Liz Morrell assesses the ways in which Top500 retailers expanded their logistics services during the first year of the Covid-19 pandemic.

While the Covid-19 pandemic has strained many areas of retailers’ operations, the logistics side faced the greatest pressure as an unprecedented number of customers moved online. Retailers had to react quickly to the shift as they sought to replace lost store sales during the first lockdown, ramping up capacity while also ensuring warehouses and distribution centres were operating safely. They also had to work closely with their delivery partners throughout, especially during peaks such as Black Friday and Christmas when, according to RetailX Knowledge Partner Parcel Monitor, there was a 29% surge in parcel volumes. In this Operations & Logistics Dimension, RetailX researchers looked at what retailers are offering in terms of collection, delivery and returns, as well as the impact the pandemic may have had on such services.

THE KEY ROLE OF HOME DELIVERY

Online sales exploded in 2020, up 46.1% on the year before, according to the most recent ONS figures. This is the highest annual growth rate since 2008. What retailers did to support their logistics operations was crucial to maximise their online spend and at least counter some of the losses incurred from store closures.

Delivery options and cost RetailX researchers saw few changes in the delivery metrics in this Dimension, possibly showing that retailers have concentrated their efforts in dealing with increased volumes rather than investing in new services. The number of delivery options remained constant over the year, with a median of three delivery options for the 474 retailers measured in both periods. There has been no change in the number of retailers offering free delivery, either with all orders or a minimum spend. Just over one in five (21%) of the UK Top500 now offer free delivery on all orders, while just under half (49%) do so with a minimum spend. However, the threshold spend has fallen slightly to an average of £60 and median of £40. The threshold is lowest for software and marketplaces but higher than average for clothing, the latter likely being to encourage customers to over-order.

How quickly do orders arrive? With lockdowns requiring consumers to stay home, demand for nominated time delivery, where deliveries are promised within specified timeslots, has fallen. This was already a niche option for retailers, with only 5% of the Top500 retailers offering it in 2020. This figure has since dropped to 4% for the 474 retailers measured on this metric in both 2020 and 2021.

Grocery remains the strongest sector for nominated-time delivery with the sector working hard to increase provision of timeslots. Nominated day delivery fell 1pp to 13%. As with nominated time delivery, the nominated day delivery option is strongest for sectors including grocery (32%) and garden (26%).

