RetailMeNot shares the results of commissioned research into the predicted levels of online spend across Europe for 2015.

Online sales are forecast to grow by 16.2% in the UK, while sales across Europe are tipped to grow by 18.4% in 2015, finds research commissioned by RetailMeNot, which operates in the UK as VoucherCodes.co.uk.

Online sales are expected to account for 15.2% of all consumer retail sales in the UK in 2015, according to the international study conducted by the Centre for Retail Research. It reveals that online retailers in the UK can expect sales to grow by 16.2% in 2015, with total online sales set to reach £52.25bn, vs £44.97bn in 2014.

Brits are expected to shop online more often in 2015, making 21.2 purchases this year versus an average of 18.8 in 2014. Shoppers in the UK will spend an average of £55.36 per online transaction this year, compared to £57.08 last year and are expected to be the most frequent online shoppers in Europe. Shoppers in Sweden will spend the highest amount per transaction (£56.43, with an average of 10.4 online purchases per year).

European online shoppers are set to spend £820 online on average, vs £738 in 2014, an increase of 11.1%. In the UK, online shoppers are expected to splash out £1,174 online in 2015, growing by 9.6% compared to last year. British online shoppers are even ahead of those in the US where the average online shoppers are expected to spend £1,120 (+7.4% YoY). Other above average spenders are Germans (£1,023) and French (£847).

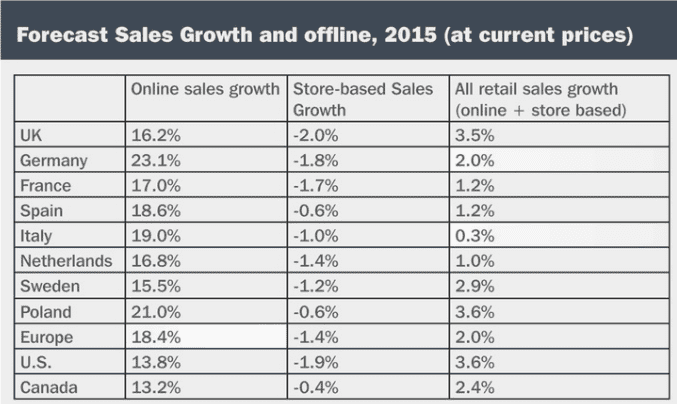

Giulio Montemagno, Senior Vice President of International at RetailMeNot, Inc, said: “Investment by retailers in improving the online shopping experience and more sophisticated consumer targeting is clearly paying dividends. In the UK, consumers are now shopping online more frequently and spending more overall, helping to increase online retailers’ market share. This is being bolstered by a growing number of online shoppers; 65.5% of Brits now shop on the web.” Strong growth online is compensating for falling sales in-store in all markets surveyed. Across Europe, store-based sales are set to fall by 1.4% in 2015, however an 18.4% increase in online sales means that total retail sales across the continent will grow by an average of 2% this year.

The US and Poland are set to see the fastest rate of growth for total retail sales in 2015. Growth of 3.6% is forecast in both countries. Italy is expected to see the slowest rate of growth with 0.3%, followed by a rate of 1% in the Netherlands, and 1.2% in both France and Spain. In the UK, store-based sales are expected to fall by 1.9%, while overall retail is expected to grow by 3.5%.

“Although in-store sales appear to be falling, many retailers are bucking the trend by embracing technology to better engage consumers. In 2015, we expect to see even more retailers take advantage of mobile and further testing of beacon technology to target consumers while they are on the go, as well as in-store, by making the shopping experience more relevant,” says Montemagno. “Despite online retail seeing the most rapid growth, the high street remains an integral part of the retail landscape. It’s for this reason that we are seeing online-only retailers bridge the online and offline gap by opening brick-and-mortar stores and offering services such as click-and-collect to make the shopping experience more seamless, while increasing market share.”

Europe’s fast-growing ecommerce market expanded by 18.4% in 2014 and this strong rate of growth is likely to continue into 2015 and beyond. Forecasts suggest that online sales will rise by a further 18.4% in 2015 and 18.7% in 2016. Meanwhile, online sales in the US and Canada are predicted to rise by 13.8% and 13.2% respectively this year. Online sales are expected to grow by 16.2% in the UK in 2015 and 15.3% in 2016.

Once again, Germany is set to see the fastest increase in sales in Europe, with online spend forecast to reach £44.61bn this year. However, the rate of growth is slowing, suggesting that the German market is maturing; online sales increased by 25% in 2014 and 39.2% in 2013, but are only set to rise by 23.1% in 2015 and 22.4% in 2016. Next year will see Germany fall behind Poland to become the second fastest growing market in Europe; the Polish ecommerce market is expected to grow by 22.5% in 2016, as growth accelerates from 21% in 2015.

Sweden’s ecommerce market is the slowest growing in Europe, however it is the most mature; 69.8% of Swedes shop on the web. Comparatively, 65.5% of people in the UK shop online, while the US average is 57.4% and the European average is just 46.7%.