The latest Purchasing Managers’ Index (PMI) from NatWest may indicated a positive start to the year for most areas of the UK, but also highlighted inflationary pressures remained strong in several parts of the country.

The PMI showed business activity growth broadening out and local labour market trends generally improved. Business confidence also picked up in most places. Rates of increase in business costs and output prices eased on average in January.

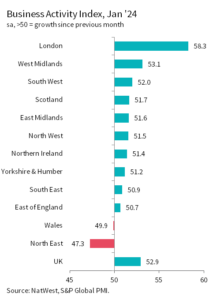

Ten of the 12 monitored UK regions and nations saw a rise in business activity in January. London (index at 58.3) once again recorded the strongest growth, followed by the West Midlands (53.1).

Output fell further in the North East (47.3), but the rate of contraction slowed notably to the weakest since last August. Activity in Wales (49.9) was broadly unchanged, following a four-month sequence of decline.

Demand

This latest data showed mixed performances in terms of new business. Half of the monitored areas saw growth in new work in January, led by another sharp increase in London. Modest rises were meanwhile seen in the East Midlands, West Midlands, South West, Northern Ireland and North West. The North East remained at the foot of the rankings, although the rate of decline there eased substantially since December.

Prices

Rates of input price inflation eased in just over half of the 12 monitored regions and nations in January. In all cases, they were below the averages seen in 2023. Still, across three-quarters of tracked regions and nations, the increases in costs were faster than the long-run trends. That was not the case for Northern Ireland, however, which saw its slowest rise in operating expenses in six months.

There was a further broad-based rise in prices charged in January as firms looked to pass on higher costs. However, rates of inflation continue to vary. Top of the rankings was Scotland, which saw a steep and accelerated increase in output prices that was the fastest for four months. At the other end of the scale, prices charged in Northern Ireland rose at a modest rate that was below the long-run average.

Capacity

January saw a general improvement in labour market trends, with employment either rising more quickly or falling at a reduced rate in almost all cases. London topped the rankings, recording its fastest rate of job creation for six months. Wales recorded the most marked drop in workforce numbers, but the pace of staff shedding did at least ease to the weakest since last October.

London was once again the only monitored region to record a rise in outstanding business (i.e. orders awaiting completion). The rate of accumulation even accelerated slightly, although it remained modest overall. Backlogs fell quickest in the North East. However, the rate of depletion there and in seven other regions and nations slowed from the previous month.

Sebastian Burnside, NatWest chief economist, said: “Regional PMI data showed a positive end to 2023, but an even better start to the new year. We saw the broadest expansion in business activity since May last year, as renewed increases in the North West of England and Scotland in January took the total number of regions and nations reporting growth to ten out of a possible 12.

“With demand showing signs of improvement and price pressures easing, firms in most parts of the UK started the year with renewed optimism. Although price increases in January were slower than seen on average over the past two years, in some parts of the UK rates of inflation are still running hot. It will be worth monitoring whether these inflation imbalances persistent going forward, with the Bank of England expected to start cutting interest rates later in the year.”

Stay informed

Our editor carefully curates a daily newsletter filled with up-to-date news, analysis and research, click here to subscribe to the FREE newsletter sent straight to your inbox and why not follow us on LinkedIn to receive the latest updates on our research and analysis.