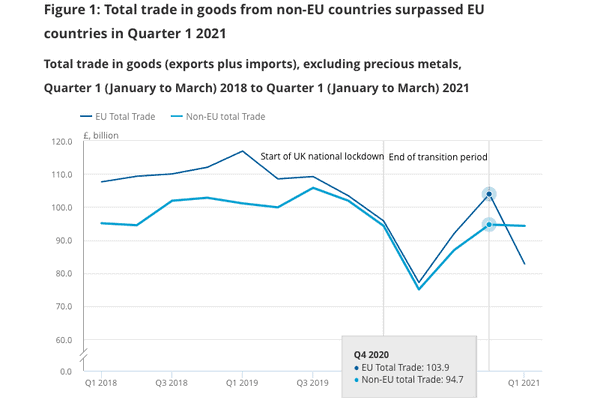

UK trade with EU countries was almost a quarter lower in the first three months of this year – following the UK’s departure from the European Union – than it was three years ago, according to official figures from the Office for National Statistics (ONS). It fell to the point that it was lower than the amount of trade done with non-EU countries in the first quarter, which also fell.

UK trade – the sum of imports plus exports – with the EU was 23.1% lower in the first quarter of 2021 than it was in the same quarter in 2018, according to a new report from the ONS. And it was 20.3% down compared to the previous quarter – the last three months of 2020 – although the ONS report suggests evidence of stockpiling at the same time, making it harder to see the impact of the end of the Brexit transition period.

At the same time, trade with non-EU countries also fell – by 0.8% compared to the same period in 2018 – but remained at a higher level than trade with EU countries. The chart above shows declines in UK trade both at the start of the UK national lockdown last March, and, more sharply, at the end of the Brexit transition period.

Changes in trade with the EU…

Imports from EU countries fell by £14bn (21.7%) between the fourth quarter of 2020 and the first quarter of 2021. Exports fell by £7.1bn (18.1%). Exports of goods to Ireland in particular fell by £1bn, or 47.3%. This is the market, says the ONS, where more new checks have been introduced, including export health certificates for animal products. Exports of food to Ireland fell by £0.3bn (65.9%) between December 2020 and January 2021 although, says the ONS, some of this may be attributed to food stockpiling.

Imports from Germany – the UK’s largest EU trading partner – have declined since April 2019, amid uncertainty around the UK’s departure from the EU, says the ONS. By the first quarter of this year, UK imports from Germany were 2.6 percentage points down at 11.8%, compared to the first quarter of 2018.

The ONS report, The impact of EU exit and the coronavirus on UK trade, says: “Rules of origin stipulations in the EU-UK Trade Cooperation Agreement (TCA) require that all goods must be able to demonstrate that they ‘originate’ in the EU or the UK to qualify for zero tariff treatment. These stipulations may have led to additional costs associated with re-exporting EU goods, which have gone through UK customs, back to the EU.

“The impact of this on total UK exports to EU countries is likely small, with only 3.9% of currently trading exporting businesses in BICS reporting currently using rules of origin to access lower or zero tariffs on exports to EU countries at the beginning of May 2021. However, rules of origin may have led to some changes to supply routes. Of the average 4% of businesses who are currently trading and have reported making changes to their supply chains because of the end of the EU transition period in BICS, the proportion changing to using more UK suppliers peaked at 70.5% at the end of February.”

…and non-EU countries

Since the second quarter of 2020, the UK has imported more goods from China than from any other country – thanks to high demand for face masks and PPE, largely supplied by Chinese factories from an economy that was by then in recovery. Exports to the US were £3.6bn (25.8%) lower between the first and second quarters of 2020 – the largest decline in exports. However, the difference in trade between the fourth quarter of 2020 and the first quarter of 2021 has been relatively low (-5.7%, or £0.2bn) – compared to an EU monthly decline of 42.2% from December 2020 to January 2021.

Commenting on the findings, Atul Bhakta, chief executive of One World Express, says: “Brexit and Covid-19 created a perfect storm for a trading slump. A complex web of travel bans, new administrative processes and social distancing measures have driven many brands to pause cross-border trade – in fact, 64% of UK business found 2020 to be their most challenging year ever, according o research from One World Express.

“Positively however, the UK could be turning a corner. The successful vaccine rollout, coupled with a better grasp of post-Brexit customs regulations, seems to be reigniting trading activity. Adding to this, we are seeing a growing demand for “Brand UK” in markets such as South East Asia, as well as promising trade deals with the likes of Australia in the offing, which will add to business confidence.

“Clearly, the UK’s trading levels have some way to go before returning to pre-pandemic levels. Yet promising trading opportunities – particularly ones beyond the EU – are continuing to present themselves. As such, I predict that the outlook for UK exports, and business growth more generally, will begin to look increasingly positive over the coming months.”