The UK’s largest retailers are getting better at online merchandising. Here, we outline some of the biggest changes over the last year.

The UK’s largest traders have made great strides in improving retail website design. In October 2015, the InternetRetailing research team went back to the websites of the largest 150 retailers to assess visual appeal – and found a 38% improvement since we first carried out our study back in September 2014. Last year, we awarded our highest score for visual appeal to a little less than a quarter (24%) of the retail websites that we assessed. This year, the figure had risen to 35%, an increase of more than 10 percentage points.

Eleven of the retailers that scored highly last year kept their positions this year. Asos were among the top retailers in this aspect.

Meanwhile, seven retailers stood out for the work they had done to improve their websites over that period of time. These were Tesco , Fat Face , Virgin Holidays , Joules Clothing , Spotify and Specsavers .

But movement was by no means all upwards: 67% of the retailers we analysed won lower marks for website appeal this year than last year. Visual appeal is, of course, a subjective measure, judged when researchers rate their own reaction to the site. But there’s also some evidence to show that visual appeal is linked to the number of product images on a site. That’s something we explore further in the Breaking new ground research feature.

MORE RELEVANT SEARCH FINDINGS

John Lewis [ and Argos stand out for the quality of search results for the second year in a row. When search findings are relevant to the initial query, customers are more likely to find the items they want to buy and to go on to make a purchase. In 2014 and 2015, we examined search findings, defining them as the quality of word match to the request that was typed in the search bar, and rated them on a scale. Overall, we found that the group of the largest 150 retailers in the IRUK Top500 improved search relevance by 14%. The number of retailers rated at the highest level didn’t change over the course of the year, although some retailers moved up to that group – and others down.

Thorntons was the most improved by this measure, while T.K. Maxx also scored highly for search relevance this year.

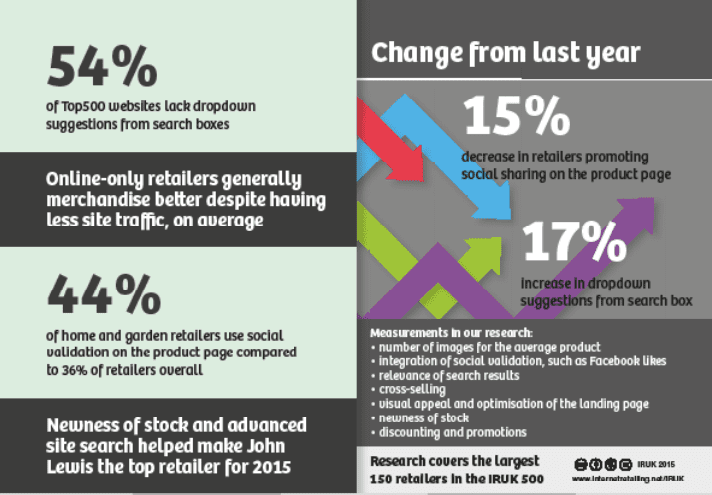

Dropdown search

The move towards introducing dropdown search options – which offer suggested search terms even as shoppers type in the search bar – is gathering momentum. Of the 136 retailers that appeared in the largest 150 group of retailers both in 2014 and 2015, this year 86, or 63%, offered dropdown search options. That’s up from 46%, and a rise of 17 percentage points, or 38%, over the year. “This,” says InternetRetailing researcher Polina Modenova, is a “big improvement.” She adds: “Retailers must be realising the effect this feature has on customers. It has the potential to improve site usability, and increase conversions.” It’s likely as shoppers come to expect help with prompted search options – which in themselves are more likely to be successful in finding the object they want – they’ll start to move on from sites that don’t offer them. T.K. Maxx is among the retailers that has introduced more sophisticated dropdown word options. It scored highest in this area for a combination of both relevant search results and dropdown word options. Others that did well in this area include H&M , Ernest Jones , Specsavers and Superdrug .

“All of this,” says Modenova, “is about site usability, and how easy it is to see a product. Across our measures, this is improving. It seems retailers are doing good work that will attract customers.”

CROSS-SELLING AND UPSELLING

The traditional tools of store-based merchandising, cross-selling and upselling, appear to have taken on a whole new lease of life online. When researchers looked in 2015 at the websites of retailers from the largest 150 group, they found 75% of sites showed extra items that the shopper might buy. “When retailers place products by the till in stores it works really well,” says Modenova. “Our study shows most retailers use similar approaches online to those that work so well in-store.”

LESS PRODUCT INFORMATION

Telling consumers about the products they are considering buying is a necessity for effective sales. Last year, we found almost 90% of retailers showed extra product information, beyond basics such as name and price. This year, we went further and analysed the quality of additional information, awarding a high index value to 32% of traders. Consumers electronics retailers stood out – this was the sector where we found the highest quality of additional information. It was followed by the stationery, books and craft sector. There are other tools that retailers can also deploy to inform customers about their products. But Top500 findings show that only 40% of retailers show stock availability on the website.

Social sharing

Enabling shoppers to share their retail purchases or wishlists over social media can mean items are seen by more people, who have an interest in knowing what products their friends like. We wanted to find out how many of our largest 150 retailers enabled shoppers to do this, through social media sharing or ‘like’ buttons. According to our Top500 2015 research, 68% did so. We expected to find, thanks to reports of the growing importance of the selfie in fashion, that clothing websites would be the most likely to enable social merchandising of this kind – and our expectation was confirmed. Some 21% of fashion retailers provided social sharing. That category was followed by home, garden and DIY, where 12% enabled sharing. Last year, 36% of retailers gave shoppers the opportunity to ‘like’ their brand or product, with use more prevalent in the general fashion sector, followed by home, garden and DIY.

“These retailers are trying to give their customers as many options as they can,” says Modenova. “They realise that social media is an important factor in drawing customers to the website, generating additional web traffic and, ultimately, sales.”