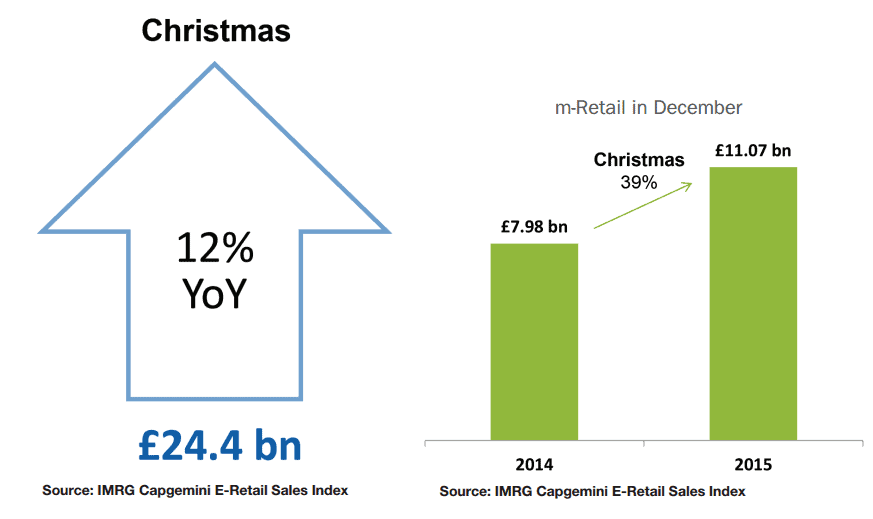

Shoppers flocked online in the run up to Christmas spending £24.4bn between the beginning of November and Boxing Day. This is a rise of 12% over the same period in 2014, according to the IMRG.

While some retailers saw an easing of sales in the run up to Black Friday, shoppers and retailers were better prepared this year for what has become the biggest event in UK retailing and for many is the biggest sales week of the year. Some 17% of all sales during the Christmas period were made during the Black Friday week, commencing 22 November, as online sales rose 62% on the previous week to hit £4.3bn. Cyber Monday week came in at £3.6bn spend.

Some sectors, such as gifts and health and beauty saw a rise in spend at 18% and 22% respectively, while others , such as home and garden, were down and other more mature online sectors such as consumer electronics were fairly flat year-on-year with a growth rate of 3% over 2014’s level.

Continuing its prominence and growth as a device of shoppers’ choice, mobile again increased its share of online spend. M-retail now accounts for 12.2% of total retail sales, increasing by 39% over the Christmas period, when compared to 2014’s level. That translates as £11.07bn spent on mobile devices compared to £7.98bn in the run up to Christmas 2014. Over the full year, m-retail recorded growth of 42% with mobile now accounting for 45% of all online sales; most of that growth is coming from tablets which saw an increase over the year of 31%, compared to smartphones’ increase of just 12%; 69% of all m-retail sales in 2015 were from tablets.

The smartphones’ share of retailing has been increasing as mobile phones increase in size. Mike Durbridge , Omni Channel Director, B&Q believes that the work that networks have done on data plans coupled with retailers’ development of responsive adaptive sites and the work done by companies such as PayPal in the payment field to shorten the checkout process is all making it easier for shoppers to spend.

Mobile will continue its prominence in retail in 2016 following a 2nd year in which all growth was from mobile devices. Mobile is settling at a growth rate of between 40 and 50% following the early days of 300+% growth with tablets continuing to account for the largest share of m-retail sales. Retailers will therefore need to continually improve the mobile experience and personalisation is going to be key to that in 2016.

VIEW OF 2015<h2/

Overall, online is forecast to grow by 11% in 2016, to reach sales of £126bn by the end of the year, the same growth rate as achieved in 2015, a year in which online sales reached £114bn, according to the IMRG.

“Rounding off a mixed year for e-retail, where we saw single-digit growth in several months [including just 7% year-on-year growth in Q1] the UK online retail industry recorded a solid performance in December, with sales growth significantly higher than the same month in 2014. With December being the wettest since records began, it appears the unseasonal weather, together with growth in mobile commerce helped to boost online sales over the festive period. As we observed in 2014, the effect of Black Friday resulted in November being the peak month for the online retail industry as consumers brought forward much of their Christmas spending, no doubt boosted by promotional activity around Black Friday,” says Tina Spooner, Chief Information Officer, IMRG.

“Sales via smartphones continue to grow at a significantly higher rate than those via tablets, with sales growth during December reaching the highest recorded during 2015 at 117.5% year-on-year. While tablets continue to account for the largest share of mobile commerce, significantly, during December four in 10 m-retail sales were completed on a smartphone, compared with 28% penetration in December 2014.”

The correlation between people buying on mobile phones and collecting their orders in store continues and will be an interesting one to watch. Also, the switch in pureplays now growing sales at a faster rate that multichannel retailers and the impact of new technology such as the Internet of Things and connected devices.

As with past Christmases, the impact of Black Friday while seeing an increase in sales, and for many retailers an improvement in margin over 2014’s discounting scrum, the key will be in turning those customers into loyal shoppers throughout the year.

Also, how retailers then manage peaks and troughs of Christmas 2016 to ease any softening of sales in early November and achieve buoyant sales across the full 8 weeks, is yet to be planned.

One thing that’s for certain is that click and collect services will continue to be part of the fulfilment story; click and collect orders have been 4% higher in 2015 in terms of percentage of sales than 2014 and accounted for 25% of multichannel retail sales in Q3.