking harder about managing costs, given inflation remains higher than consensus.”

Mohsin Rashid, CEO of ZIPZERO, added: “What a blow for Britons. Just as financial recovery had begun to feel possible, hope has once again been ripped away as inflation remains eye-wateringly high – at almost double the Bank of England’s target.

“The inflationary pillage of our pockets is set to continue, at least for the first half of 2024 – so expect tight budgets and financial sacrifice to remain the default for millions across the country. Until inflation is properly squashed back down to manageable levels, it lies with the government and retailers to step up their support for consumers, through targeted relief and competitive pricing respectively.”

Stay informed

Our editor carefully curates a daily newsletter filled with up-to-date news, analysis and research, click here to subscribe to the FREE newsletter sent straight to your inbox and why not follow us on LinkedIn to receive the latest updates on our research and analysis.