Verto Analytics examines the reality of how people shop online throughout the day on different devices.

A study, which explored the online shopping habits of 5,000 UK adults across PCs, smartphones and tablets, conducted by Verto Analytics, reveals a marked difference in when age groups are most likely to shop online.

“Retailers and online shopping platforms who want to acquire traffic on their properties need to be aware of when different demographics are most likely to be receptive to shopping online and the likelihood of buying,” says Mike Read, Verto’s UK Managing Director. “Different media buying and traffic acquisitions strategies, and programmatic buying plans, should be driven with these demographic insights in mind.”

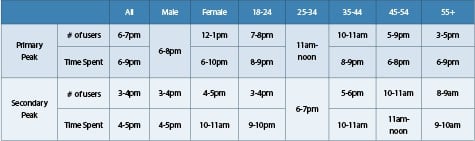

The number of people shopping online rises steadily from 3am to 1pm and then fluctuates (although broadly rising) until 7pm before dropping off for the rest of the night. The amount of time people spend shopping (engagement) during the day follows a similar pattern to popularity. However, the average amount of time an online shopper spends peaks between 6-9pm. In short, the most popular time of day for online shopping is 6-7pm but actual activity is heaviest between 6-9pm.

However, there is quite a difference in the most popular times between demographics. For example, 35-44 year olds are most likely to shop online between 10-11am while for 45-54 year olds it’s 5-9pm.

In terms of the times of day when online shopping is heaviest (i.e. how much time is being spent) there’s also a large difference – ranging from 11am-noon among 25-34 year olds to 8-9pm among 18-24s and 35-44 year olds. Furthermore, women tend to account for a disproportionately high share of online shopping activity between 5-10am (62%+) and 8-10pm (68%+).

Read says that understanding these differences is “particularly important from an advertising point of view as it reduces the chances of ineffective campaigns and wasted budgets by tailoring your activity around when it’s most likely to hit your desired audience.”

The research also delved into how people use different devices to shop online, with the majority of time (57%) still happening on a PC versus 32% on mobiles and 11% on tablets. Initially Verto’s data may seem at odds with IMRG sales data which shows PCs accounting for 46% of ecommerce sales, with mobile at 28% and tablets at 25%. However, Read points out that Verto’s data incorporates all browsing and research behaviour in addition to actual purchasing whilst IMRG is focused purely on the latter. “It’s a reminder that PC still plays a major role in shopping and shouldn’t be completely ignored in the rush to mobile.”

Men are more reliant on PCs for shopping – it accounts for 71% of their time compared to 46% among women. Among women, 43% of their online shopping is done on mobile – compared to just 19% among men. Consequently, women account for a staggering 75% of mobile ecommerce time.

Different age groups are also more reliant on mobiles for shopping. Adults under 35, for example, spend 56% of their online shopping time on a mobile and, consequently, account for nearly half of all mobile shopping time. Mobiles play a much more important role in online shopping for the new generation of online shoppers and their disposable income. They’re more comfortable with the mobile channel and using it to journey through the different online shopping stages.

The reliance on PCs increases as people get older. For instance, PCs account for just 38% of online shopping time among 18-24s compared to 82% among people 55+. Read also warns the industry about its “fixation” on shopping apps which still only account for 15% of shopping activity. The more ‘traditional’ behaviour of visiting websites accounts for the other 85%.

PC usage peaks between 7-9pm and 10am-noon, whilst mobile shopping peaks from 4-10pm (excluding a lull between 5-6pm) and tablet shopping 5-8pm.

Consequently, PCs account for the highest share of shopping time between 8-12am (63% share). Mobile’s share of shopping time is highest between 6-7am and 9-10pm (both 43%). Tablet’s share is greatest between 6-7pm when it accounts for 21% of shopping activity – nearly twice as much as the average 11% share it holds throughout the day.

Mobile provides a more stable, across-the-day type of presence to interact with consumers, while PCs peak in the morning and evenings.

“It sounds obvious, but if manufacturers and retailers want to be more successful at targeting online shoppers, they need a much better understanding of how people’s ecommerce behaviour changes throughout the day, particularly across different devices,” notes Read.

“Likewise, the platform on which to advertise, and the plans for cross-device campaigns, should take into account the fact that online shopping is still more PC-centric than many other sectors – such as search, restaurants, gaming and messaging. People likely feel safer to go into further research and consideration on online shopping properties using their PCs and bigger screens. If you want to optimise and drive for conversions, it might be interesting to try to spark interest and trigger intentions via mobile-centric campaigns and content, but when it goes down to conversions and purchase behaviours, bigger screens might well be the platform of choice for your targeting.”