The European marketplace landscape is undergoing rapid transformation, driven by technological advancements, shifting consumer behaviour and macroeconomic changes. So what does the future hold?

Continues growth

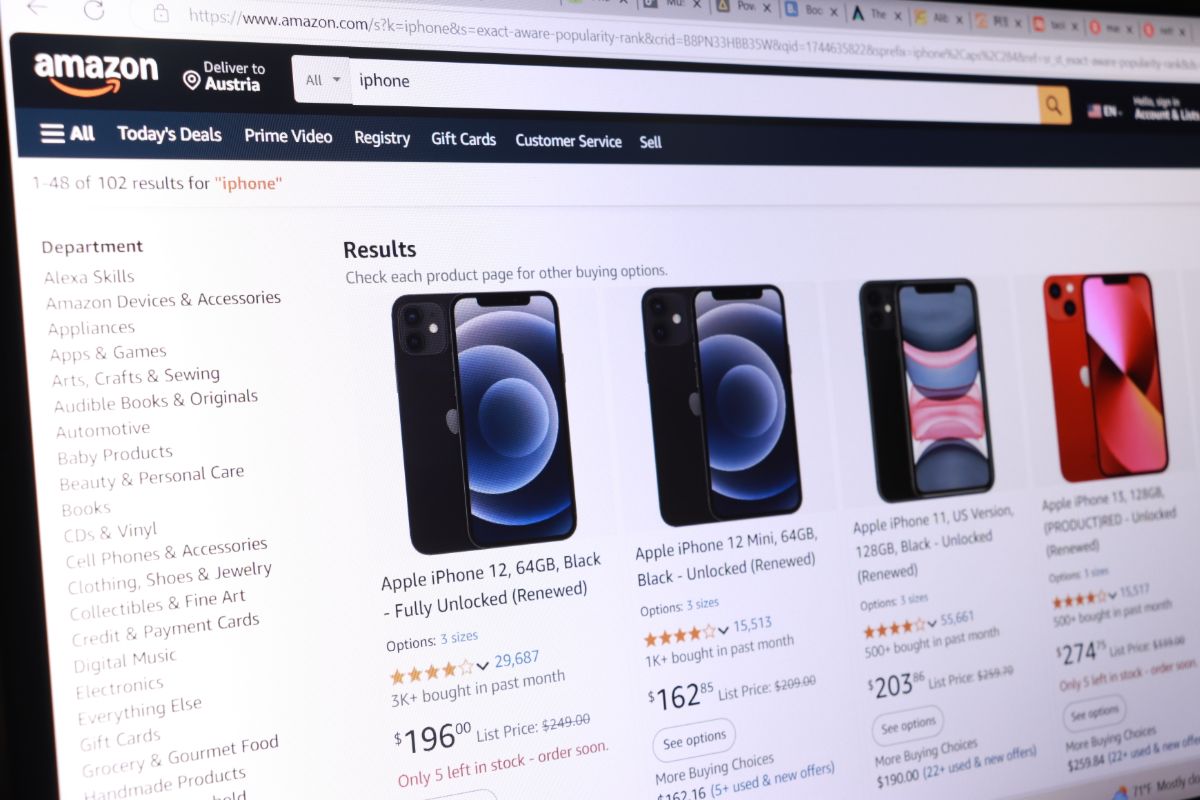

The key thing is that the marketplace sector is set to see continued growth. The European B2C ecommerce market is projected to reach more than €500bn by 2025, positioning it just behind China and the US. This growth – in Western Europe in particular, which is set to expand by 20% by 2027 – is being driven by the uptake of online and mobile retail more generally. Marketplaces will be at the vanguard of this growth, as more and more consumers embrace the convenience these sites offer, while a growing number of retailers will use marketplaces to sell their wares – as well as setting up their own marketplaces.

But the growth will come at the expense of the sector fragmenting to some degree. Specialised B2B marketplaces, such as ManoMano for building materials, or Vinted for second-hand fashion, are gaining traction. This trend contrasts with broader B2C approaches, indicating a move towards more niche-focused platforms. This specialisation is already being seen as retailers and brands turn to marketplaces that cater to specific parts of the overall market.

There is also likely to be a continued shift towards marketplaces being part of a broader omnichannel strategy, offering another platform alongside retailer physical retail, ecommerce and mobile commerce presences.

Strategic partnerships between retailers and other businesses, such as technology providers or logistics companies, will also become more common. These partnerships can help retailers improve efficiency, reduce costs and expand their reach. They are also going to be crucial for many retailers and marketplaces to counter the threat seen from new entrants from China.

Changing consumer behaviour

How consumers shop is also changing. The ongoing economic uncertainty caused by factors such as Brexit, trade tensions and the pandemic will continue to impact consumer spending. Retailers will need to adapt their strategies to navigate these challenges, while rising inflation rates may cause a decline in consumer spending power. Retailers will need to manage pricing carefully to remain competitive and maintain profitability.

All this is going to shift consumer behaviour at a time when consumer behaviour is already very different to a decade ago. Shoppers will increasingly prioritise sustainability and ethical practices when making purchasing decisions. Going forward, all retailers will need to demonstrate their commitment to environmental factors and social responsibility to attract and retain customers. This is especially true for marketplaces, which will have to manage this change across a pantheon of sellers.

This also presents marketplaces with an opportunity. As niche and specialist marketplaces become more popular, so sustainability-focused and eco- focused specialist marketplaces will also find new opportunities in the sector.

There will also be an increase in mobile and social shopping, with marketplaces having to ensure their sites are optimised for mobile and that their social presence is as shoppable as it is shareable.

Subscription-based services will become more popular, offering customers convenience and value. Retailers can explore subscription models for products like beauty boxes, clothing or groceries.

Artificial intelligence (AI)

AI will continue to play a crucial role in personalising the shopping experience and marketplaces will leverage AI to transform how they do business.

Chief among these changes will be how AI will enhance personalisation and product discovery, improving recommendations and search capabilities, and using natural language processing and image recognition to match buyers with relevant products or services. It will also personalise experiences, which will be tailored to individual user preferences, browsing history and behaviour patterns.

Consumers will also benefit – are benefiting already – from AI-powered chatbots helping deliver more effective customer service, especially in resolving issues more quickly and easily.

For the marketplaces themselves, AI will bring about a revolution in automated and intelligent operations, optimising inventory management, pricing strategies and demand forecasting.

New technology will also radically change dynamic pricing, with AI-powered pricing models adjusting in real-time based on various factors like demand, competition and user behaviour. And more sophisticated algorithms will better match this supply and demand, potentially leading to higher conversion rates and more transactions.

AI may also help to create new types of digital products or services, potentially expanding the pool of suppliers. It will help sellers in creating better listings, optimising descriptions and improving product imagery.

More pertinently, AI will better understand the data that marketplaces gather as they sell, which will lead not only to better dynamic pricing and stock choice, but also improved and targeted marketing – in particular via retail media.

This is an excerpt from ChannelX Europe’s Marketplaces 2024 report. Outlining the overall performance of the sector across Europe, the report assesses how marketplace trading as a whole has changed since 2023, focussing on both the sectors using marketplaces and the regions where marketplace use has changed.

The report offers an insight into not only how the European marketplace sector as a whole operates, but how each marketplace by region and sector drives that performance – and what that means for the year ahead.

Stay informed

Our editor carefully curates two newsletters a week filled with up-to-date news, analysis and research, click here to subscribe to the FREE newsletter sent straight to your inbox and why not follow us on LinkedIn to receive the latest updates on our research and analysis.