The recently published RetailX Growth 3000 2023 report, which illustrates the breadth of the retail businesses that serve shoppers across Europe, highlights that speed, cost and convenience of delivery, collections and returns underpins success.

According to the report, when retailers offer fast and convenient delivery options, it’s more likely that shoppers will buy. Such services do most to add value by boosting margins when delivery services are profitable.

Since last year, the Growth 3000 retailers have cut the average time in which they promise to make a standard delivery by 0.03 days, to 5.35 days. The median retailer delivers in four days – the same as last year. The fastest average delivery promises are from those selling workwear (average 3.1/ median 3) and nutrition supplements (3.86/3). The slowest are from those selling homewares (6.04/5) and gardening products (6.04/5). Shoppers buying from Czechia (4.35/3), Denmark (4.35/3) and Romania (4.43/4) can expect to see their deliveries the fastest, while those buying from Estonia (8.93/6) wait the longest.

Faster delivery

More retailers now offer next-day delivery, with the availability of this service rising by 3 percentage points (pp) to 24% among the 2,282 retailers, brands and marketplaces assessed on this metric both this year and last. This is most commonly found when buying from those selling workwear (48%), confectionery (36%), flowers and gifts (35%). It’s least common from those selling music, film and TV products (7%) and software (9%). Next-day delivery is more commonly available when buying from the UK (+7pp to 35%), Czechia (23%) and Ireland (+1pp to 20%) – yet less than 1% of those selling to Slovenia, Latvia or Bulgaria offer it.

Saturday delivery (-1pp to 9%) is slightly less available this year. It is more likely to be offered by those selling pet supplies (29%), DIY & trade (21%), flowers and gifts (18%), and when buying from the UK (-2pp to 14%), Switzerland (8%) or Portugal (7%).

The cost of delivery

Fewer offer free delivery on all orders (16%) than offer it when shoppers spend a minimum amount (42%) – suggesting that retailers want to make sure the service helps them to reach more people but in a profitable way. Delivery is most likely to be free on all orders for those buying jewellery (36%) – where deliveries are likely to be both small and of high value – from household utilities (35%), or from marketplace hosts (25%).

Free delivery is less likely when buying pet supplies or music, film and TV products (both less than 1%). Instead, most pet supplies retailers (95%) offer free delivery on a minimum order value, as do most pharmacies (64%) and supermarkets (57%).

Marketplace hosts (24%) offer this approach at a similar rate to those offering free delivery on all orders. This is also the sector where this is least available. Free delivery on a minimum order value is most available in Austria (51%), Czechia (-6pp to 49%) and Romania (48%) – and least available in Norway (-1pp to 21%).

How do they use convenient collections and returns?

Retailers widen access – one of the key metrics in this value chain – when they make it easier to buy from them through services such as collection from store or by offering easy returns.

Collection

The proportion of G3K retailers offering shoppers the ability to pick up their online order instore or a third-party collection point has declined, by 26pp to 41% (from 67%) since last year. Specialist grocers (74%) are the most likely to offer collection, along with those selling nutrition supplements (66%), gardening products (63%) and alcohol (62%). Those selling musical instruments (39%) are least likely. Collection is most commonly available in the UK and Norway, where 57% of retailers that sell to this market offer it, followed by Slovakia (56%). Only 13% of retailers in Germany (-6pp) and 19% in France offer collection.

The sharpest declines in collection year-on-year were in Czechia (-17pp to 25%), Sweden (-13pp to 34%), France (-8pp to 19%) and the Netherlands (-8pp to 20%). Growth 3000 retailers offer collection from an average of 667 points( +9.71), although the median retailer offers collection from four stores, which is unchanged on last year. Collection is available from the largest number of stores in homewares (mean 386/median 16.5), multi-sector retailers (959/15.6), fashion (828/6) and brand stores (639/4). The average retailer has 47 of their own stores – five more than last year – while the median retailer has one. Sectors with most stores include maternity and children (av 57.5/med 6.8) and fashion (73/5).

