As the digital age threatens traditional buying and merchandising practices, big data and digital tools are allowing retailers to optimize their product and trading strategies. Katie Smith, Retail Analyst, Editd explains further.

Digital analytics have been used to forecast and strategize in the financial, insurance and advertising industries for many years, and retail is well rehearsed in processing big data findings about customers’ habits from loyalty card schemes. But in a new era of retail, digital tools have switched up a gear, and now allow entire market visibility around product, pricing and consumer.

There are many risks associated with an industry which previously made decisions based solely on a combination of intuition, knowledge of zeitgeist and gut instinct to determine trends and design direction. While those traditional methods and use of trend consultants’ macro forecast predictions may be a great start point for inspiration they aren’t based on tangibles and don’t take into account subtleties in market and consumer, nor do they have the ability to detect the slipstream trends whose entire life span may only be a few months, but are important commercially. Supposing Rihanna decides to start wearing batwinged sweaters, just because she can – that’s going to generate sudden, and profitable, consumer demand that can’t be pre-empted by old school trend forecasters 24 months prior.

Then there are the common pitfalls inherent to fashion retail that can’t be understood via mood boards and street style spotters’ selections. The biggest risks in fashion retail revolve around quantities, timings, unseasonable weather and price points. Ordering too much or too little of something can cripple a retail quarter, as Marks & Spencer discovered when they underestimated the popularity of tribal prints and coloured chinos in 2012 and admitted they could have ordered four times as many cardigans and jumpers; exceptionally costly mistakes at this scale of retail. Having the wrong style, colour or trend, or being too early or late to react keeps buyers awake at night. Being priced incorrectly,discounting too early or not being prepared to react when there’s an extended cold spell or unusually late summer are some of a merchandisers’ biggest pain points – none of which are helped by colour palettes for Winter 2016 or a gallery of street style from the coolest bar in Berlin.

Those risks have been further compounded by changes to the industry in recent years. Globalisation has ramped up the pressure within retail, seeing the traditional notion of the fashion season break down. With the mainstream adoption of ecommerce driving trans-seasonality, retailers are now marketing to diversely different climates and can no longer be driven by the rules of brick and mortar.

The internet has not only spawned social media’s role in propelling consumer tastes and allowing them to be steered into unexpected new trend directions at rapid pace, it has also created a climate where new apparel competitors can spring up from anywhere and blindside a traditional buying and merchandising approach. Internal BI systems no longer suffice, they’re not responsive enough and don’t answer to the speed that trends develop at – your sales reporting can’t inform you about something you never produced in the first place. And price comparison tools used in other industries aren’t a fit for fashion products, which are nuanced beyond price and have complex layers of options, colourways and styling features.

OPTIMISING TRENDS

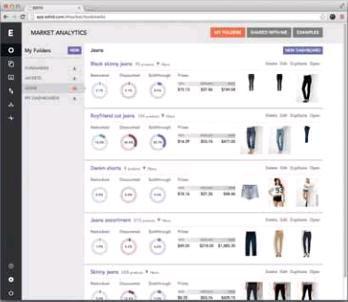

The relevancy and efficiency of traditional comp shopping is also being called into question. Retailers who are considered ‘fastmoving’ are conducting comp shops on 4-8 week cycles (and some still only do this bi-annually), requiring an entire team to update messy Excel spreadsheets that are then shared across the business as a playbook for the next period. The method, which worked 10 years ago when product turnaround in brick and mortar stores was slower, is now flawed given that information recorded is only a snapshot of one day and can be out-of-date by the time a product has been distributed.

Thanks to the online changes, there are new tools and processes which are now helping retailers trade better and are addressing those key industry risks, cutting back on manual process and human error. The amount of big data that is thrown off each product’s lifetime online is traceable and means that successes, or trends, have a way in which to be analysed and optimised.

Retailers are increasingly relying on analytics tools to access this sort of big data and decrease the considerable workload placed on trading teams. “In today’s fast paced environment, buyers and merchandisers are under pressure to know every datapoint that affects their world, but can’t possibly have time to do it all themselves,” says Anthony Benham, Business Change Manager at ASOS , “Critical decisions around pricing, assortment and discounting, and keeping an eye on what’s going on across markets is a full time job.”

Big data is able to contribute at every stage of the retail calendar, not just with comp shop cycles. Pre-season planning and buying can be pivoted around data on what’s trending, which brands are doing well and which aren’t, and can highlight the key times to act upon a trend. Insight into competitor’s pricing architecture can reveal opportunities and weaknesses with visibility of products across the market, not simply your own offering. It’s not just software which can help out with pre-season assortment planning – some brands have built bespoke ways of measuring consumer interest in their products before they need to commit to orders.

Burberry and Topshop Unique have both developed campaigns to test consumer reaction during runway shows. These showcases involving social media attract and encourage the commentary of a much wider audience than those attending the prestigious show. In the three hours after Topshop Unique’s SS12 runway show, 2 million people from 100 countries viewed the brand’s stream across their homepage and Twitter account. Metrics attached to the sharing of imagery, the volume of online chatter and availability to pre-order are all risk-prevention tactics.

The benefit of access to big data to buyers and merchandisers can’t be underestimated – being able to see the market instantly and clearly is a very powerful tool. Analytics can assist in-season, alerting retailers when a new style is selling fast – in time for them to order more, now that manufacturing lead times are as low as three weeks.

In-season buying can be better informed with real-time data on how brands are performing elsewhere, down to specific garments and enabling retailers to be on top of sudden discounting. Meanwhile, visual merchandising databases, which capture retailer and brand communications and site updates can be used to plan for holidays and discounting periods as well as help retailers understand how competitors’ promotions have impacted their sales – did a competitors’ promo on outerwear last week dent sales for the retailer? Having that insight on hand allows retailers to react and prepare, and also explain trading results within their business.

Looking further ahead, innovative merchandising can draw on data to understand what’s up next, applying scale to runway collections, adding commercial analysis to the shapes and trends seen and apply quantity to colour usage – cutting out hype and instead drawing from tangibles. It’s an exciting time in the apparel industry; the retailer who optimises the best by incorporating data in every stage of the product lifecycle, from development right through the supply chain to shipping, pricing and marketing, will be the retailer that wins.