The recently published RetailX Global Sustainability 2024 report has found consumers are willing to pay extra for sustainably produced items, so brands need to be clear about the environmental impact.

Consumer feelings about the planet and the natural environment extend to the products they buy and expectations of how brands and retailers behave. They are actively looking for information about how, where and by whom the products they buy are produced and the impact they have on the environment.

However, there is a disconnect between consumer expectations and the messaging they receive from retailers.

As RetailX research into how the Global Top1000 brands and retailers communicate their sustainability journey with consumers shows, the level of information from brands and retailers varies. Some are transparent in their operations, while others share only the regulatory minimum.

There are differences in consumer thoughts and purchasing behaviour as well, with variations across countries and consumer demographics. ConsumerX research from RetailX highlights some of those differences, as well as the opportunities for brands targeting consumers willing to pay a premium for sustainably produced goods.

More than three-quarters of consumers feel that retailers should be environmentally friendly and this belief extends across different countries and demographics. Among the consumers included in the ConsumerX survey, it is online shoppers in South Africa, United Arab Emirates and Brazil that feel the strongest about retail sustainability. More than 80% of online shoppers in these countries agreed with the statement “I want retailers to be ecologically sustainable”.

Even more people (85%) want retailers to have fair workplace practices and ensure the companies that supply them also have high welfare standards. This is true of consumers across the income spectrum and age brackets, although GenZ and Millennial shoppers are slightly more likely to be concerned about environmental factors and fair workplace practices.

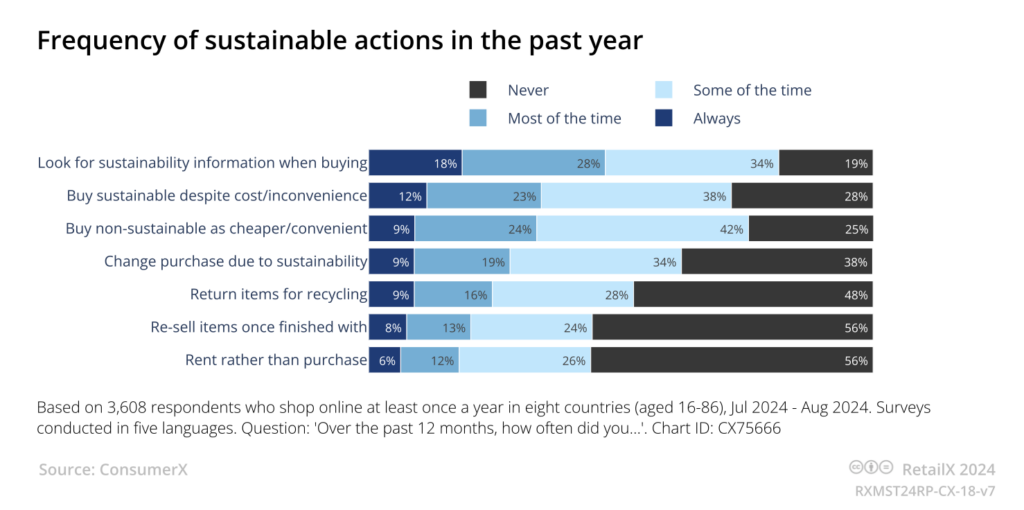

At a time when the majority of consumers are actively looking for sustainability information when buying online (81%), it not surprising to note that some have changed their mind over a purchase when they have seen the brand or retailer’s information about its sustainability. 9% of consumers said they could always be swayed by environmental claims, 19% said “most of the time,” and 34% have changed their mind at some point in the last year.

Furthermore, consumers will do more than choose a sustainably produced item. 62% are willing to pay extra for products they know were produced and transported in a way that did not harm the environment.

Again, it is consumers in the United Arab Emirates that are most likely to pay a premium for an item they perceive as being the more sustainable option. The UAE is one of the largest consumer markets online in the Middle East, with ecommerce valued at $10.2bn in 2023 and accounting for 14% of the overall retail spend, according to the RetailX Middle East Ecommerce Report. It is no surprise then that retailers in the UAE are keen to share their sustainability journeys with customers and other stakeholders online and are adopting circular models around reuse and recycling.

In the previous ConsumerX survey of more than 7,000 consumers across 14 countries, 67% of Millennials and GenZ said they would pay a premium, a figure above the overall average of 58%, highlighting the difference between younger and older shoppers.

While there is a group of consumers that always chooses the sustainable option regardless of the cost or any inconvenience over buying other products, there are also shoppers who have had to buy a non-sustainable product because an alternative wasn’t available. 11.5% of consumers said they always bought a sustainable product if given the option to do so and a further 23% said they did so “most of the time”. 38% of consumers responded “sometimes” when asked: “over the past 12 months, how often did you buy a sustainable product despite the expense/inconvenience?”

The percentage of consumers buying a non- sustainable product because the alternative was too expensive or inconvenient is similar. Three-quarters have bought a non-sustainable option because of these factors at least once in the 12 months prior to the survey taking place.

This is an excerpt from the The Sustainability 2024 market report , which brings together the information from RetailX’s ecommerce market reports and performance-based ranking reports with consumer sentiment and behaviour data from ConsumerX. The report gives a rounded view of the current state of sustainability communications and services in retail and ecommerce globally.

Data and analysis covers a number of key themes to highlight trends and opportunities, while company profiles showcase activities of individual brands and retailers of note.

Stay informed

Our editor carefully curates two newsletters a week filled with up-to-date news, analysis and research, click here to subscribe to the FREE newsletter sent straight to your inbox and why not follow us on LinkedIn to receive the latest updates on our research and analysis.