By market, retailers selling to Luxembourg (62/1), Portugal (52/3), Spain (46/2) and Ireland (43/2) tend to have a larger number of average stores, although median numbers by market remain low. Waiting times until items are ready to collect have fallen slightly, by 0.25 hours to 59.7 hours – just under 2.5 days. The median retailer takes 48 hours to make goods ready to collect – unchanged on the previous year.

Collection times are faster for nutrition supplements (27.9/24), pharmacies (33.8/24) and consumer electronics (45.2/24) and when ordering from Slovakia (39.4/24), Denmark (47.8/48) and the Netherlands (48.5/24.8). The median retailer charges nothing for collection, while the average cost among those that do charge fell by €0.02 to €2.37. Stationers tend to charge more for collection at both the average (€2.39) and the median (€2.22) level. Those selling maternity and childrens’ products (€1.24/0),and pharmacies (€0.75/0) tend to charge less.

By market, the median charge for collection is zero, while the average charge ranges from €0.36 in Switzerland to €6.73 in the Netherlands.

Returns

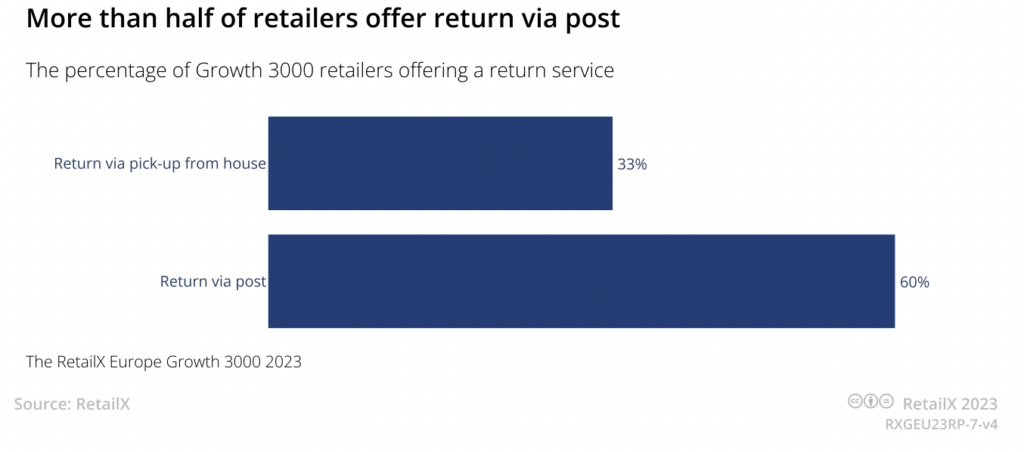

European retailers are required to give shoppers two weeks to return a product after ordering online. The most widely offered returns option from Growth 3000 retailers in 2023 is by post (60%), with pet supplies (95%), pharmacies (86%) and DIY & trade (84%) brands and retailers the most likely to offer this. Returns via pick-up from the house (33%) have grown quickly in recent years, with DIY and trade retailers (56%) the most likely to offer this, followed by gardening retailers (54%) – perhaps because the measure proves more cost effective when more expensive items are being returned.

By contrast, only 6% of supermarkets offer this option. 14% offer returns via a drop off to a third-party location, such as a collection point. This is more widely used by jewellers (34%) and retailers selling maternity and children’s products (27%) and sports and leisure equipment (24%). It is less used by those selling DIY and trade equipment (under 1%). Some retailers charge a fee to return an item. Where these are charged, the average fee is €14.40 – €0.20 less than a year earlier – while the median fee stayed the same at €6. Sample sectors include homewares (mean €30.10/median €5.72), brands (€14.10/€5.43) and fashion (€6.91/€4.95).

Company feature: How Tous manages fulfilment options

Barcelona-based jeweller Tous offers a broad range of delivery, collection and returns options. Two-day standard home delivery or collection from a collection point cost €3.95 in its home market of Spain, or are free when shoppers spend over €69.Collection from one of the family business’ more than 200 Spanish stores is free. Premium same-day and one-day delivery options are also available at an extra charge. Returns can be made for up to 30 days and are free through a Tous store, through a carrier pickup or can be returned through the post, using a returns label.

This feature originally appeared in the RetailX Growth 3000 2023 report and was authored by Chloe Rigby.