The shift among a wider consumer base towards luxury is in part prompted by certain demographic groups looking at a more sustainable approach to consumerism, particularly in fashion, the RetailX Global Luxury 2024 report has found.

Across all retail sectors, many shoppers are starting to make purchase choices based on their environmental impact, most notably in clothing, where 46.4% of consumers choose sustainable options, groceries (44.8%) and beauty and cosmetics (32.4%). While the luxury sector specifically attracts some 15.2% of sustainable shoppers, the pull of sustainable clothing, cosmetics and even food does have an impact on the sector.

Part of the shift to sustainable shopping, both within and without the luxury sector, involves a growing role for second hand goods. Globally, more than a quarter (28.3%) of consumers are buying second hand clothing, with around one in ten (10.2%) actively buying second hand luxury goods.

Second hand luxury ticks several consumer boxes. Firstly, it allows access to luxury goods at a much more affordable price for a much larger number of shoppers. Secondly, for fashion shoppers, it opens up a whole new tranche of products and styles, many more unique than mainstream fashion, again at a much more affordable price. Thirdly, second hand and vintage taps into the sustainability mores of all audiences.

For luxury brands it also creates a new revenue stream and, where these brands are not directly selling their own end-of-line and vintage goods, it does wonders for brand image and awareness. In fact, second hand luxury has become such an attractive market that a range of marketplaces sites have sprung up online to purely service this niche.

So, how are consumers shopping second hand luxury? As with all luxury goods, higher income shoppers are more likely to buy second hand luxury, with 16.9% doing so globally. However, a sizeable 6.3% of lower income and 8.2% of middle-income shoppers are also doing so.

This is clearly reflected in the age groups that are doing this. Millennials lead the way with second hand luxury purchases, with 12.4% of them doing so. Gen Z is close behind on 11.5%. However, even older Gen X shoppers are getting into the vintage luxury habit, with a noticeable 7.4% saying they buy in the sub-category.

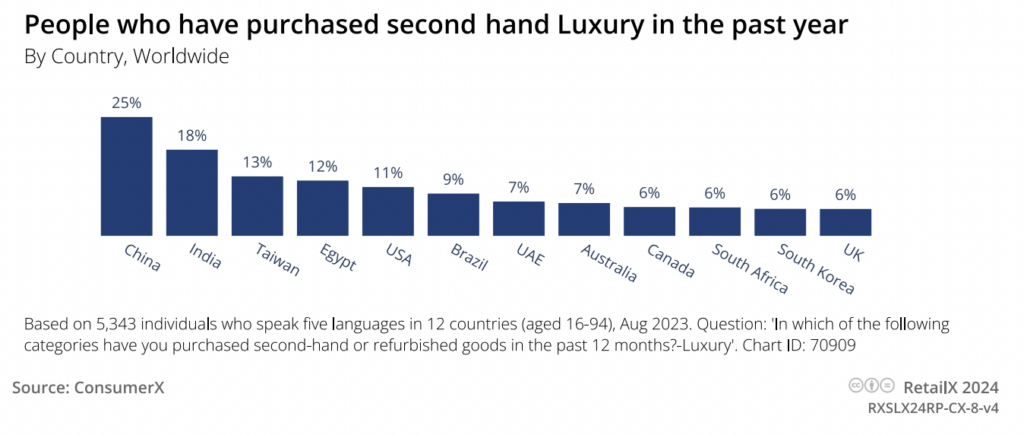

Second hand luxury purchases are most prevalent in the growing luxury markets of China, where 25.4% of shoppers buy second hand luxury. India (18.5%). Middle Eastern markets of Egypt and UAE also make a good showing at 11.9% and 7.5% respectively, however, this is way below the levels of new luxury purchases seen in these markets. The US also sees a comparable level here, with 10.5% of its consumers saying they buy second hand luxury.

Again, the more established markets of the Canada (6.3%) and Australia (7.1%) lag behind, with the UK making a poor showing at just 5.9% of consumers saying they buy second hand luxury.

It is worth noting, however, that despite these relatively low numbers, the markets for second hand luxury – even in the UK – turn over multi-billions of dollars each year and, while small compared to some sectors, are still very lucrative.

This is an except from the RetailX Global Luxury Report 2024, authored by Paul Skeldon. Download the full report for a look at consumer behaviour, the channels and devices used to make purchases, sustainability, predictions of consumer change and 22 in-depth company case studies.

This report aims to give senior retailers both insight of a market worth $354.81bn as well as details on how the major players are reacting to economic forces and are using technology and customer experience to differentiate their products and increase sales.

Stay informed

Our editor carefully curates two newsletters a week filled with up-to-date news, analysis and research, click here to subscribe to the FREE newsletter sent straight to your inbox and why not follow us on LinkedIn to receive the latest updates on our research and analysis.