InternetRetailing senior researcher Martin Shaw considers what the IRUK data tells us about delivery, collections and returns

UK RETAILERS TODAY work hard to ensure that customers receive the goods they’ve ordered in the most convenient and cost-effective way. Just as importantly, retailers try to ensure that it’s as easy as possible for customers to return unwanted or faulty items. But what sets the best-in-Dimension retailers apart here? Over the following pages, we look in depth at our research in the three key areas of delivery, returns, and click and collect.

MAPPING DELIVERY

Retailers in the IRUK 500 have differing approaches to fulfilment. This is because different retailers target different kinds of customers who have different interests and priorities, and fulfilment options and operations develop in response to these consumers’ needs. While it may be important, for example, to get a new item of clothing delivered in time for a party at the weekend, consumers may be more patient when ordering a hard-to-find item from a niche retailer.

Nonetheless, as the graph on this page shows, it’s striking that even among mainstream retailers,there’s a surprising divergence in the number of delivery options on offer. Clearly, for whatever reasons, some retailers see offering delivery options as a point of differentiation.

Statistics cover 98 of the largest IRUK 500 retailers and the study was researched with the assistance of Oracle-Micros. *The figure here refers to multichannel retailers only.

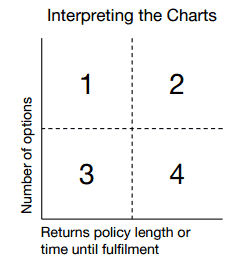

The charts in this article show the number of returns, delivery or collect options offered by a retailer on the vertical axis. The fulfilment timescale or returns policy length is measured on the horizontal axis.

This leads to an intriguing question: is it fair to say that more options and faster fulfilment are definitively ‘better’ from the customer’s point of view? And if so, is the underwhelming showing of some of the UK’s largest retailers in this area a transitional problem, or, have these companies left the field in the battle for customer loyalty, yielding it to the likes of Amazon?

A recent PwC report found that just 16% of businesses make money from ‘multichannel’, so perhaps a broader appeal within a diverse market begins with fulfilment efficiency. With that in mind, what is the most efficient delivery offering for a retailer to make?

In a recent webinar run by InternetRetailing’s sibling eSeller.net, Chris Dawson of Tamebay suggested that, even for small retailers, the best proposition includes at least three fulfilment options. The first is the standard option with a low threshold for free delivery and a three to five day timeframe. There should be an expedited, if costly, next-day delivery option for those shoppers who need something urgently.

Statistics cover 98 of the largest IRUK 500 retailers and the study was researched with the assistance of Oracle-Micros.

Rounding out this optimal set of delivery options is a ‘no rush’ option, free for any order value. This final option would appeal to both retailers and shoppers over busy sales days such as Black Friday, when most customers only require their goods by Christmas and delivery services can’t otherwise cope with the spike in demand.

The circles depict 98 of the largest IRUK 500 retailers, excluding grocers. The chart compares the number of delivery options (vertical axis) to timescale of standard delivery (horizontal axis). The ‘footprint’of the retailer, as measured by stores, web traffic and revenue, is given by the size of the circle. Researched in collaboration with Oracle-Micros.

BEST PRACTICE RETURNS

Turning to returns, top retailers offer customers easy, rapid and inexpensive returns on unwanted or faulty goods. These companies aim to minimise both the likelihood of a return being made, and try to cut the costs when this happens.

This has resulted in a retail landscape where ecommerce returns policies conform more to consumers’ demands than ever before. But still not everyone is happy. Customers have come to expect a service that’s both free and easy. A recent UPS study found that 54% of online shoppers read returns policies prior to purchase and are more likely to buy from stores that allow them to send goods back for free.

The circles depict 98 of the largest IRUK 500 retailers, excluding grocers. The chart compares the number of returns options (vertical axis) to the returns policy length (horizontal axis). The ‘footprint’ of the retailer, as measured by stores, web traffic and revenue, is given by the size of the circle. Returns options include to a store, by post, or through a third party service such as CollectPlus. Researched in collaboration with Oracle-Micros.

Compare this to IRUK 500 research showing that a majority of the UK’s large retailers offer free returns and refund the original delivery charge. Are retailers responding to consumer demand, or are they fuelling that demand by increasing convenience?

It’s evident from our research that even companies from the same sector have adopted very different returns strategies, as the graph on this page clearly shows.

CLICK AND COLLECT

At present, click and collect is only offered by 44% of retailers in the IRUK 500, and by 58% of the largest 100. It’s a service that promises increased convenience for consumers, but also more efficient fulfilment: couriers can deposit dozens of orders at a collection point at once, without the risk of failed delivery. Some retailers offer click and collect from a store within the hour, highlighting the advantage multichannel retailers have in this area. Other options include third-party networks such as CollectPlus and collection points at train stations.

Statistics cover 98 of the largest IRUK 500 retailers and the study was researched with the assistance of Oracle-Micros.

The circles depict 70 of the largest IRUK 500 retailers, excluding grocers. The chart compares the number of collection options (vertical axis) to timescale of standard collection (horizontal axis). The ‘footprint’ of the retailer, as measured by stores, web traffic and revenue, is given by the size of the circle. Collection options include from a store, from a transport location, and from a collection service. Researched in collaboration with Oracle-Micros.

Top500 companies are fulfilling ecommerce orders and returns in different ways. Some appear more ‘advanced’ than others, perhaps because a strategic decision has been made to emphasise customer service in an era of transparent pricing.

By making fulfilment and returns faster and cheaper, retailers have in turn produced a more demanding consumer market, in a self-reinforcing cycle. This process is enabled by technology and can be expected to continue as ecommerce becomes more popular.

IN CONCLUSION

Our research suggests it’s not safe to generalise about the state of logistics in the retail industry. Even among the largest companies, those in similar sectors are pursuing different strategies, and while the ‘best’ can broadly be measured by speed and number of options, success could well derive more from the retailer’s cost efficiency than the customer’s convenience.