Two reports – from LCP and Martec – have investigated IT spend in retail, how the budget is moving away from IT Departments and where omnichannel is pushing up sales by 10-20%. Emma Herrod reports.

Last year, operations and supply chain consultancy LCP reported that retailers had to be omnichannel or die. Following a year in which investment in omnichannel systems has been high, some 40% of UK retailers now say that they are omnichannel businesses up from 27% last year. These companies are proving that omnichannel is a route to success with reports of increased sales between 10-20% over the past 12 months. This is double the number of major retailers that reported a similar increase in 2013.

However, LCP believes that 14-15% of large retailers with a turnover in excess of £500m are still in danger of terminal decline.

These Challenged Multichannel Retailers, as LCP labels them, are trying to adapt to the multichannel world by bending existing bricks and mortar infrastructure. Instead, they should be following the example of omnichannel pioneers such as John Lewis which are fully committed to transforming front and back-end operations to deliver a seamless experience to customers.

Not only are they seeing lower like-for-likes, explains Stuart Higgins, Retail Partner at LCP, they also risk losing customers to those businesses that do offer a seamless experience since companies such as John Lewis are raising customer expectations for consumers across all sectors. There is no ‘one-size-fits-all’ approach for omnichannel success but the transformation can only be realised through complete cross functional and total organisational commitment. LCP recognises four key capabilities as:

- Consistent customer proposition;

- Seamless order management and customer experience;

- Fulfilment excellence;

- Effective personalisation;

Flexibility, in being able to offer what the customer wants, when and how they want it will buy loyalty, believes Higgins.

“There’s no point having an excellent front end without backing it up with the infrastructure to make sure that you fulfil those promises, explains Higgins. “Otherwise you will lose customers,” he warns. Over a third of retailers who claim to be omnichannel have experienced an increase in customer complaints revealing that a focus on the front end, without the back end to match, isn’t working.

LCP also recognises a group of ‘Omnichannel Followers’, the recent converts to investing in omnichannel retailing but without a fully integrated business model. These companies, which make up 27% of LCP’s respondents, are retrospectively fixing their back-end systems to keep up with the omni leaders. However, this group does run the risk of not establishing the core systems for long-term success.

“If retailers take the view that they’ll fix the back end later, they’re intrinsically planning for failure,” comments David Wild, CEO, Domino’s Pizza Group . “They’re saying that online will be a minority part of their business and therefore doesn’t need an efficient suite of back-end systems.”

“Omnichannel as a model still dominates retail but it’s not the only choice,” says Higgins.

A quarter of the survey respondents have made a strategic decision to adopt either an optimised multichannel or pureplay approach to retailing. These include companies such as Amazon and Asos as well as the discounters who concentrate on their bricks and mortar offerings. The real challenge for retailers is to understand which group they are in – Omnichannel Pioneers, Omnichannel Followers, Optimised Multichannel or Pureplay, Challenged Multichannel – and then define which model will provide a sustainable route to growth and profitability.

Insight through data is going to be key to the future of omnichannel businesses, explains Higgins. Insight both in terms of customers and business performance data. Many of the respondents recognised that they can’t measure their own business performance with 40% saying that they are having to make significant investments in data analytics generally. Around a quarter of the 100 retailers surveyed in the UK and the US still said that they lack the tools to understand and measure the channels in their business.

IT IN RETAIL

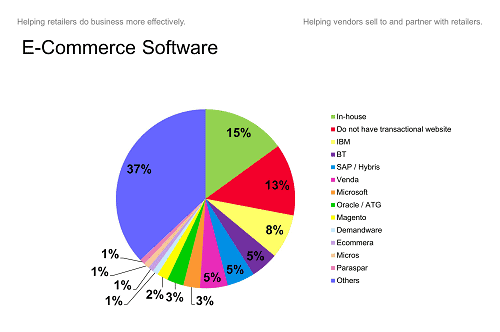

This is an area in which 15% of leading retail businesses are planning to invest in the coming year, according to research from Martec International. Its IT in Retail 2014 report, sponsored by Wipro, reveals the impact that omnichannel is having on areas of the business away from the traditional IT department and IT Director’s remit including business analytics and data warehousing tools.

While the level of IT spend by retailers as a percentage of sales remains the same as last year at 0.9%, this is an overall increase in monetary terms since sales levels have risen since 2013. “Things have really got moving this year,” says Fran Riseley, Director, Martec International. “Retailers have been wanting to replace systems for quite some time but due to the economy many projects have been on hold,” she comments.

Some 27% of the 150 IT Directors surveyed put multichannel and ecommerce as an investment priority for the year (up from 21% last year) but Martec’s research found that the majority of overall spend is connected to multichannel retailing such as ERP or supply chain, explains Riselely.

“One third of IT Directors say that other departments are spending on IT – but they don’t know about all it. It could be as much as half and half,” comments Riseley. In 20% of retailers, ecommerce departments pay for IT projects which aren’t managed by or paid for by IT. Marketing also runs IT projects independently of IT in 14% of retail businesses. Much of this spending is on cloud-based systems and this look likely to increase as more services go that way, she explains. Spend on cloud-based systems has risen from 33% to 51%.

Riseley agrees that omnichannel is becoming increasingly important to retailers with its effect showing on the level of non-store sales. Non-store sales account for 8.6% of the bricks and clicks respondents’ total retail sales, an increase of 18% since last year. Retail sales grew by 1.8% over the same period. Hence 16.2% is cannibalization from existing stores. With respondents expecting online sales to top out across all sectors at 20-29% of sales, clearly there is a long way for online growth to go and a lot more stores to close.