The rapid growth of digital retail channels is slowing down the shopping process in the fashion retail sector, according to research by retail analysts Conlumino for Webloyalty .

The total length of time taken from browsing to collection of a fashion item has increased from 0.5 days in 2002 to 3.4 days in 2012, reflecting the huge choice of shopping destinations now available to fashion shoppers. But with this increase in duration comes an increasing cost to retailers of maintaining customer engagement throughout the four phases of the purchase process: browsing, researching, purchasing and collection.

The research shows that in 2002 the average shopper would complete the whole process in half a day, in a single shopping trip to the high street. In the past ten years, the rapid adoption of smartphones and tablets, combined with extensive broadband penetration, has driven retailers to develop innovative multichannel shopping experiences. Consumers can now access fashion retailers online through their desktop computer, tablet or mobile, as well as in store and through catalogues. 90.7% of shoppers now use two or more channels when making a fashion purchase. The result of this proliferation in choice is an increase to the time spent on making a purchase.

Shoppers now spend over half an hour longer browsing for fashion than they did ten years ago. The time spent on the research, purchasing and collection phases has actually decreased, as a larger proportion of this activity now happens on online channels which are fast and convenient. What is notable, however, is that the length of time between each phase has increased enormously.

The first reason for this is that time lapses as consumers move between channels. They may spot an item they like in store but wait a day or two before buying online. The increase in purchasing from remote channels has also hugely increased as shoppers wait for their home deliveries to arrive.

Neil Saunders of Conlumino says: “The birth of several new channels being used by shoppers to make fashion purchases has added both to the cost and complexity of managing the path to purchase for retailers. Since consumers also now spend more time between browsing, researching and purchasing, retailers face the new challenge of maintaining customer engagement with the brand over a longer period of time.”

While posing new challenges, these changes in shopping behaviour also offer new opportunities for customer engagement. Guy Chiswick, Managing Director of Webloyalty UK, says: “Consumers now spend 34% more time on shopping for fashion than they did ten years ago. Taken alongside the increasing use of online channels by consumers as part of this process, this offers the opportunity for brands to ‘personalise’ the purchase experience. Engaging with shoppers throughout the whole purchase process is vital. This includes connecting with the consumer in the time between each phase of the purchase process. Email updates, information on the next season’s trends or targeted offers to customers between ‘click’ and ‘collect’ will all make a difference.”

An increase in the number of fashion orders placed remotely has led to a corresponding increase in the number of returns. The cost of returning unwanted clothing to UK fashion retailers reached £90.76m last year according to the research. The majority of this cost – £61.52m is being borne by retailers. This represents some 47.4 million purchases returned over the past year. The c ost of a further 13.6 million returns, some £29.24m – was taken on by British consumers.

Returns are a particular problem in fashion where consumers are now used to ordering multiple items in a range of sizes, colours or cuts in the knowledge that they can easily send back items that they don’t want. In many ways, the home rather than the store has become the fitting room, often at the retailer’s expense.

While many retailers do build in some cost of returns, there is the danger that as remote channels continue to grow, the cost of servicing the consumer also grows. This situation would inevitably erode profitability. The ideal situation for retailers is to minimise the volumes of returns while growing sales. To do this, they may need to revisit how the returns process fits into their multichannel strategy.

This will become increasingly important as online sales in the fashion sector overtakes growth in physical stores over the coming years. Over the next five years, Conlumino predicts that the fashion market will grow by £7.9bn with physical stores accounting for 45.9% of that growth. This switch in the channel driving the lion’s share of growth in the sector represents a “coming of age” for online fashion; a milestone achieved by the electricals sector around four years ago.

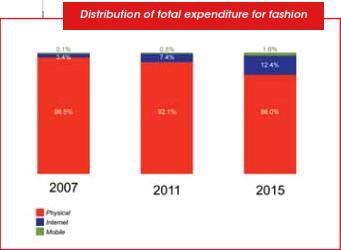

Online penetration in terms of spending on fashion has been relatively low with less than 8% going through the online channel last year – in contrast to just under 12% for all retail spending. Online fashion spending is now seeing rapid growth and Conlumino forecasts that online will account for 12.4% of the sector’s sales by 2015. Mobile, while still embryonic, will have a share of 1.6% but growing rapidly.

The full research can be downloaded from www.webloyalty.co.uk/research.