InternetRetailing senior researcher Martin Shaw outlines what IRUK data reveals about mobile and cross-channel retail

AT THE HEART of cross-channel retail lies the mobile phone. It is a piece of technology customers always have at their fingertips, even if they don’t make a purchase with it. Mobile binds together channels and the customer journey. This isn’t just a glib industry truism, the facts support it. According to the Samsung Future Shoppers Report, published late last year, 44% of 17-24 year olds, the dominant consumers of tomorrow, use their mobiles to research a product while looking at it in-store.

The increase in consumer use is mirrored in website design. Data compiled by Knowledge Partner BuiltWith shows that 398 (80%) of IRUK 500 websites have Viewport Meta tags, meaning that pages will render to a mobile-optimised size. This compares favourably to the internet as a whole – 24% of the top million websites in the world have the tags. The trend towards mobile optimisation in websites is very obvious when graphed.

APP COMMERCE

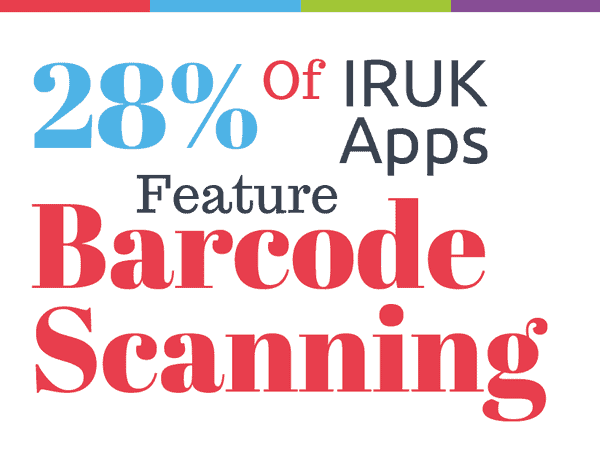

Mobile apps are surprisingly scarce among British retailers, perhaps because retailers rely on responsive mobile sites to serve mobile visitors. There is added value in having an app due to greater responsiveness and fewer connectivity issues. Poq Studio reported double the conversion rate in its clients’ apps than their mobile sites. Yet few retailers choose to offer apps. Only 93 (18.6%) of the IRUK 500 off er transactional iOS apps, according to our research.

Without a doubt building a good app is an expensive process, but the small uptake is remarkable in a world where, according to Affiliate Window research in December 2014, 44% of ecommerce traffic comes from mobile. Much of our ongoing research is now directed towards understanding retailers’ reluctance to embrace apps (see six mobile KPIs on page 29) but in the meantime a first crucial step has been identifying in general terms how the Top500 are doing here. Accordingly, in this section we review the whole cohort – the broad or narrow support for particular app functions, beginning with ecommerce’s potential to drive footfall into the high street.

DRIVING FOOTFALL

Mobile technologies are an effective way to bring shoppers in-store. If anybody still needs to be convinced of the value of ecommerce-driven footfall, consider the stores and shopping centres vying to be pick-up locations for online orders. One reason for the competition here is that shoppers collecting a parcel are inclined to make incidental purchases while they’re out and about.

It’s reasonable to suppose that customers who already have a relationship with a brand, evidenced by downloading an app or opening a mobile website, are potentially more likely to make such purchases. Multichannel retailers are capitalising on relatively simple features, with 75% of multichannel retailers’ apps sporting a store finder, according to IRUK research. In our article on app KPIs (page 29) we examine the take-up of cutting edge features such as geofencing and beacon technology which also drive footfall.

INTERNET RETAILING IN-STORE

The natural culmination of using ecommerce to encourage tech-savvy customers onto the high street is to offer internet retailing in-store (IRIS) technology (see our feature on page 32 for a look at the future of IRIS). Consider a modern department store such as House of Fraser , where there are typically touchscreen devices to view and compare items that can’t be displayed in the store’s limited space. Despite these items not being stocked on the premises, consumers see value in finding information about products within the confines of the (physical) store.

As far back as 2012, House of Fraser’s multichannel director, Andy Harding , said the strategy was paying dividends and would be rolled out to all stores. The advantages of IRIS become even more obvious if stores find ways to capitalise on shoppers’ existing mobile phones and tablets. By offering free wi-fi , for example, a retailer attracts shoppers (and shopping-averse spouses) but also sees which competitors’ websites are being viewed. If the retailer’s app allows shoppers to scan products for more information and this is advertised in-store, the merchant can “convert curiosity”.

CONVERTING CURIOSITY

Do the apps of 40 top retailers offer relevant results even when specific items are searched for or queries are misspelt? Roughly half the apps have little more than a keyword search; cosmetic similarity belies a big difference in usability. This data is drawn from an InternetRetailing and Poq Studio study, covered extensively in the New Research section“A third of customers who use their phones to research a product in-store, buy it elsewhere”

Persuading information-hungry consumers to part with money is challenging, but an effective app helps. A pan-European study by Tradedoubler last year revealed that one third of potential customers who use their phones to research the product they are looking at, change their minds and buy it elsewhere. This may sound like bad news, until you realise that retailers can capitalise on “showrooming” by providing expanded information and customer reviews within an app or mobile site – information that should be displayed next to an “add to shopping cart” button. Stores promoting the app or mobile site keep browsers’ interest in their store.

IN THE FUTURE

A Forrester study on the future of retail, European Cross-Channel Retail Sales Forecast predicts that by 2018, 44% of retail sales in Europe will be influenced by the internet, with mobile the main channel. But reports of the high street’s death are an exaggeration. The same Forrester study predicts that, while the role of the store will fundamentally change, it will remain central to cross-channel retail. The experience of Argos backs up this idea. The homeware retailer reported last year that 44% of sales start online, although 90% of transactions involve a store somehow (see our feature on Argos on page 18).

The overall lesson here is that timeliness and convenience are important to customers, and retailers need to remove points of friction. Even when a customer buys on a PC, an idea that may seem a little steam-powered to younger consumers, the chances are a mobile phone displaying a confirmation email will act as the customer’s evidence of identity at point of collection.