As the UK’s rate of inflation remains unchanged at 2%, the newly published RetailX European Luxury 2024 report stresses that one of the main reasons for the flattening out of luxury spending lies with inflation.

The Russian invasion of Ukraine in February 2022 kicked off a rise in energy prices and a decreased in consumer spending confidence. The upshot of rising energy prices was rapid growth in inflation across global economies. Much of Europe’s reliance on Russian oil and gas saw this impact European markets more than others. Recovery here has also been slower.

The impact on luxury was twofold. Shaken consumer confidence saw a reduction in spending across the board, with luxury – very much a discretionary spend – being one of the hardest hit sectors.

Inevitably, rising inflation also saw the price of luxury goods increase, further denting any discretionary spending that was likely to occur. Off the back of a post-pandemic surge in sales, this has led to luxury sales in Europe being turbulent.

This wavering in confidence rooted in inflation has been the largest drag on spending, with consumer data illustrating that across all age groups, inflation is slowing consumer luxury spending.

The demographic where this is most pronounced, with 59.3% expecting inflation to see them spend less on luxury, is GenZ. This is likely down to the sector, firstly, being the biggest spenders and most regular shoppers of luxury. Secondly, it is important to note again that some if not many of these GenZ luxury shoppers are also being bankrolled by their parents, so inflationary pressures may be squeezing GenZs who want to spend because costs have become unaffordable to their parents.

Those parents, typically GenX and Boomers, are also slowing their spending as a result of increased inflation, although not by as much. Here 55.8% and 57.5% respectively are expecting to spend less on luxury due to worries about inflation.

Only Millennials, of whom 49.3% expect to spend less on luxury due to inflation, are looking for their spending to be unaffected by inflationary pressures.

These shoppers tend to have a higher level of disposable income and so are less impacted by inflation eroding their spending on other aspects of their lives, such as family costs, grocery bills and mortgages and rents.

They are also more likely to spend what money they have on brands and designer goods. While still impacted by inflation, they are less impacted than the other groups.

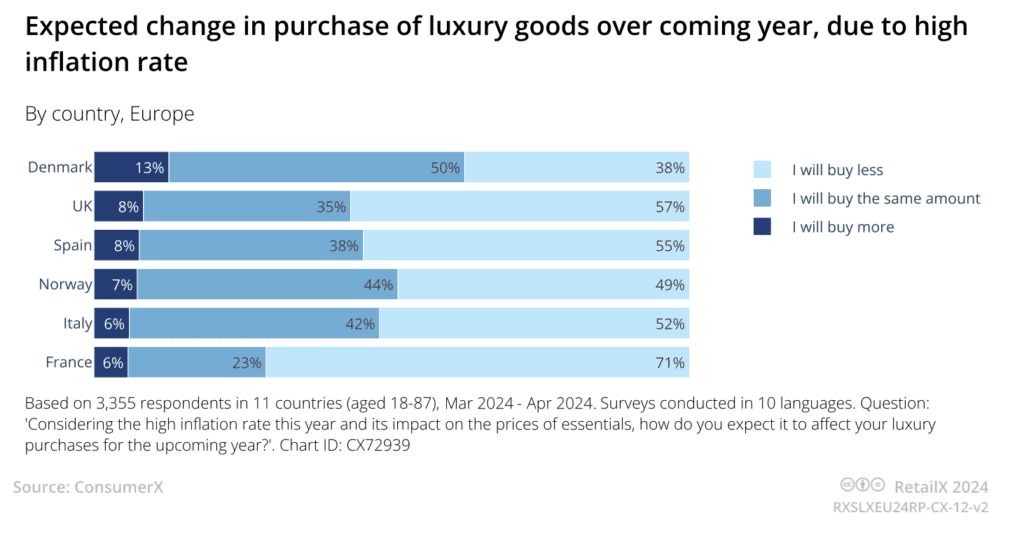

The impact of inflation on luxury spending is particularly strong in France, where 71% of all shoppers say that they will spend less on luxury as a result of rising inflation.

Conversely, Denmark sees some 12% of all consumers expecting to spend more on luxury, more than any other market in the region.

Interestingly, when looking across the continent at those that believe their spending will remain unaffected by inflation in the coming year, in all other markets outside of the extremes of France and Denmark, the level is consistently around 40%.

This points to the impact of inflation on the European market starting to show signs of lessening as inflation rates come down.

However, it is worth noting that, at the time of writing, political upheaval in the European Union (EU) post elections is likely to lead to more economic uncertainty in many nations – not least France, Germany and Italy – which, ultimately, could see any degree of spending optimism in these markets get shaken again.

This is an excerpt from the RetailX European Luxury 2024 report, authored by Paul Skeldon.

Download the full report here, it uses the results of our ConsumerX data to analyse attitudes to what, why, where and how Europeans’ buy luxury goods. It also features key player profiles on Coach, Farfetch, Gucci, Guerlain, Longines, Louis Vuitton, Lyst, Pandora and Ray-Ban.

Stay informed

Our editor carefully curates a daily newsletter filled with up-to-date news, analysis and research, click here to subscribe to the FREE newsletter sent straight to your inbox and why not follow us on LinkedIn to receive the latest updates on our research and analysis.