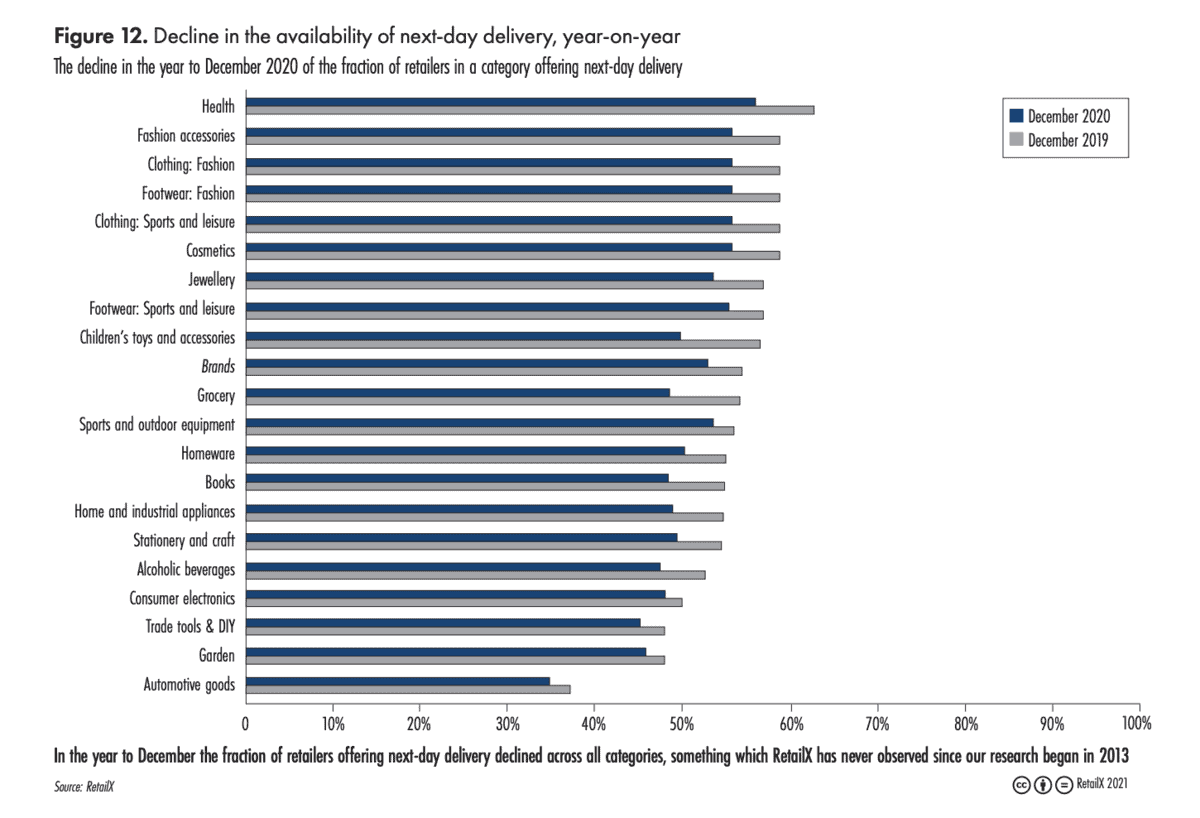

Part of the reason that nominated day delivery has fallen could be the increasing expectation from customers that next-day delivery is the expected norm. We found that more than half (54%) of the UKTop500 now offer next-day delivery. But this figure is a 4pp fall for the 488 retailers measured in both periods. This isn’t too surprising since the sheer scale of online demand has meant that retailers and their delivery companies have struggled to guarantee next-day promises and are easing pressure by directing customers to standard services instead. At the time of writing in January, for example, JD Sports temporarily suspended its UK next-day delivery service, routing customers to its ‘five to seven working day’ standard service instead.

THE EVOLUTION OF CLICK AND COLLECT

Click and collect services have offered a vital lifeline for stores whose delivery networks are stressed, with many using their stores as collection hubs and investing in contactless services. Dixons Carphone, for example, invested more than £15m to roll out a zero-contact drivethrough model with dedicated parking outside its stores. At 54%, the proportion of the 492 retailers measured in both periods who offer collection remains unchanged on the previous year.

Speed of collection Despite its importance as a delivery channel, the UKTop500 results show that same-day collection has increased by just 1pp to 8% of the 462 retailers measured in both periods. This is most popular for sectors including trade tools, equipment and DIY (12%) and home and industrial appliances, automotive goods and children’s toys and accessories, all of which stand at 10%. It is lowest for fashion, footwear and jewellery, at 4%. Next-day collection, which has been declining for some time, has fallen 1pp, down to 16% of the 461 retailers measured in both periods. Instead, our research shows that customers are being faced with a median collection time of 73 hours – that’s just over three days.

HOW HAVE RETAILERS MANAGED THEIR RETURNS STRATEGIES?

A big challenge that retailers have faced during the pandemic is managing returns. Research from the Royal Mail suggests that retail returns increased by 25% last July, compared to the same month in 2019, as shoppers sent back unwanted lockdown purchases. However, some retailers, including Next and Asos, have also reported lower levels of returns. This initial peak of purchases, as well as the greater challenge of physically returning products during lockdown, have seen retailers extend returns policies, with 28 days following store reopenings now a popular option. RetailX researchers found the average returns period is just over two months, while the median is just under one, at 28 days for the 484 retailers measured in both periods.

How are they managing the cost?

One of the biggest rises in this Dimension is in pre-paid returns, now offered by just over half (51%) of the UKTop500. This is up 13pp from 38% in the previous year for the 491 retailers measured in both periods. Fashion clothing and footwear (both at 66%) are among the sectors most likely to offer this.

Where can customers return products?

Another big variance has been how and where customers can return products. Almost three-quarters (73%) of retailers now enable shoppers to post their return. That’s 5pp up on 2020. This is strongest in areas where customers tend to over-order for choice, such as sports and leisure clothing (85%) and fashion footwear (83%).

There has also been a rise in returns to store, with an 8pp increase up to 50% of the 481 retailers measured in both periods. This may be as retailers try to ease the pressure on other channels or perhaps trying to give customers a reason to return to store when open. Once again, return to store is most popular for categories where customers often over-order, including footwear and accessories (both 59%) and fashion clothing (58%).

One of the biggest surprises has been the fall in returns via dropoff at third-party locations. These third-party locations are classified by RetailX researchers as non-retail fascia stores or lockers and can include a myriad of options, from convenience stores staying open during lockdown, to retailers offering returns for other retailers.

Here, the number of retailers offering the service has almost halved, down from 24% to 15% for the 481 retailers measured in both periods. Such locations offer an easy return route for customers but it’s possible that retailers may have tried to steer customers to other options in order to ease the pressure on couriers. The option is most popular for clothing and footwear retailers, where around one in five offer it.

Pick up from house has also fallen, down from 16% to 10% of the 481 retailers measured in both periods. With couriers stretched to breaking point in 2020, this feature will have been a nice-to-have that many retailers simply wouldn’t have been able to promise.

This feature first appeared in the RXUK Top500 2021 report. Click here to read it in full and to download it.