Global marketplaces are on the rise and this trend will likely continue over the next few years. This is evidenced by the marketplaces’ impressive revenue growth and Gross Merchandise Volume. Richard van Welie, Chief Editor, Research & Advice, Ecommerce Europe examines why retailers cannot ignore marketplaces.

Retailers across Europe believe that the market share of marketplaces will continue to grow, reaching around 40% of the global online retail market in 2020, according to a study by the Ecommerce Foundation. However, the ‘Rise of the Global Market Places’ study also found that retailers consider themselves superior and are not the least worried.

The market share held by marketplaces currently hovers between ten per cent and thirty per cent depending on the country, so a rise to forty per cent represents significant growth over the coming years. In this regard, it is interesting to note that retailers generally see their own company grow over this period as well.

This leads to another interesting conclusion: retailers seem quite positive about the impact of marketplaces. For instance, they are only slightly worried about the impact of Alibaba and Amazon, while they are more positive about companies such as Apple, Google and Facebook.

In addition, retailers tend to overestimate their performance in comparison with global marketplaces. They consider themselves to be stronger in almost every field, and especially at customer-facing processes, with IT development and big data being the only fields in which marketplaces are believed to be slightly better.

Currently, retailers are often already using online marketplaces to support their operations, and predominantly for marketing, domestic sales, IT and analytics and big data. “These activities fit in with what the respondents believe is the most positive aspect of marketplaces,” says Prof. Jory Abraham, Managing Director, Ecommerce Foundation.

“Through online marketplaces, they can reach more consumers, without a lot of additional effort. This also makes marketplaces an ideal place to start cross-border activities, as you can test your product or service without having to set up a foreign online shop at the start.”

The study also highlights four critical factors as keys to marketplaces’ success: assortment, prices, convenience and inventiveness.

Negative influences

The impact of marketplaces also has its negative sides. First of all, they are not cheap to work with. Price is an important pillar for ecommerce platforms and in order to keep their prices as low as possible, among other things, marketplaces try to take as much margin from their suppliers as possible. Together with the fact that as marketplaces become increasingly dominant in the retail industry, smaller retailers are often forced to cooperate in order to survive.

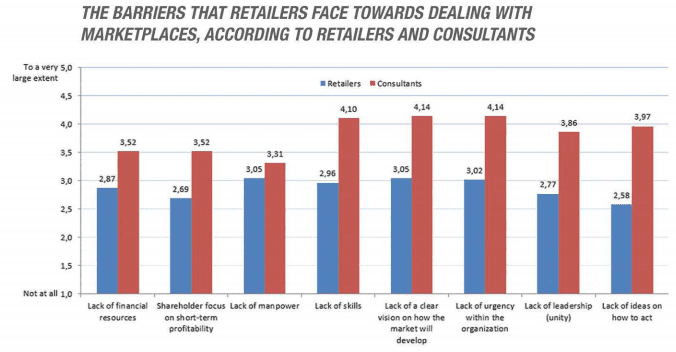

The study also shows an interesting difference between the opinions of retailers and retail consultants; both of whom were amongst the 274 respondents and interviewees questioned about the influence of marketplaces, retailers’ capabilities and time to adjust, perceived barriers and appropriate strategies for dealing with marketplaces. It turns out that consultants are not as rosy about the retailers’ future. They believe that retailers lack the skills and leadership in order to properly deal with the rise of global marketplaces. As a result, retailers respond too slowly and cautiously to these occurring changes.

More challenges

The interviews provided further interesting insights from C-level managers around the world and highlighted the fact that global marketplaces are not the only concern for retailers. Increasing market transparency, more powerful consumers, the sharing economy and new technology also pose new challenges.

Therefore, retail may look very different in 10 to 20 years, whereby a scenario where marketplaces are the dominant force is not at all unlikely. After all, marketplaces are estimated to have a market share of nearly 40% and, according to a study among 12,000 consumers, shoppers expect to buy 50% of their goods and/or services online in 2020. This would lead to a so-called “Platform Empire” scenario, in which retailers and brands will still exist, but may have lost up to 70% of their traditional market.

“We have conducted this research in order to provide retailers with a much needed wake-up call. And based on our results, we offer them three tips for dealing with online marketplaces,” says study co-author Prof. Kitty Koelemeijer of Nyenrode Business University in conclusion. “First and foremost, retailers should never ignore them. Retailers can learn a lot from the marketplaces’ successes and failures, and even though it will come at a price, they also offer a huge customer reach. Therefore, retailers should balance the accompanying costs with the benefits and decide for themselves what will work best for them.

“Second, retailers should choose a specialism and become an expert within this area. This way, they can offer customers better and more customized service than marketplaces. Having inventory will become much less important, as they actually may only offer services.”

“Finally, pure players are often ‘right-brained’ supply chain ‘machines’. This offers an opportunity for omnichannel brands and retailers to create a company with a heart. Build a strong relationship with both your employees and customers, so that people will definitely grow fond of you.”

ADDITIONAL INFORMATION:

Why marketplaces rise

Marketplaces work with a lot of suppliers and as a result, they can offer a very broad and deep assortment, giving the customer a wide range of solutions to their quest for products and/or services. In addition, marketplaces can offer their items at a lower price than retailers because of the scalability of their platform. Also, convenience is a key aspect for online platforms. They strive to make the customer experience as smooth as possible, which is evidenced by developments such as one-click buy and same-day delivery. As a result, they excel in customer satisfaction.

Marketplaces combine these three success factors with a form of inventiveness that is remarkable for companies of that size,” says Prof. Abraham. “For example, Amazon now has more than 150,000 employees and it still is able to remain quite innovative, by developing new products and services that benefit both the platform and consumers. They are able to combine continuous innovation with operational excellence, which gives them a clear edge over the more traditional retailers and brands.”