Shoe Zone is investing in digital while also closing stores. The multichannel retailer today says that its digital sales grew by 82% over its latest financial year as the sales channel gave it a route to market at a time when stores were closed during Covid-19 lockdowns. But at the same time, much of its stock was locked in non-trading stores, and its overall sales fell by 24.3%. At the bottom line it reported a pre-tax loss of £14.6m, and it took on its first debt in 15 years to help it survive Covid-19.

Shoe Zone is set to have 427 shops when it reopens from the latest lockdown in April – down from the 460 that it had at the end of its last financial year, in which it closed 50 and relocated 10 others. In its current financial year so far it has closed 33 shops, a figure that is expected to reach a similar level to last year. This, says Shoe Zone, “is faster than previously forecast, mainly due to Covid-19 and certain towns becoming unviable due to the closures of complementary retailers”. It now expects to close a similar number of stores for the next two or three years. At the same time it will relocate around 10 shops a year to become hybrid stores in town centres – selling both branded and own footwear.

In the year to October 3, Shoe Zone revenue of £122.6m was down by 24.3% from £162m a year earlier, and the retailer posted a pre-tax loss of £14.6m – down from a profit of £6.7m a year earlier. The retailer says it is now “extremely unlikely” to return to profit until the year ending October 2 2022 – at the earliest.

Shoe Zone chief executive Anthony Smith says the financial pressures of Covid-19 mean that the retailer now has debt on its balance sheet – a £7m CBILS loan – for the first time in more than 15 years.

He says: “The business model of digital, big box, hybrid and town centre stores remains the same although the percentage contributions of each area are changing fast due to lockdown restrictions, some of which will be a permanent shift.”

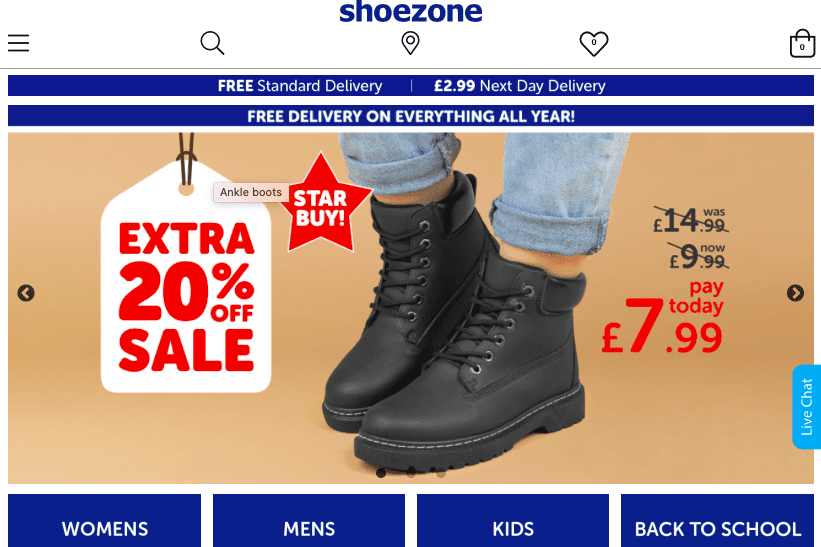

In the future Shoe Zone, a Top100 retailer in RXUK Top500 research, expects to invest further in digital sales, while focusing on hybrid and Big Box stores. “Our relatively new autonomous digital department has been very effective at coping with unexpectedly huge growth in sales and volumes,” it says in today’s statement. Sales growth of 82% came as the retailer offered heavy discounting and a ’buy one, get one free’ offer in order to generate cash – and while digital sales reached £19.3m, its contribution to profits grew more slowly, at £4.6m – up from £3m a year earlier. Digital orders are currently supplied from its warehouses, but the retailer says that it had to slow some online-only lines as a result of lack of availability from suppliers.

Most of Shoe Zone’s products are manufactured in China, with others made in India and Europe – making it vulnerable to the risks of international trade. It says that since Christmas its freight rates have increased to about £6.500 per container – up from £1,900 a year earlier. On average the business imports 100 containers a month.

By the end of December 2020, Shoe Zone had 51 Big Box stores. In its latest financial year, £17.1m – up from £15.6m last time – came via the channel. That’s 14.3% of turnover. But the roll out has been suspended for the foreseeable future as a result of the pressures caused by Covid-19.

The retailer now has an average lease length of two years on a store estate now centred on on town centres and retail parks. It employs about 3,000 people around the UK. The retailer wrote down the value of its freehold property values by £2.3m “to reflect the deteriorating retail property environment”.

It is also working to reduce its impact on the environment, eliminating single use plastics from own label products, recycling cardboard and plastic waste from stores and head office, and using sea transport to reduce emissions, while also trialling its first compressed natural gas delivery lorry.

Terry Boot has joined the business as finance director.