The majority of luxury shopping took place in stores worldwide last year with just 13.9% using online channels, the newly published RetailX Global Luxury Report 2024 has highlighted.

This should come as no surprise. The luxury market is as much about selling an image and a lifestyle as it is products: it is the ultimate in experienced selling. The store environment works as both a destination and a ‘theatre’ to deliver that experience, which encompasses everything from personalised shopping agents through to the packaging up of the purchased goods – often all done with a glass of champagne in hand.

Another factor driving the overwhelming physicality of luxury retail is that as much as 40% of sales occur in travel hubs, offering the opportunity to tap into a new range of customers in airport duty free shops.

Desktop versus mobile

During the pandemic, luxury retailers were literally forced to shut up shop, with physical retail outlets closed and international travel suspended. This had a huge impact on the sector, which was forced to reach into its deep pockets and accelerate the rollout of ecommerce and mcommerce solutions.

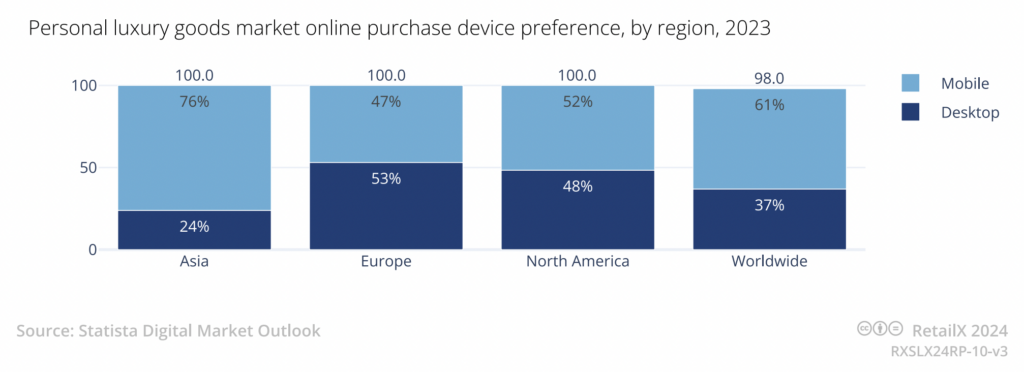

Across the pandemic years, this led to an uptick in online luxury shopping, coinciding with an increasing interest in luxury goods among younger demographics. This has seen mobile become the dominant channel in online luxury retail, with 61% of those that do shop online using mobile to do so.

Regionally, there are also some marked differences in online luxury shopping habits. In Asia, which has a younger, wholly mobile-first luxury audience, mobile accounts for more than three quarters (76%) of online luxury sales. Here, luxury shoppers – who tend to be Millennials and Gen Z – use their mobiles for everything and there is a deep link between social media influence for luxury brands and luxury and affordable luxury shopping.

High-end smartphones are also the preserve of better-off shoppers, who tend to be more tech savvy and more inclined to use their smartphones than a desktop to shop. This is seen across all regions among younger shoppers, many of whom are mobile first and heavily influenced by the social media they consume on their smartphones. Where the mobile/desktop split shifts is where markets have a broader age range of shoppers.

In North America, for instance, the split between mobile and desktop is almost 50:50, reflecting how the luxury market there is split reasonably evenly across age groups. In Europe, which tends to attract an older demographic of domestic luxury shoppers, desktop is still the preferred channel for luxury purchases, accounting for 53%, an albeit small number, of online sales.

This is an except from the RetailX Global Luxury Report 2024, authored by Paul Skeldon. Download the full report for a look at consumer behaviour, the channels and devices used to make purchases, sustainability, predictions of consumer change and 22 in-depth company case studies.

This report aims to give senior retailers both insight of a market worth $354.81bn as well as details on how the major players are reacting to economic forces and are using technology and customer experience to differentiate their products and increase sales.

Stay informed

Our editor carefully curates two newsletters a week filled with up-to-date news, analysis and research, click here to subscribe to the FREE newsletter sent straight to your inbox and why not follow us on LinkedIn to receive the latest updates on our research and analysis.